Cheer cheese remains top-selling brand after Coon name change

Go woke, go broke? Here’s what really happened after iconic brand Coon changed its name to Cheer.

EXCLUSIVE

So much for “go woke, go broke” — Aussie shoppers are still cheering for Cheer.

When the iconic cheese Coon changed its “offensive” name in 2021, some outraged shoppers vowed to boycott the brand declaring it was “cancel culture” and “political correctness gone mad”.

And late last year, commentators declared “go woke, go broke” had struck again, after Canadian dairy giant Saputo was forced to shut down its Maffra factory in Victoria’s Gippsland region, sacking 75 workers, following dismal financial results.

But according to data from market research provider Euromonitor International obtained by news.com.au, Cheer cheese has remained the top-selling brand despite the name change.

And a Coles spokeswoman also confirmed that “there’s been no impact to sales since the rebrand”.

Between 2018 and 2020, Coon was the leading brand with an 8.9 per cent market share, according to Euromonitor data.

In 2021, under the new name Cheer, it increased that share to 9 per cent, and 9.2 per cent in 2022.

By contrast, the number two brand, Fonterra’s Perfecto Italiano, held an 8.1 per cent market share in 2020 and 8.2 per cent in 2022.

“Pre-Covid, Coon was experiencing growth at a rate comparable to the overall market, without having observed any significant changes in market shares as of yet,” said Euromonitor research analyst Arshad Mawla.

“In recent years with changes to the brand name to Cheer, it has exhibited a slightly higher growth in the market but has not resulted a notable shift in market shares yet.”

Interestingly, however, the number of shoppers who report buying Cheer has fallen dramatically compared with Coon — suggesting they simply don’t remember the name.

Roy Morgan Research poll manager Julian McCrann said around 12 per cent of Australians were buying Coon cheese in 2018-19, or about one in eight.

“With the name change to Cheer cheese which was rolled out in mid-2021 we saw an initial spike for Cheer cheese just after it launched (and there was a heavy advertising campaign), however over the last 18 months or so this has dropped to around 7 per cent of Australians who now say they buy Cheer cheese in an average four weeks,” he said.

Mr McCrann added there were “a couple of things to keep in mind with this result”.

“As people answer our questionnaire and tell us what type of cheese they have been buying there is a question of recall,” he said.

“Some people might be buying the same cheese, but not realising there has been a name change and so might not have even noticed they are now buying Cheer cheese rather than Coon. These changes can take an extended amount of time to filter through to everyone.”

The total size of the retail cheese market in Australia has increased slowly year-on-year with the exception of 2019 and 2020 during Covid.

Between 2021 and 2022 the market grew 2.3 per cent to $3.35 billion, according to Euromonitor.

“Inflationary pressures have dampened consumers’ ability to spend on dairy, where prices have risen, with private label products performing well as a result of this,” said Euromonitor head of insights Tim Foulds.

“However, health and nutrition, indulgence, and convenience are fuelling sales in categories such as cheese. Consumer interest in plant-based alternatives is on the rise, and major domestic player Bega announcing the launch of its first plant-based cheese alternatives.”

According to IBISWorld, domestic per capita cheese consumption has declined slightly over the past five years.

But shifting consumer preferences away from cheddar towards more expensive premium varieties such has goat’s cheese and fetta have boosted revenue and somewhat offset those declines, the market research firm says.

“Saputo was the first of the major dairy processors to pass on rising costs to customers, putting its products at a competitive disadvantage to rivals like Bega and Mainland,” said IBISWorld senior industry analyst Matthew Reeves.

“A rising premiumisation trend in the retail cheese market — partly limited by elevated inflation over the past year — has constrained sales of everyday cheese products like (but not excluded to) the Cheer brand.”

Saputo Australia, which acquired the Coon cheese brand when it purchased Warrnambool Cheese and Butter in 2014, reported a $54.4 million annual loss for the 12 months to March 31 — a stark difference to the $30.6 million net profit in 2021.

The company, which in addition to shuttering Maffra announced it was scaling down two other factories, blamed the financial woes on milk supply issues, with milk collections plummeting to 2 billion litres from a forecasted 3.1 billion litres in just three years.

Saputo international president and chief operating officer Leanne Cutts said it was a “very difficult decision”.

“Today’s announcement continues our journey towards long-term success for our business in Australia by increasing our efficiency and productivity, and making our business more competitive,” Ms Cutts said in a statement last November.

“Site management will work closely with affected employees at the three impacted sites to discuss redeployment and retraining opportunities. Where alternative roles are not available, these employees will be provided with severance and outplacement support.”

In its most recent annual report, the Canadian company noted that it had “stepped up our diversity, equity and inclusion (DE&I) initiatives”, including “rolling out our unconscious bias training globally”.

Saputo chief executive Lino A. Saputo said in his statement that the company’s latest performance “reflected persistent supply chain headwinds stemming from Covid-19 and its related ongoing impacts, and this global reality presented one of the most challenging operating environments to date”.

“Our Dairy Division (Australia) also had to contend with a declining milk pool, an ongoing issue the team is tackling head-on and which significantly impacted productivity and costs in FY22,” he wrote.

The annual report says the company “successfully completed the rebranding of Cheer cheese”, which was “supported by a strong awareness campaign in its first year”.

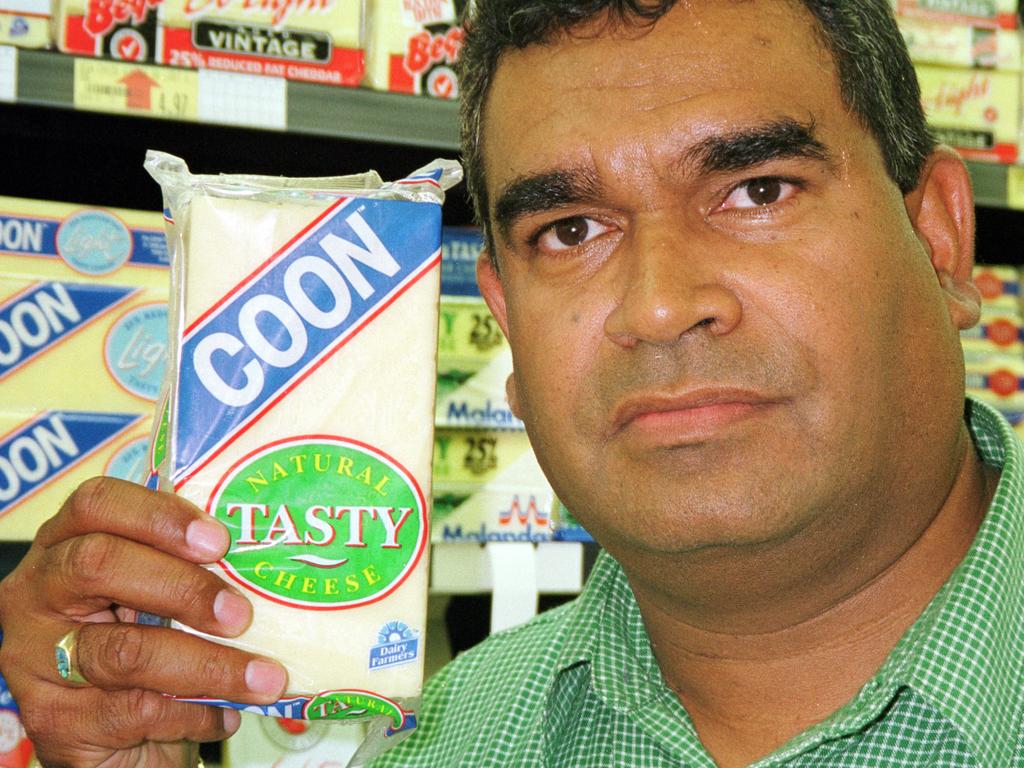

Saputo first announced in 2020 it was changing the name of Coon, following years of campaigning by Indigenous activists including Dr Stephen Hagan.

The renaming of the cheese sparked fierce debate in Australia between those who said it was merely a family name and those who asserted the more widely known slur meant it should no longer be used.

Kraft Australia introduced what was then called Red Coon cheese in 1931. The Coon name derived from the work of Edward William Coon of Philadelphia who developed a technique of ripening cheese using humidity and high temperatures, which became known as the “cooning” method.

However, Australia’s Coon cheese did not use this ripening method nor was it made by Edward Coon or his company. Rather, it was ostensibly named in honour of Mr Coon. At the time it was created, the racial slur was in use in Australia.

The cheese had gone through various owners with ongoing calls to rename the brand, including from Dr Hagan, who first made the request in 1999.

Announcing the decision in July 2020, Saputo said one of its “basic principles as an organisation is to treat people with respect and without discrimination and we will not condone behaviour that goes against this”.

“As such, we performed a careful and diligent review of a sensitive situation involving one of our brands,” the company said.

“We wanted to ensure we listened to all the concerns surrounding the Coon brand name, while also considering comments from consumers who cherish the brand and recognise the origin of its founder Edward William Coon, which they feel connected to.”

Saputo said after “thorough consideration” it had decided to retire the Coon brand name.

“We are working to develop a new brand name that will honour the brand-affinity felt by our valued consumers while aligning with current attitudes and perspectives,” it said.

“We believe we all share in the responsibility to eliminate racism in all its forms and we feel this is an important step we must take to uphold this commitment.”

In January 2021, the new name was revealed, and the rebranded Cheer cheese began replacing Coon on shelves in June that year.

Mr Saputo told breakfast TV at the time it was a “challenging” decision because Coon was such a well known brand in Australia.

“Although we’ve only owned it since 2015 it was important for us to understand that name did not please other consumers,” he said in an interview with Seven’s Sunrise.

“You want to have a culture that is fully inclusive, where everyone feels like they’re accepted, where everyone feels like they’re respected. We thought there was no harm in changing the name. In fact, a real plus, a real benefit to our consumers.”

Cheer represented “a cheese for everyone, and we trust our valued consumers and those who are new to our products will embrace this new name”, Saputo commercial director Cam Bruce said.

Speaking to news.com.au as Cheer began hitting shelves, Dr Hagan said it was “great work” by the brand’s owners to fulfil their commitment to phase out the name.

“That Coon cheese fella finally got his way,” he said.

Woolworths declined to comment Cheer cheese sales, saying Saputo “would be best placed to comment on their sales for Cheer post-rebrand”.

Saputo did not respond to requests for comment.

— with Benedict Brook