‘Devastating’: Baskin-Robbins franchisee left $210,000 out of pocket after bitter dispute

A Queensland franchisee has opened up about the “devastating nightmare” that left his family hundreds of thousands of dollars out of pocket.

A Queensland franchisee has opened up about the “devastating nightmare” that left his family more than $200,000 out of pocket after an agonising, years-long dispute with a popular ice cream chain.

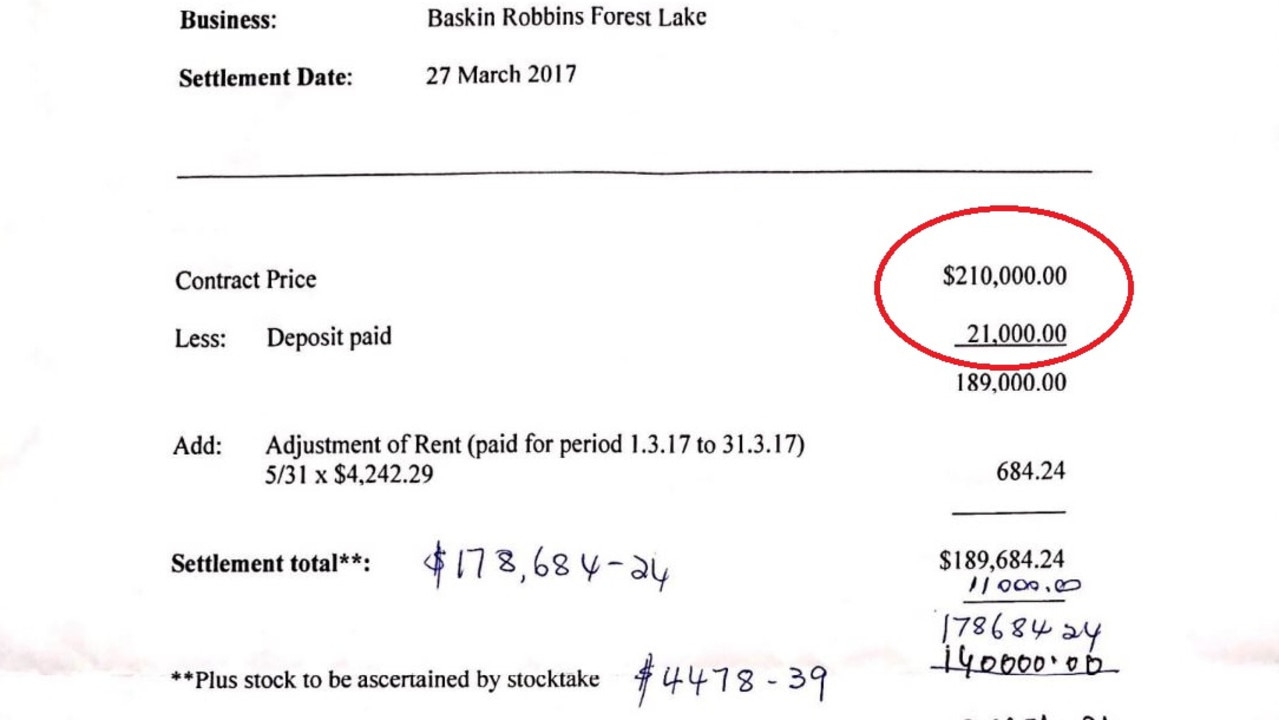

In March 2017, a Queensland couple, who spoke to news.com.au on the condition of anonymity, purchased a Baskin-Robbins ice cream franchise in Forest Lake, investing $210,000 plus extra to cover stock.

The business owners had “no issues” initially, but after their contract period ended at roughly the same time as the Covid pandemic hit, the franchisor asked them to renew, which they were hesitant to do given the uncertainty of the times.

“We had been very obedient and complied with all the policies and conditions of the franchisee agreement,” the business owner said of their initial years in business.

However, the pair ultimately decided to sell up, and the franchise was put on the market with the help of a seller’s agent, with the couple reaching an agreement with the franchisor to continue running the business on a month-by-month basis as they waited for an offer.

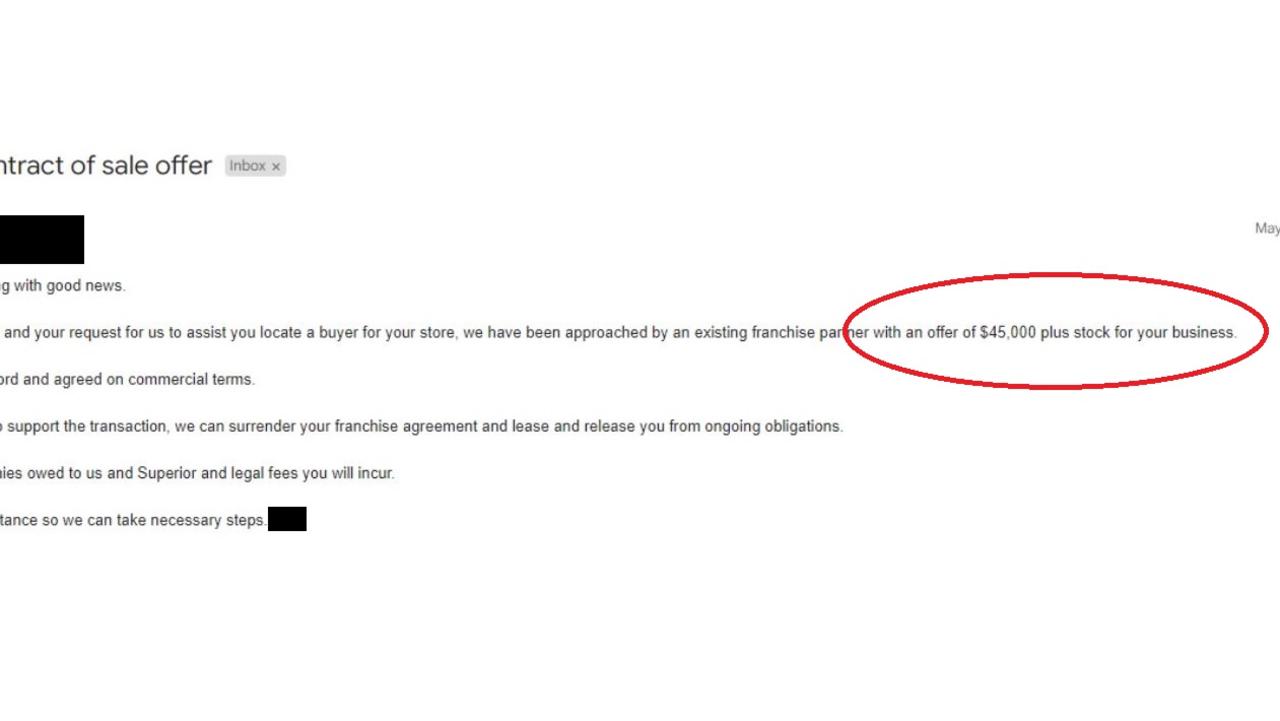

Then, in June 2020, the pair received an email stating a potential buyer had been found – but also accusing them of under-reporting sales, an allegation they strenuously deny.

“It was a clearly false allegation … if we were making such good sales, why would we want to sell the business?” the husband said.

In the end, the pair were offered a mere $45,000 plus stock as a result of the alleged unreported sales.

“We invested $210,000 in the business and over three years we had brought the business into good shape, and they were telling me to sell it for not even one-quarter of what we put in,” the husband said, adding the store had reached every requirement and hit every benchmark under their leadership.

“It was not fair.”

Then, in July 2020, they received a one-month eviction notice from a lawyer.

“We didn’t know what to do – we were really financially struggling during the pandemic time with no option to get any more money and no scope to sell the business,” he said.

In early August, they turned up to the store one morning ready to open as usual, only to find the locks had been changed.

“The store was seized, we had no access to the till money and there was still a banking amount in the lockers. But it was locked with a different key,” the former business owner said.

The couple contacted the ACCC and were told to reach out to the Small Business Ombudsman to lodge a complaint.

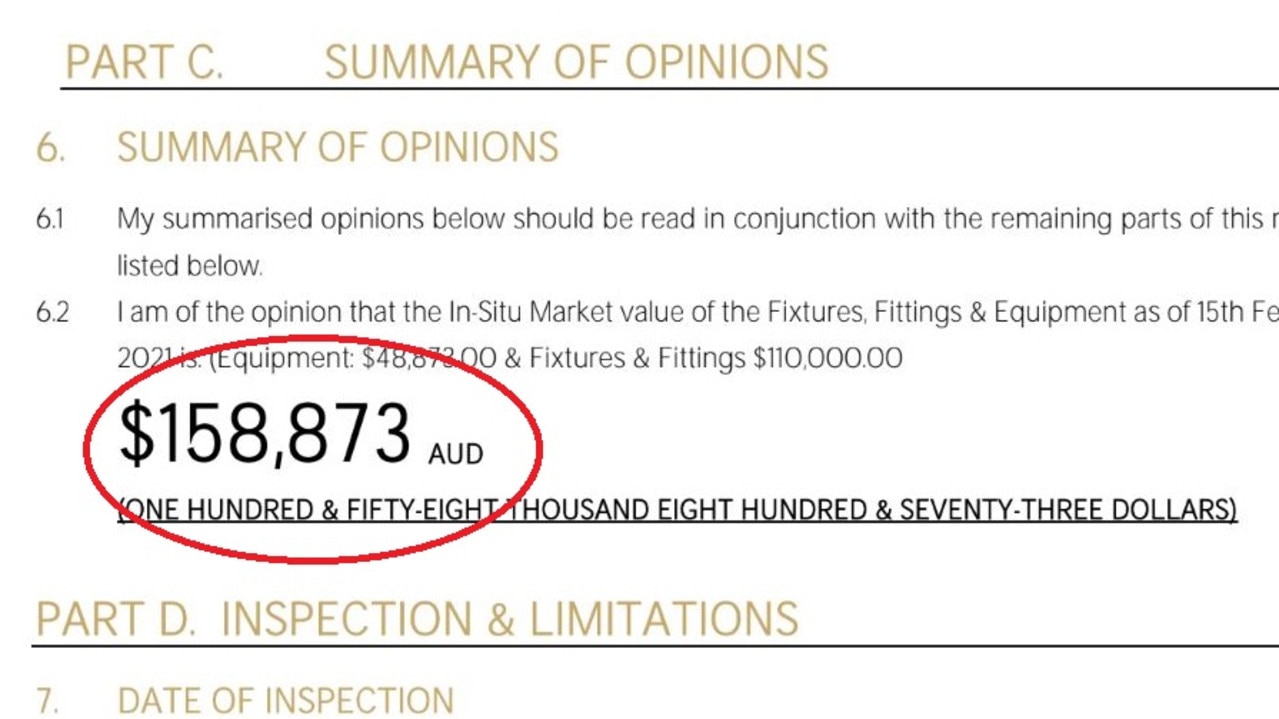

In September 2020, mediation was arranged with the franchisor, but the couple claim they were never given a breakdown of the basis behind the $45,000 offer. Eventually, it was agreed to enlist the services of an independent valuer, who in February 2021 came up with a new figure – $158,000.

The couple accepted that solution – but the other parties rejected it, and simply walked away from mediation.

The Ombudsman and Small Business Commissioner informed the couple that they could not force the other parties to settle the business, and that the only option left was to commence legal proceedings – an option they say they can’t afford, especially as they have also been slugged with a $17,000 bill for outstanding debt with the franchisor and must also repay the money they initially borrowed to buy the business in the first place.

The couple believe the franchisor was keen to proceed with the low-ball offer as the store’s lease agreement was under the franchisor’s name, and because they were also responsible for financing the de-fitting of the store if it were to close down, which would leave them $30,000 to $40,000 out of pocket.

In an added blow, the husband’s mother, who lived overseas, died during the pandemic, and he was unable to be with his father and other relatives due to the travel restrictions in place at the time.

“I was completely lost and so depressed – I didn’t know where to go, who to contact or what to do,” he said.

“It has been devastating. It has been going on for so long, and especially these days, everybody is struggling.

“It has been difficult to make ends meet. I can’t explain how we survived – only by God’s grace and blessings.”

The couple are now working full-time in customer service roles after having refinanced, and they are now attempting to rebuild their lives and get back on their feet financially, and resolve the dispute amicably.

However, the personal toll has been immense, with the couple unable to afford to have another child or take even a few days off to spend with their family, and effectively being forced to walk away from the hospitality industry.

“It’s more than a nightmare – no words can express,” the husband said.

“Every time we go to a restaurant or walk past an ice cream shop the whole picture comes back. I can’t eat ice cream – it’s too painful. Since then, every day is painful and we are too worried to even take a couple of days because we will lose they pay which is very hard financially.

“We have a teenage daughter who knows about all our pain – we had so much extra stress on top of trying to raise a child. Financial stress, mental stress, and we couldn’t have another baby because we felt we had to work every day.

“I lost my personal life, my family life, my financial life and my dream of working in hospitality – everything. And I can’t regain those four or five years.”

He said more assistance and support was needed for small business owners and franchisees in particular, claiming many were also seriously struggling.

“If Australia wants to succeed we have to correct these flaws because the only way the economy will grow is if people are interested in buying businesses and creating more job opportunities,” he said.

He said he wanted to share his family’s story to help other franchisees in future.

In a statement provided to news.com.au, Baskin-Robbins denied the allegations in relation to not acting in good faith to resolve the matter with the former franchisee partners of its Forest Lake operations.

Baskin-Robbins confirmed it had worked with a third party to make “every attempt to resolve the matter”, however, “they have been unsuccessful to date”.

The firm also confirmed the former franchise partners chose not to renew their franchise agreement or lease, and claimed that they “fell behind on rent payments, supplier payments and any attempt towards a resolution included taking into consideration recovery of sums owed”.

“We recognise the hard work and dedication of so many of our franchise partners who do uphold their franchise agreement, and respectfully fulfil their obligations under that Agreement,” a company spokesperson said.

“We are currently celebrating growth across our network which is made possible thanks to the small business owners which make up our ice cream family, doing the right thing by their employees, and working hard every day to build a sustainable business for the communities they serve.”

The statement claimed that this was also evident “in the growth of the companies’ multi-unit operators investing in the strength of the brand and their businesses”.

Baskin-Robbins also confirmed it had provided support and assistance to franchise partners during the pandemic, including seeking relief in leasing costs through rental abatement, as was secured for the Forest Lake franchise partners.

Launched just months before Covid, delivery was also a huge focus resulting in positive sales growth and momentum for franchise partners, despite the difficult climate.

“We have every interest in helping our franchise business partners succeed. We provide in-depth training when they join our network and continue to provide ongoing support to give them the best opportunity to run a successful business,” the statement continues.

The company confirmed attempts at a resolution remained with third-party mediators who confirmed on the last attempt, on March 30, 2021, that the company had acted in good faith but that the mediation had been deemed unresolved.

This information was provided to both parties and to the office of the Australian Small Business and Family Enterprise Ombudsman.