How Aussies are getting sucked into these weekly $249 mistakes

Australians are making this mistake every week, and it’s a trend that’s seen “dramatic” growth — but don’t be fooled.

It seems like a great option — buy now, worry about how you’re going to pay for it later.

You can wait until payday, and spend the money you have to make last until then on important things like booze and clothes. Just kidding — Uber rides homes too.

But if you think you’re being sensible committing to pay later schemes at the checkout, think again.

New research shows both shoppers and retailers agree that people who use buy now, pay later tend to spend more, buy more items, shop more frequently and return to the same stores that provide it.

A Power Retail report released this week found Australians are using the schemes weekly, and most purchases are between $100 and $249.

They say the spending option has “reached a critical mass in the Australian online shopper market” with more than 1.8 million users.

The service has grown at a “dramatic” rate of more than 120 per cent a year, with 50,000 transactions per month in April 2016 ballooning to 1.9 million in June this year.

Retailers surveyed in the report said buy now, pay later had increased profits.

The report also revealed the option becomes “ingrained” in shoppers, with 67 per cent of people using the service 12 months on from their initial trial.

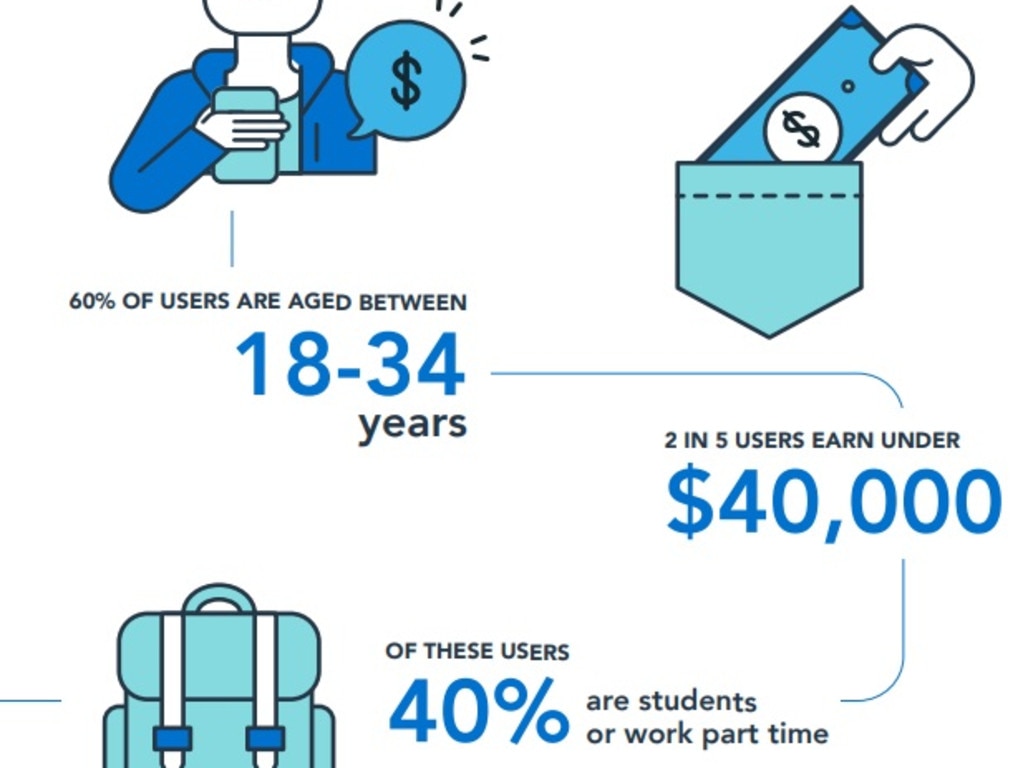

In no surprises, millennials are the ones using pay later plans the most, after the services exploded in 2015.

But an ASIC report last month warned Afterpay was being used as the lender of last resort by debt-ridden consumers.

The corporate regulator also warned the entire buy now, pay later sector that it was prepared to use new powers to intervene against harmful products.

While some buy now, pay later providers offer fixed-term contracts up to 56 days for amounts up to $2000, other providers offer a line of credit for amounts up to $30,000.

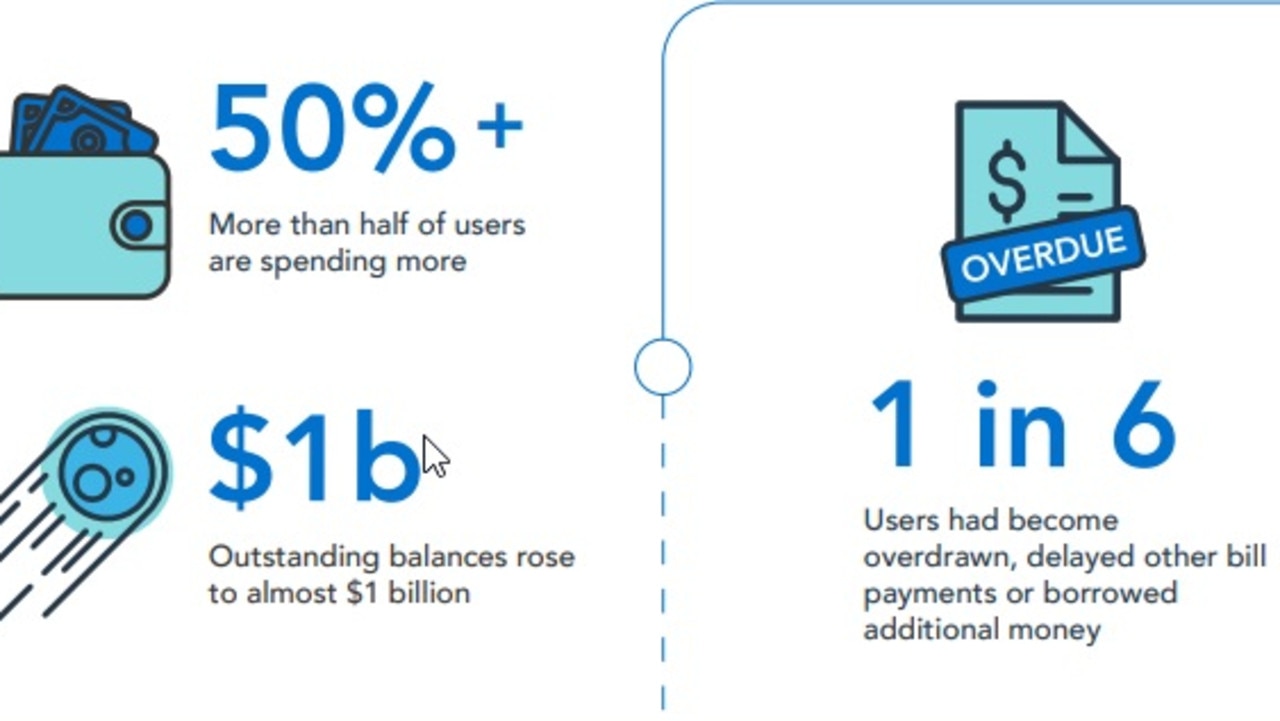

ASIC said at the end of the financial year, there was $903 million in outstanding buy now, pay later balances.

“Although our review found many consumers enjoy using buy now, pay later arrangements and plan to continue using them, there are some potential risks for consumers in using these products,” ASIC commissioner Danielle Press said at the time.

“We found that buy now, pay later arrangements can cause some consumers to become financially overcomitted and liable to paying late fees.”

RELATED: How a recession gave one Aussie a billion-dollar business idea

One in six users had either become overdrawn, delayed bill payments or borrowed additional money because of an arrangement.

Most consumers believe these arrangements allow them to buy more expensive items than they would otherwise and spend more than they normally would.

Power Retail’s report was similar to the ASIC findings.

The nationwide research initiative saw more than 5000 retailers and consumers surveyed, and highlighted how retailers could leverage the payment option to achieve growth.

As part of their research, Power Retail conducted interviews with online retailers.

Showpo founder Jane Lu said most of their customers did not have credit cards so this was a great way for them to manage their cashflow.

Many said it should be a de facto payment method that sites needed to offer to increase traffic.

Power Retail managing director Grant Arnott said it was a “serious trend to take notice of right now”.

“In a few years’ time it will no longer be an alternate payment option and will be simply expected by consumers,” he said.

“Also, due to the recent banking royal commission, some consumers have lost trust in the banks and will therefore start trusting a new generation of financial services.

“Alongside this, with the growing impact of Amazon Australia, competition in the Australian e-commerce sector has never been so fierce, and thus, success will come to those who adapt.”

But ASIC warned it would be targeting options where consumers were paying more than they needed using a buy now, pay later arrangement.