Bunnings threatens tradie after criminal contractor runs up $23,000 bill

TONY Stengel is being chased by Bunnings for something he didn’t even do after someone stole his ute and went on a staggering spending spree.

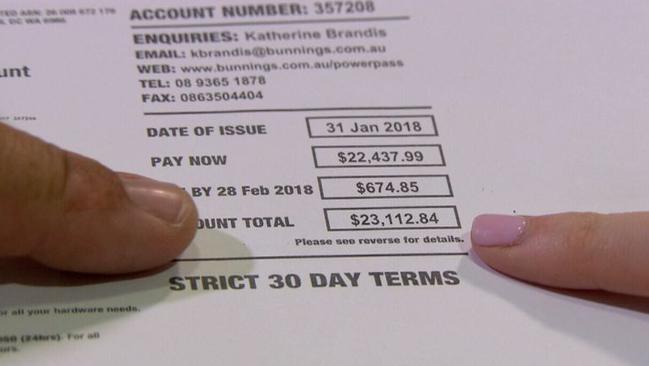

A QUEENSLAND tradie being threatened by Bunnings about a $23,000 bill fraudulently run up by a former subcontractor has begged the hardware giant for a “fair go”.

Tony Stengel from Hervey Bay handyman business Tony’s Rent A Hubby had his ute stolen last year by Darren Keyssecker, who drove 400km to Brisbane and went on a spending spree using Mr Stengel’s Bunnings and Caltex cards.

Keyssecker, who was later jailed for four months for car theft and fraud, racked up $1500 at Caltex and $17,000 at Bunnings on a string of items including security cameras, engraving machines and power tools.

While Caltex waived the bill after Mr Stengel informed them of the situation, Bunnings instead called in the lawyers, putting a caveat over his $500,000 home. Bunnings is demanding full payment of the bill, which currently stands at nearly $23,000 including interest.

“After the initial contact with Bunnings saying this is what happened, this is the police report number, their lawyers got involved and then they basically started proceedings to put a caveat on my house,” Mr Stengel told news.com.au

“I have only spoken to their lawyers [since then]. Their legal stance is, due to Darren having the PIN number to the account, it’s my responsibility for allowing him to use it.

“I did offer to go thirds in the bill, saying it’s a third my problem and a third yours because you have a duty of care. They refused that, saying they want the full amount paid, including court costs, legal costs, and you have six months.”

Mr Stengel said he filed a legal defence, but received correspondence back from Bunnings’ lawyers saying he had failed to lodge the defence properly and he had until Thursday 22 February to reissue it “otherwise they will take further action”.

He has not done so. “I haven’t spoken to the lawyers, I haven’t done anything, I’ve just been that stressed,” he said, adding he was not sure what would happen next.

“That’s up to their lawyers and the judicial system. They haven’t given me a timeline. After this they may extend it but at this stage I doubt it very much due to their not being overly easy to deal with.”

Mr Stengel said Bunnings was “walking over” a loyal customer who had been with them for nearly 15 years. “For them to do this to me and not chase the person that has been charged, sentenced and punished, it’s just wrong, it shouldn’t happen,” he said.

“I’m not impressed. It has left a foul taste in my mouth. I still deal with Bunnings because I don’t have a choice in Hervey Bay. We don’t have any other hardware stores, Bunnings has basically closed them down.”

Mr Stengel said his message to Bunnings managing director Michael Schneider was, “How about a fair go? Go after the right person instead of your loyal customers.”

In a statement, Mr Schneider said Bunnings was “absolutely committed to doing the right thing by our customers and team and we always seek to behave in a fair and consistent manner”.

“We are really disappointed that we have been unable to resolve this with Tony,” he said. “It is our understanding that in this situation, a card and PIN linked to the Bunnings account — in an ex-employee’s name — was provided to a number of employees and subcontractors. As with a bank account, this puts the account at risk.

“We strongly encourage all customers to keep their personal details safe to ensure the security of their account and order additional cards, with associated PIN numbers for individual employees.

“To service his business needs in line with increased trading activity on his account, Tony’s credit limit was increased and he was notified of this in writing.

“We have offered to help him through this unfortunate situation several times, including a reasonable, long-term, interest-free payment plan. We also allowed him to use his Bunnings account to run his business while we tried to resolve this situation.

“We will always first try to work with our customers to help them through any difficulty they may have in paying their account, offering customised payment options that they are comfortable with.

“A caveat is only lodged as an absolute last resort and is a common clause used by most suppliers in the building and associated industries. A caveat only provides the creditor with a registered interest should the property be sold — it does not give the credit provider the ability to sell the property — only the owner or mortgage holder can do that.

“We remain absolutely committed to working with Tony to resolve this and we again encourage him to get in touch with our team to discuss further.”