Future of Target uncertain as sales continue to decline

Retail stores have been hammered by the impact of the coronavirus. But Target’s problems started long before the lockdown.

All eyes are on Target as the Australian retail killing season shifts up into top gear. Amid a catastrophic slowdown in the Australian economy, Target’s owner Wesfarmers released an update to the market on how retail trade was faring in its various businesses on Monday.

Bunnings is doing great, they said. Officeworks is humming as people work from home. Kmart: surviving. But Target? Things are not going well.

In recent weeks, “in-store sales momentum has moderated in Kmart and has declined significantly in Target, reflecting the broader decline in customer footfall in shopping centres and ongoing weakness in discretionary categories, particularly apparel,” said Wesfarmers managing director Rob Scott.

That’s bad news because Target was already looking weak. In the six months to December, it recorded a sales fall – again – and Wesfarmers lamented the mid-range department store chain was performing “below expectations”.

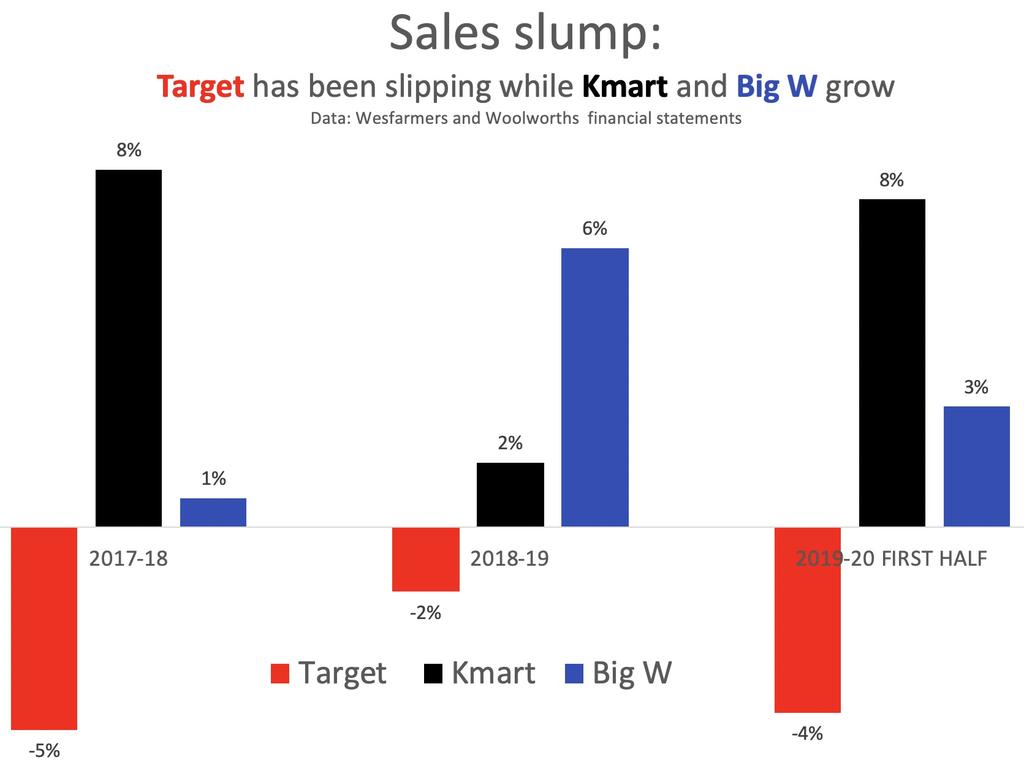

Several years ago the plan for Target was to focus on clothing. Taking on Uniqlo and H&M seemed like suicide at the time. Lo and behold, Target has done terribly since, as the next chart shows.

Many recent retail insolvencies have been clothing companies. Jeanswest is a prominent example. And that was before the coronavirus locked us in our homes and turned getting dressed into an optional activity.

When the bad times come, it is the weakest animals that don’t survive. Target is in a very weakened state, and these are very bad times for retailers (at least those who aren’t selling pasta and toilet paper). The ABS reports “strong falls in turnover” at department stores and clothing stores. Target is both.

MOVING TARGET

Things are suddenly moving very fast at Target. Wesfarmers is doing a comprehensive “assessment of strategic options for a commercially viable Target.”

Wesfarmers has no patience for sluggish businesses. It sold off Coles a while ago, and it wants to own only strong profit-makers. One option might be to rebrand more Target stores as Kmart and only keep a few choice Target outlets.

But Kmart could get stretched too thin. There are more Target stores in Australia (285) than Kmarts (231). Shutting stores must also surely be on the agenda. (Despite plunging sales Target shut just four of its stores between July and December last year). Making Target into an online specialist would be another option. So might selling the brand.

Perhaps a private equity firm would buy Target? One such firm bought Harris Scarfe, although that didn’t work out well for the retailer, which went into administration in December. By June 30 Wesfarmers will decide what it plans to do.

AUSTRALIAN RETAIL’S MOMENT OF TRUTH

The coronavirus is likely to cause a significant shake out in Australia’s business environment. Many industries include a weak competitor who has been hanging on somehow or other, hoping one day they will turn the corner. Their owners must now face the fact that any such corner is now a long way away.

With aviation entirely shut down, Virgin bit the bullet early – it has already gone into administration. Retailers have not faced the total shutdown that aviation did, and many have got rent holidays from their landlords, so they will be slower to face their doom. But it is impossible to imagine we have seen our last retail insolvency for the year. Many will be small local businesses that don’t make the news. Those are small tragedies – families losing their livelihoods and neighbourhoods losing a local shop.

Others will be a big tragedies, putting many out of work. Some retail sectors – like the big department stores – include two competitors, both of whom are struggling. The shutdown must be pushing Myer and David Jones to the very brink.

Myer has said its online business is growing strongly, but that is growth off a small base. It would be a shame to lose them both. Surely at this point they’d be better off merging.

If there is good news for retail it is in the medium term. With a competitor shaken off, the remaining businesses can perform even better. Just like Bunnings was able to thrive after Masters disappeared, we can expect solid growth and profitability from the businesses that remain.