Fears major Aussie retailer in trouble

Its shares slumped after a major announcement from the retailer which employs 4000 staff and has 700 stores.

There are concerns a major Australian retailer is in trouble after it first announced a trading halt on the ASX – resulting in their share price plummeting – with one expert explaining a major issue is how its brands are “cannibalising” their own market.

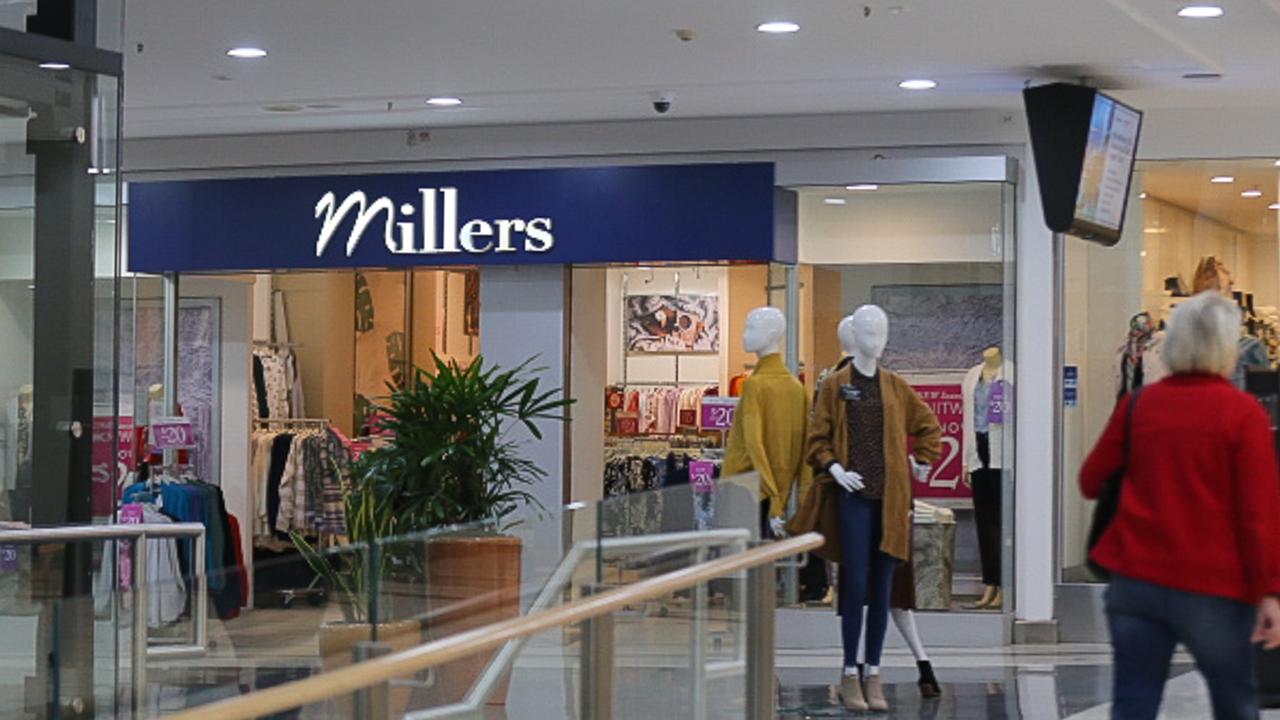

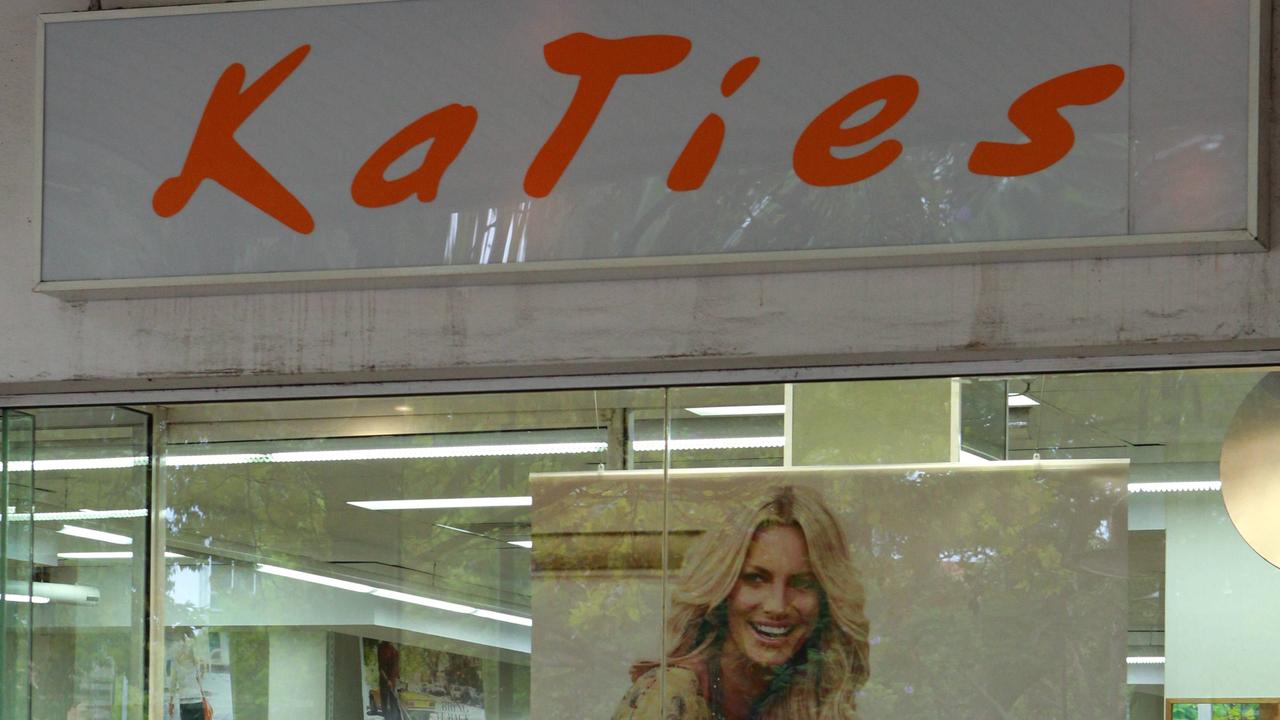

Mosaic Brands, which owns the labels Noni B, Millers, Rockmans, Rivers and Katies, already closed hundreds of stores last year but its woes appear to be continuing.

It currently employs 4000 staff and has approximately 700 stores around Australia.

The ASX-listed company’s shares initially plummeted 24 per cent after it emerged from a trading halt to reveal it had engaged Deloitte to advise on “refinancing considerations”. At the end of Wednesday, its shares had dropped by 13 per cent to 4c.

Mosaic Brands appears to be facing the same issue Kmart and Target did five or six years ago, said Queensland University of Technology Business School retail expert Professor Gary Mortimer.

“From a consumers’s point of view and particularly with the brands they have with the likes of Millers and Katies and Noni B and all the others – they are essentially creating multiple brands to market to the exact same audience – middle aged, middle class woman,” he told news.com.au.

“These women all shop at the same stores so you are cannibalising your own market. If you walk into a shopping centre, you will find at least two, if not three, of those brands all competing for the same customer and that just duplicates and triplicates the cost of doing business. As you are not only selling the same product to the same consumer but then you have different brand’s costs like staff, advertising and logistics, so the cost structure doesn’t appear to be sound.

“It was the same problem that Kmart and Target faced five or six years ago with Wesfarmers owning two discount department stores essentially competing for the same kind of customer.”

Mosaic Brand’s performance also hasn’t been consistent over a number of years, Prof Mortimer said.

When the pandemic hit, the company recorded a $170.5 million loss, despite $736.8 million in revenue in 2020.

Then it announced an $11.5 million loss in 2022, before recording a profit of $1.2 million in 2023 – yet there was also half a billion in revenue across both years.

During covid, Mosaic Brands were forced to close all their stores but took an $83 million wage subsidy from the government, Prof Mortimer added.

“Like many other retailers and organisations, it helped prop up their profit and produced strong results in 2021. Then they hit a fairly significant issue – a $630,000 fine at the end of 2021 for making claims about some of their products would keep you safe from covid,” he said.

“In 2023, they tried to right the ship by closing 250 stores and there were claims they would create mega stores. Closing stores certainly reduced wage costs and logistic costs as they didn’t have to ship products to stores that weren’t selling.

“They had a solid profit result in 2023 and now we see a warning that they will announce a loss for the 2024 financial year. Their results tend to peak and then drop quickly and there doesn’t seem to be much consistency.”

A botched technology rollout just before Mother’s Day this year which delayed delivery of stock, as well as the cost of living crisis impact on consumer spending would “severely impacted revenue and earnings in the fourth quarter,” Mosaic said in June.

Mosaic Brands also can’t escape the current economic climate like many other retailers, Prof Mortimer added.

“There are macro issues like the cost of living crisis and discretionary income shrinking,” he said.

“When consumers are facing high mortgage costs, utility and food prices are going up, insurance prices are going up, its almost this perfect storm where people are spending less on footwear, clothing and accessories and they’ve got those business selling the same type of product to the same audience.”

The Australian Competition and Consumer Commission has also launched a federal-court case alleging Mosaic Brands failed to deliver orders within advertised time frames, or within a reasonable time frame, or not at all. The company is defending the court action.

In an ASX announcement, Mosaic Brands also revealed that Deloitte had been advising it on safe harbour provisions.

These work by protecting company directors from personal liability and essentially pushing them to place a company into administration if the company is insolvent, and instead they can action a better plan for the business and creditors.

Prof Mortimer said the trading halt and subsequent ASX update could mean two things.

“It might signal they have a buyer for the business or as they are reported to be working with Deloitte, it could be restructuring the business,” he said.

“It may mean they get rid of some brands that tend to replicate each other or do what they did in 2023 and decide to close a couple of hundreds of stores that are making a loss. That’s not unreasonable as we’ve seen Myers and David Jones do that. In order to grow you have to shrink your fleet sometimes.”

Mosaic Brands will report on its results for the 2024 financial year on August 28.

It said the group has suffered from operational issues in recent months that have adversely impacted trade.

“These are being worked through by the directors, management and its advisors, and the group anticipates a recovery in its trading performance through the course of H1 FY25 once these operational issues are resolved,” the company said in an ASX-statement.

“We also confirm that the senior secured creditor of the group remains supportive, and we continute to work with our suppliers to deliver for our customers.”