Dick Smith blasts private equity firm behind retailer’s stock market float

FURIOUS entrepreneur may fund class action against firm which floated his old company, as electronics store manager says retailer “destroyed” merchandise.

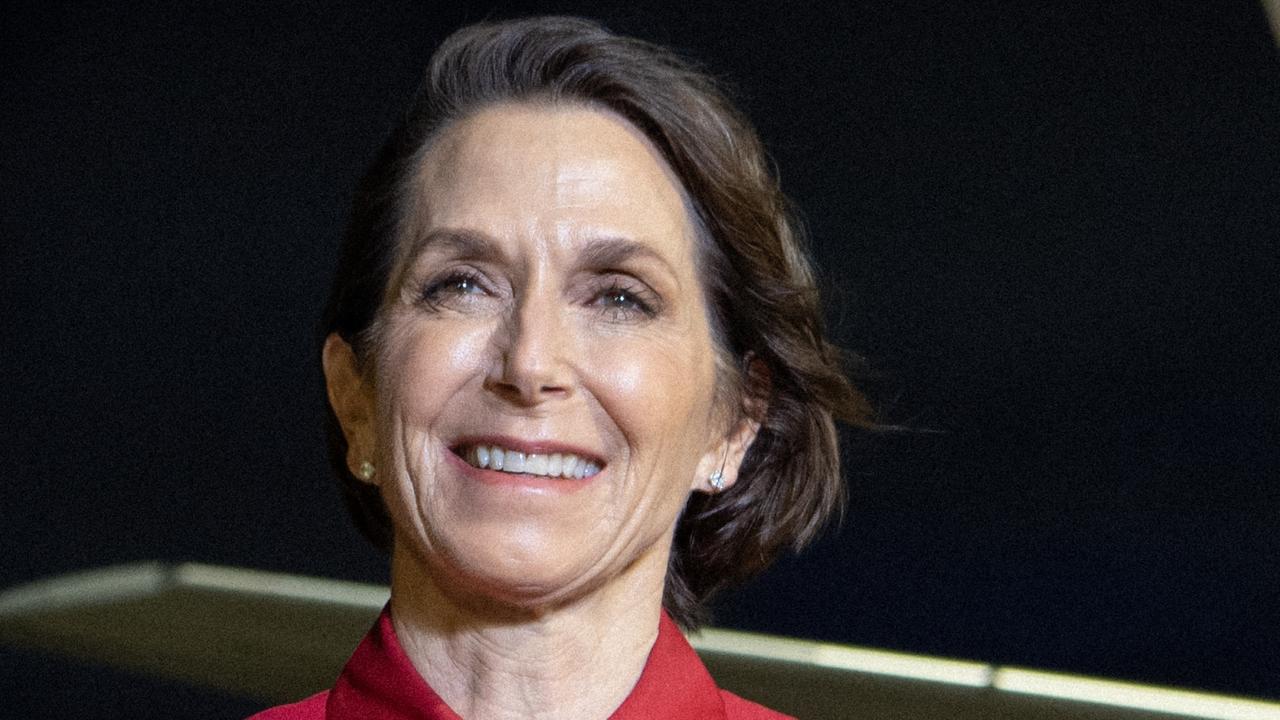

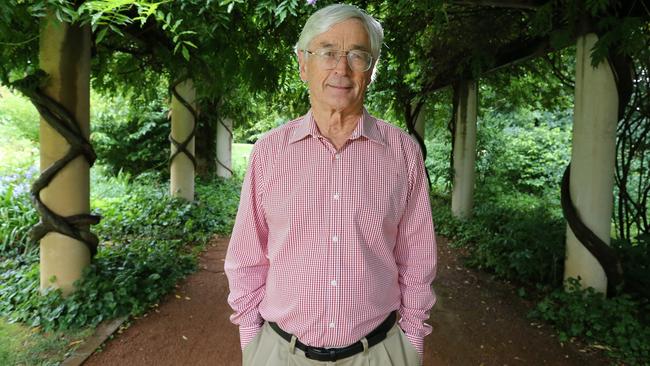

AUSTRALIAN entrepreneur Dick Smith says he will consider funding a class action against Anchorage Capital Partners, the private equity firm which floated his former company on the stock market in 2012.

Mr Smith said Anchorage, which made hundreds of millions in the purchase from Woolworths and subsequent stock market listing, lacked “morality and decency”, The Australian reports. He has also demanded refunds for customers holding now-worthless gift cards.

“As I think everyone understands, I’m absolutely outraged at people like [managing director] Phillip Cave and Anchorage Capital Partners because of their absolute dishonesty,” Mr Smith told The Australian.

“There can be absolutely no doubt they knew that things were going wrong and instead of doing the right thing, they’ve let typical Australians suffer.”

Dick Smith collapsed last week with debts of around $390 million, including $250 million to unsecured creditors, including customers with deposits and gift cards, which receiver Ferrier Hodgson said would not be honoured.

Administrator McGrathNicol yesterday told the first meeting of creditors the ultimate fate of the retailer may not be known for up to six months as it would be seeking an extension beyond the current February 9 deadline.

Last week, legal experts told the Herald Sun a class action against Dick Smith was not a given. Any class action would need to demonstrate Dick Smith directors failed to disclose market sensitive information or made misleading statements to investors about the health of the group.

However, questions have been raised about Anchorage’s restructure of the business after purchasing it from Woolworths for $20 million. The retailer listed on the share market for $2.20 a share in 2012, raising $345 million — more than five times its initial price.

In one scathing analysis, Forager Funds Management described the float as “the greatest private equity heist of all time”, with Anchorage “using all the tricks in the book” to turn Dick Smith from a “$10 million piece of mutton into a $520 million lamb”.

Anchorage allegedly marked down a significant amount of Dick Smith inventory to later sell at a discount in order to post attractive earnings figures. “The inventory writedown is the most important step in the short term,” Forager Funds’ Matt Ryan wrote.

“They are about to sell a huge chunk of inventory but they don’t want to do it at a loss, because these losses would show up in the financial statements and make it hard to float the business.

“The adjustments never touch the new Dick Smith’s profit and loss statement and, at the stroke of the pen, they have created (or avoided) $120 million in future pre-tax profit (or avoided losses). Now they can liquidate inventory without racking up losses. And boy did they liquidate.”

Financial accounts show in November 2012, Dick Smith had inventory that cost $371 million but had been written down to $312 million. By June 2013, inventory had dropped to $171 million, pointing to a massive clearance sale.

“The reduction in inventory has produced a monstrous $140 million benefit to operating cash flow, basically from selling lots of inventory and then not restocking,” Mr Ryan wrote.

One store manager told news.com.au the Forager Funds analysis was “100 per cent spot on”. “It’s common knowledge within the business about just how much stock was completely written down and destroyed before the float,” he said.

“DSE buying team went on a buying spree with suppliers to get as much vendor kick backs as possible without considering how the stock will actually sell.

“That’s how we are in the mess we are now. Banking rebates without selling the stock and opening stores everywhere isn’t a sustainable business model for growth and profit.”

McGrathNicol administrator Joe Hayes said yesterday the investigation into the causes of the collapse would examine a number of items “of interest”, including the rapid store network expansion and a large “other income” figure in 2013.

Dick Smith’s dramatic share price plunge late last year was triggered by a series of profit downgrades followed by yet another writedown in the value of its inventory, this time to the tune of $60 million.

Mr Hayes said an initial assessment of the business showed $220 million worth of inventory, but it was too early to say whether this would again be written down.