Coronavirus: Coca-Cola sales and profits plunge amid pandemic

Coca-Cola was finally getting back on its feet – then the pandemic hit and sales plunged, leaving the brand’s future on shaky ground.

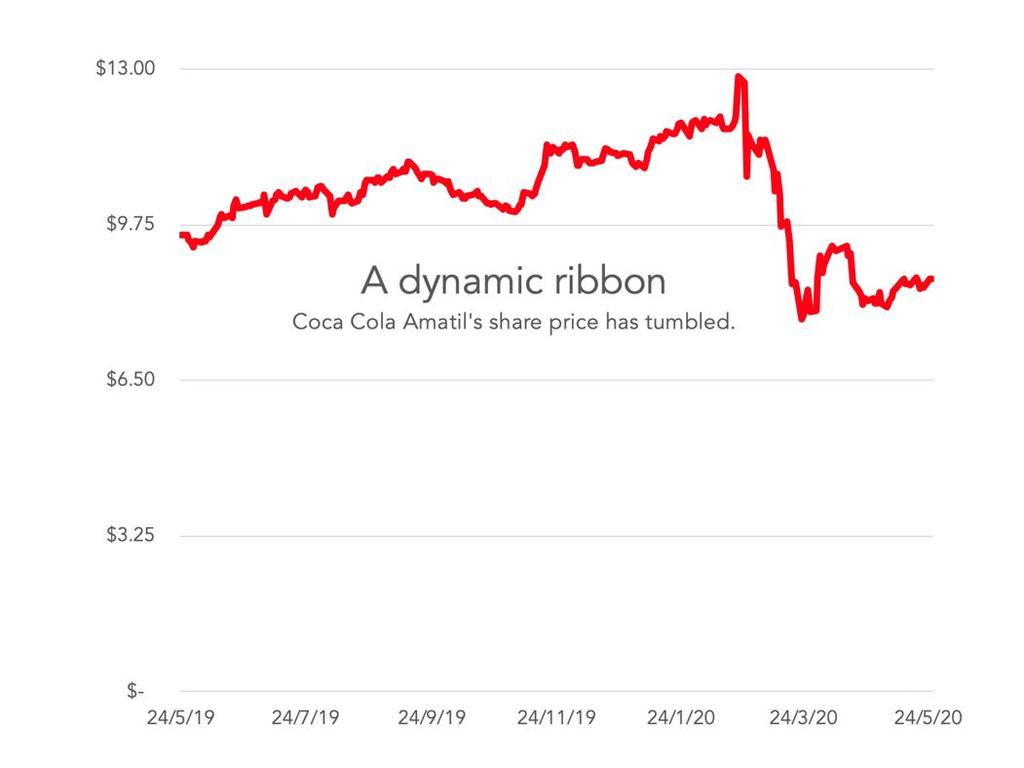

On Tuesday, the Australian outpost of the mighty Coca-Cola empire – Coca-Cola Amatil – came to market and made its confessions. The pandemic and shutdown has hit them, they said, and hit them hard. The company’s share price fell.

Volumes sold are down 33 per cent, said Coca-Cola Amatil managing director Alison Watkins. That’s a one-third decline, and it comes just as the beverage boss got Coke back on its feet.

As we know, Coca-Cola’s famous cola beverage has been falling from favour for a long time. People in the advanced world don’t buy sugary coke so much anymore. But Coca-Cola Amatil has not had its head in the sand. It has been moving and innovating – diversifying so that it is not so dependent on the eponymous cola brand.

It now owns about half the brands you see in any drinks fridge, from Monster energy drinks to Powerade and Barista Bros coffee, as well as a dizzying array of alcohol brands.

That strategy has held the tide, and then the introduction of Coke No Sugar was enough to see its Australian revenues rise in 2019 – the first such rise since 2012. Joyous news for the beverage company and its shareholders.

And now this. 2020 has been a gut punch to the beverages industry.

Just about everywhere a person might buy a drink has been hit: cafes, restaurants and bars are shut. Few people are going to service stations since we aren’t driving. The football isn’t on. Vending machines are feeling lonely. And convenience stores aren’t especially relevant when you’re at home on the couch. Coca-Cola Amatil saw a 55 per cent fall in these channels.

The sole lively spot in the retail environment has been supermarkets. Coke has been trying hard to boost sales there. They redeployed 250 staff from their dead zones to supermarkets, but to little avail. Not everyone drinks Coke at home. Cola certainly hasn’t been in danger of running out on the supermarket shelves. After a little spot of panic-buying in March, volumes sold in April were actually 10 per cent lower than the same month a year earlier.

I haven’t heard reports of any punch-ons in the cola aisle. Worse news – for Coke, relying on drinks we put in our trolleys is bad for the bottom line, as grocery sales come at a much lower margin than the ones they sell through restaurants and vending machines.

“While revenue since the start of April has broadly declined in line with volume, the impact on our group margin percentages has been much greater, reflecting marked shifts in channel and package mix,” said Coca-Cola Amatil managing director Alison Watkins.

Atkins says she has spotted some signs of life in the market.

“(S)ome green shoots are emerging. Trading in the first three weeks of May has seen a modest improvement on our April run rate with our volume declining by approximately 26 per cent (compared to the same period in 2019).”

Let me say, when a 26 per cent year-on year decline in a big stable business like Coca-Cola counts as a “green shoot”, it shows just how incredibly bad things had become.

GETTING THE FIZZ BACK

Perhaps the most shocking news of all that Coca-Cola transmitted to the market on Tuesday was this: As the drinks market collapsed, they actually won market share.

“It has been a testament to the strength of our brands that we have been able to outperform the broader beverages sector and achieve market share gains in Australia, New Zealand and Indonesia,” said Watkins.

This means that no matter how bad it has been for Coca-Cola Amatil, it was even worse at other drinks companies.

“We are determined to emerge from this crisis stronger and better than before,” said Watkins, and that sounds like normal corporate-speak. But the pattern of this crisis means it is actually possible.

The pandemic has been less “disruptive” than some people expected. It is big established companies with lots of money who will survive, and smaller ones that die off. Virgin is gone, for example, and Qantas remains.

Coca-Cola is the Qantas of cold drinks, and after the crisis, it will probably find itself facing a bit less competition.

In the future, they may end up owning even more of the drinks in that drinks fridge.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.