Buy now pay later business Openpay in liquidation following collapse

A major player in the buy now pay later market has gone into liquidation after attempts to sell or recapitalise the business failed.

EXCLUSIVE

Defunct buy now pay later business Openpay was put into voluntary liquidation late last week after attempts to sell or recapitalise the business failed.

Openpay collapsed into receivership in February this year owing more than $66.1 million to creditors, $4.1 million in unpaid leave and wages to employees, and with just $1.2 million left as cash in the bank, according to reports.

It is unclear whether retailers had been fully paid for transactions over the Openpay platform at the time of its collapse.

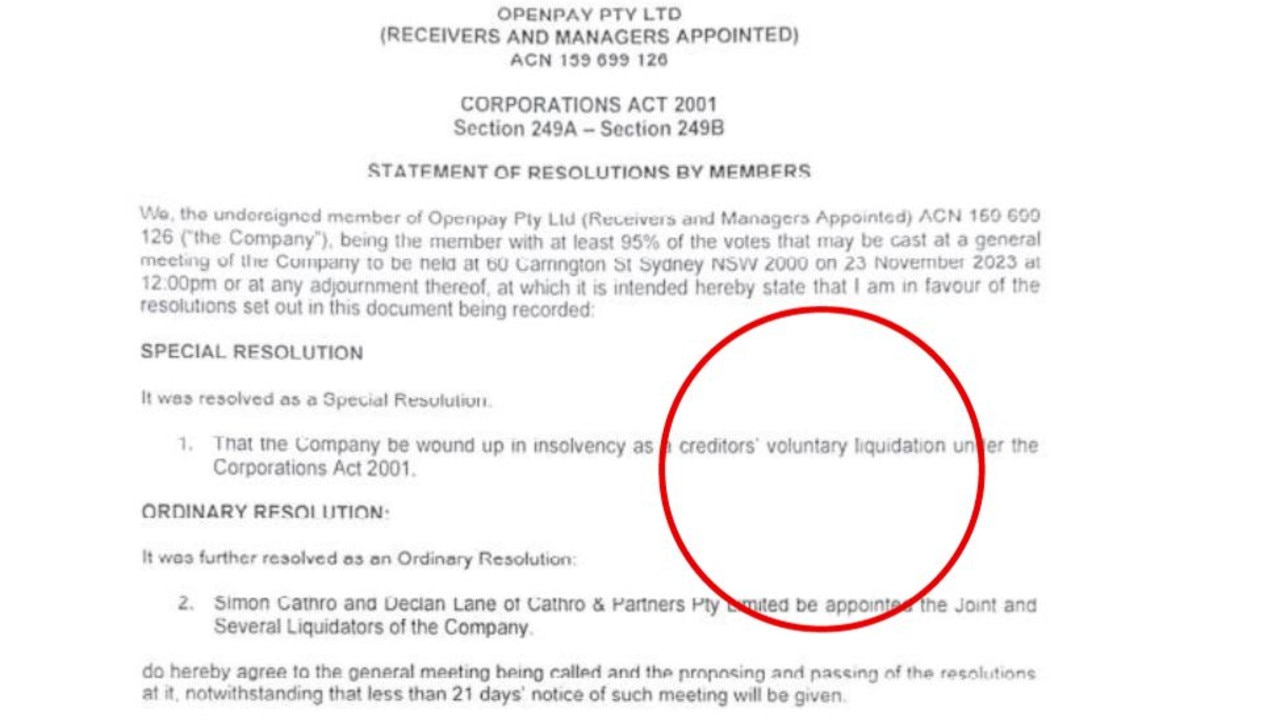

On Thursday, Simon Cathro and Declan Lane of Cathro & Partners were appointed as liquidators and administrators to oversee the winding up of Openpay, according to documents filed with the Australian Securities and Investments Commission (ASIC).

Know more? | michelle.bowes@news.com.au

Cathro & Partners have not responded to requests from news.com.au for an interview and the size of its remaining debts are unclear, however it is possible that retailers and staff are still among its unsecured creditors.

Customers were no longer able to use Openpay for new purchases following the appointment of McGrathNicol as receivers of the company on February 4, 2023.

Buy now, pay later works by advancing payments for customer purchases to retailers for a flat fee, while allowing customers to pay back the purchase cost in instalments over time.

In a statement to the Australian Securities Exchange (ASX) at that time, the receivers said customers would need to keep paying their invoices while they worked “closely with Openpay’s employees, merchants and customers to urgently determine the appropriate strategy for the business”.

In a subsequent announcement, McGrath Nicol sought expressions of interest from parties looking to purchase Openpay or its OpyPro B2B SaaS (business-to-business sales-as-a-service) platform or interested in recapitalising the business.

In July, it was announced that the OpyPro B2B SaaS platform had been sold to a related company – OP Fiduciary Pty Ltd – for $10 million, which was payable as a reduction against the secured debt Openpay owed to this business.

Openpay first listed on the ASX in 2019 at $1.60 a share.

Its shares traded as high as $4.70 before falling to a low of just 0.20 cents before it collapsed.

It was officially removed from the ASX on August 28.

ASIC documents show it had not made a profit since its stock market debut.

Know more? | michelle.bowes@news.com.au