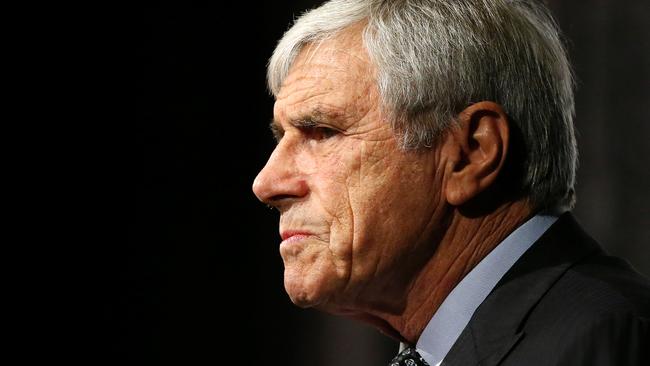

Gerry Harvey suffers shareholder backlash over remuneration

HARVEY Norman’s 75-year-old billionaire founder Gerry Harvey has suffered an embarrassing smackdown by shareholders today.

A RETAIL supremo who prides himself on being frugal has ironically suffered one of the biggest backlashes against his salary since shareholders were given extra powers three years ago.

Harvey Norman’s 75-year-old billionaire founder Gerry Harvey says he’s an everyday man who flies economy and shuns luxuries like a big boat, but does indulge in breeding race horses.

A decade ago, he told shareholders he didn’t lead an extravagant life, describing himself and his wife — Harvey Norman chief executive Katie Page — as “miserable bastards”.

Compared to the leaders of most multi-billion dollar listed companies, they take home modest salaries.

But this didn’t stop three-quarters of shareholder votes going against Harvey Norman’s remuneration report at this week’s annual general meeting.

This is one of the most prominent protest against executive pay since the Corporations Act was amended in 2011.

Under the previous Labor government’s changes, a first strike occurs when a quarter of shareholders vote against a company’s remuneration measures for the previous financial year.

If more than 25 per cent vote no for a second year running, shareholders are asked to vote on a board spill resolution.

Mr Harvey was nonchalant in the face of the revolt, and declined to say if the no vote had sent him a message.

“It doesn’t really matter much because it doesn’t change anything,” he told AAP.

The Australian Shareholders Association opposed Harvey Norman’s executive pay arrangements because it wanted the retailer’s performance incentives paid in shares and cash, instead of just cash, to closely align remunerations with shareholders’ interests.

Nick Bury, a company monitor with the group representing mum and dad retail investors, said Mr Harvey was “probably a bit embarrassed” as his homeware and electronics chain departed from its usual practice of setting a good example for other companies. “They haven’t made mistakes like this before,” he said.

“They have been good corporate citizens ... and I would not want to take that away from them.” Mr Harvey blamed complex tax arrangements for its unpopular decision.

“It’s become that complicated, I don’t understand it anymore,” he said.

“Every company’s got its remuneration board — in years gone by I never had any of that, I just did it myself.” Harvey Norman shareholders were opposed to Mr Harvey’s $1.1 million salary package, which rose by $100,000 after the electrical and homewares seller posted a 49 per cent profit increase.

Ms Page took home $2.8 million in 2013/14, marking a 54 per cent pay rise.

Last week, Seven Group chairman Kerry Stokes weathered a major shareholder revolt when 40 per cent of them voted against chief executive Don Voelte’s $5.5 million package.

The ASA was opposed to the structure of Mr Voelte’s remuneration as it was tied to the company’s shares rising.

“The shares could rise due to sentiment rather than due to increased earnings,” Mr Bury said.

“We don’t consider that was a good measure of performance.” But the ASA still regards Mr Stokes and Mr Harvey as veteran, model corporate citizens despite their recent bouts of unpopularity.

“Kerry Stokes is a very able entrepreneur and Gerry’s a great retailer.”

SHAREHOLDERS UP IN ARMS OVER EXECUTIVE PAY

* Heron Resources second strike, almost 70pct of shareholders against; board spill to be called (Nov. 2014)

* Cabcharge fourth strike, 49pct no vote but board spill avoided (Nov. 2014)

* Seven Group first strike, 40pct against (Nov. 2014)

* Newcrest first strike, 45pct against (Oct. 2014)

* Boart Longyear first strike, 43pct against (May 2014)