Demand for workers down in August, while retail turnover is up

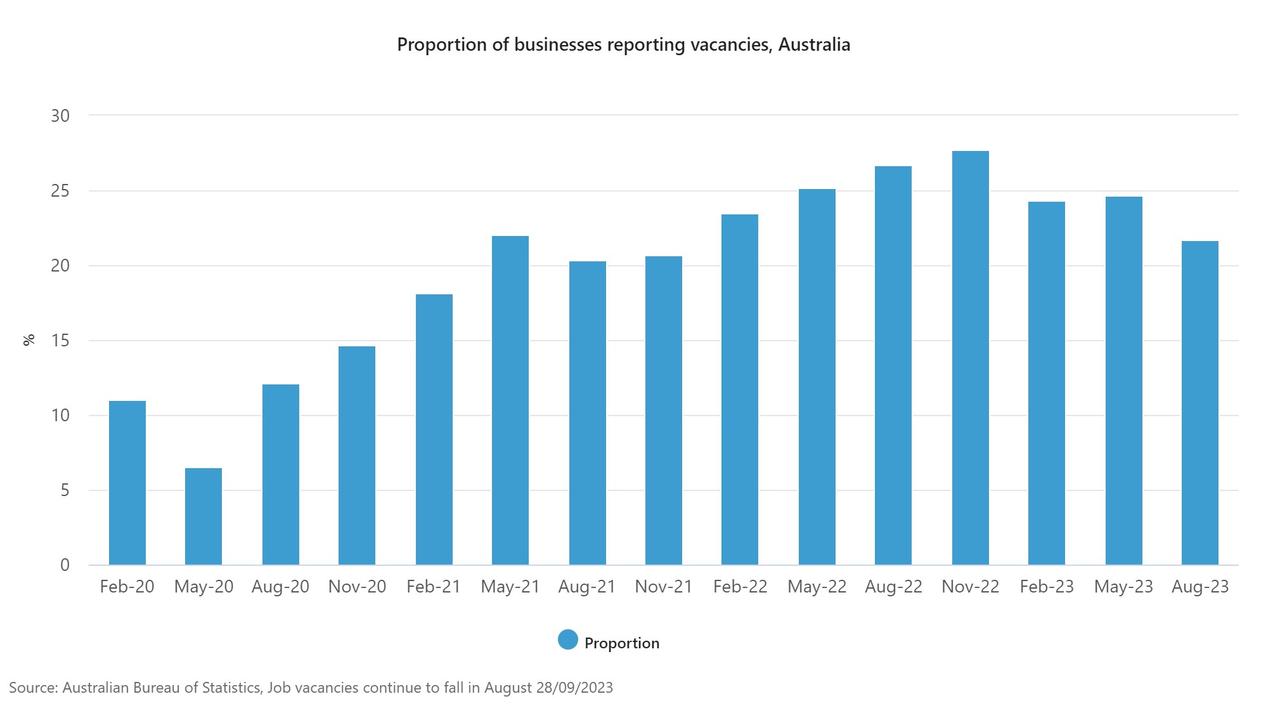

The latest figures from the ABS show demand for workers cooling in August for the fifth straight quarter.

Demand for new workers has cooled for the fifth quarter in a row, according to the latest Australian Bureau of Statistics (ABS) jobs vacancy data.

The report, released Thursday, covers the three months to August, and shows there were 390,000 job vacancies in that quarter — down 38,000 from May.

ABS head of labour statistics Kate Lamb said the drop was about nine per cent between May and August, seasonally adjusted, and down 18 per cent from the peak in May 2022.

“Demand for workers eased again in August for the fifth straight quarter,” Ms Lamb said.

“This coincided with an increase in the unemployment rate over the three months to August.

“While these indicators are no longer at historical levels, both are still showing that the labour market is tighter than it was before the COVID-19 pandemic.”

Job vacancies were still around 72 per cent higher than they were in February 2020 — about 160,000 more jobs that employers are looking to fill.

“The percentage of businesses reporting at least one vacancy also fell from 25 per cent in May to 22 per cent in August. However, this was still double what it was in February 2020 at 11 per cent,” Ms Lamb said.

Public sector vacancies fell by 3,000 (down six per cent) while the private sector fell by 35,000 (down nine per cent).

ACT saw the largest percentage drop in job vacancies (down eight per cent) while Queensland was the only state to see growth (up four per cent).

Financial and insurance services showed the largest drop in job vacancies (down 15 per cent) for the August quarter, while retail trade vacancies rose 19 per cent.

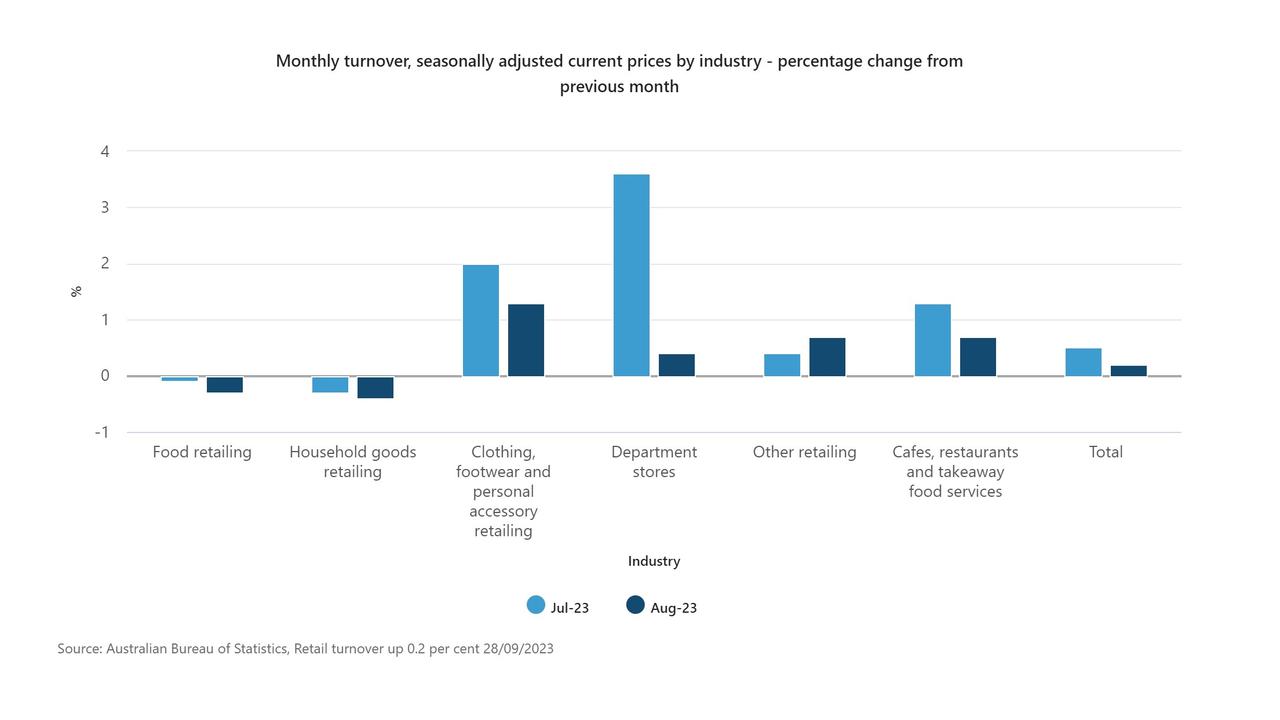

The ABS also released its latest Retail Trade figures on Thursday, showing retail turnover was up 0.2 per cent in August.

That follows a 0.5 per cent rise in July, and an 0.8 per cent fall in June, seasonally adjusted.

ABS head of retail statistics Ben Dorber said the modest rise in August shows consumers continued to restrain their retail spending.

“In trend terms, retail turnover rose 0.1 per cent, and was up only 1.3 per cent compared to August 2022 — the smallest trend growth over 12 months in the history of the series,” Mr Dorber said.

“Considering how high inflation and strong population growth has added to retail turnover in the past year, the historically low trend growth highlights just how much consumers have pulled back in response to cost-of-living pressures.”

Clothing, footwear and personal accessory retailing (up 1.3 per cent) recorded the largest rise, followed by cafes, restaurants and takeaway food services (up 0.7 per cent), other retailing (up 0.7 per cent), and department stores (up 0.4 per cent).

“Warmer than usual weather and additional promotional activity linked to Afterpay Day lifted spending on discretionary goods, especially clothing, footwear and personal accessories,” Mr Dorber said.

“Spending was again boosted by the 2023 FIFA Women’s World Cup with strong demand for fan gear and increased spending across cafes, restaurants and takeaway food outlets as large crowds attended matches and live sites across the country.”

Oxford Economics Australia economist Sean Langcake said it’s a very modest increase in sales, given the brisk pace of population growth and price inflation.

“Inflation and higher mortgage and rent costs continue to push up cost-of-living pressures, which in turn is weighing on consumer confidence and spending,” Mr Langcake said.

“Consumer spending on services is outpacing retail goods, but overall these data point to another soft outcome for household consumption in Q3.”