Bricks and mortar stores still lack ‘seamless’ shopping experience

Twice I’ve tried to do the simplest thing at a big Aussie retailer and twice I’ve been thwarted. It shows the gaps they still have to bridge.

I never actually meant to go to Myer; it wasn’t the plan that day. I’d found myself in a corner of Sydney and, to kill time, I wandered round the local shopping centre.

Absently mindedly, I found myself in the Myer men’s department perusing some jackets. Well it’s cold out there.

The jacket was nice, was reasonably priced. It might be just the thing for winter. But the frustrating process of buying it highlighted the gaps traditional retailers still have to go to create the so-called “seamless” online and instore shopping experience they promise.

In fact, this lack of connection between the online and offline happened twice at Myer in the space of a week.

A retail watcher told news.com.au some bricks and mortar stores were finding it “challenging” to provide an online experience that matched up to instore expectations. And it’s likely they will have to spend big bucks if they want to prise open customers’ wallets.

Part of the problem is the way I shop. I’m not a huge impulse purchaser. I like to weigh things up, to sleep on it.

Given Sydney winters seem to last for a total of about three weeks, I hesitated on buying there and then. Would I be paying $150 plus for some wool polyester mix that would spend most of the year hanging in my wardrobe?

Yet, the next day I decided it was a worthy investment. I was headed up the Blue Mountains soon and when it fell to -1C, I’d regret being so thrifty.

But I had no desire to head back to the suburban Myer I found the jacket in. And besides, I wanted to try it on again. Perhaps the same jacket was in my local store and I could pop in after work?

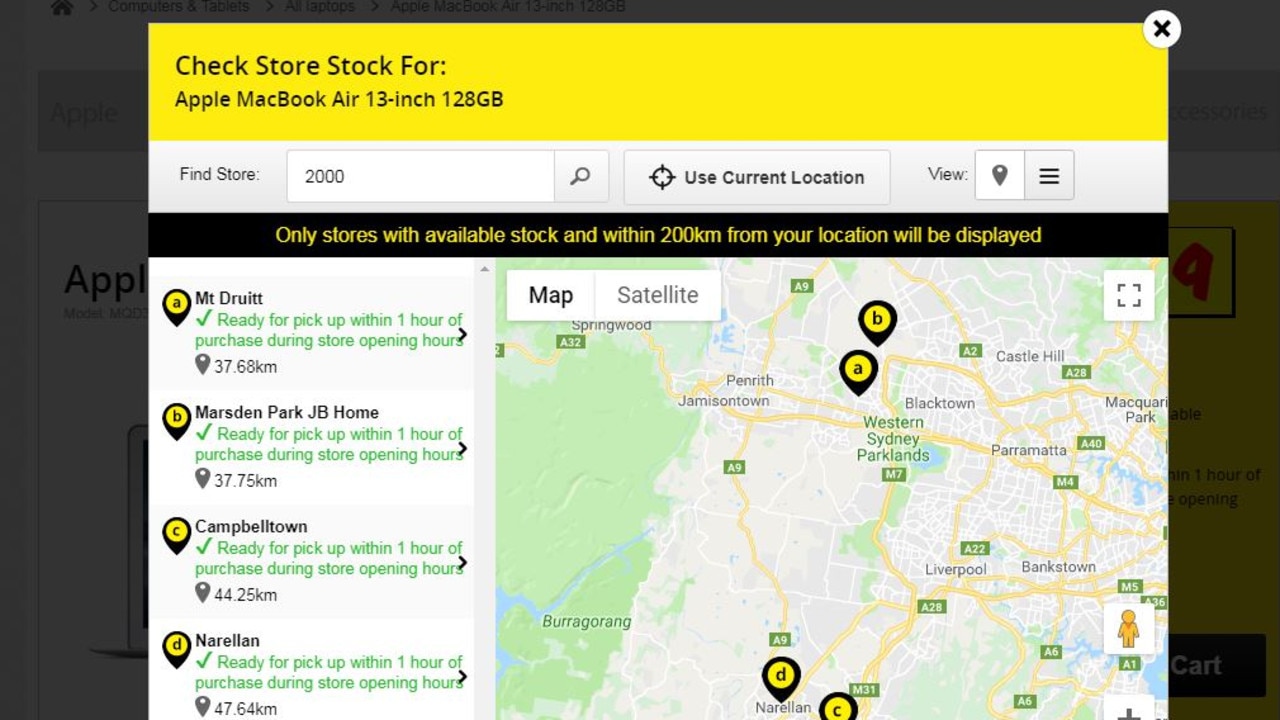

I know in the past I’ve been on JB Hi-Fi’s website and been able to see which stores have a particular gadget in stock; maybe Myer’s website could do the same?

It could not.

I could get the jacket delivered (it would take several days), I could click and collect (could also take several days if out of stock). But I couldn’t see if the jacket was there sitting on the rack so I could be confident my trip wouldn’t be a complex waste.

To be fair to Myer, you can check the availability of some products. But not all. David Jones also failed to show which stores had which products in stock, but a spokeswoman told news.com.au that feature was down for “routine website maintenance”.

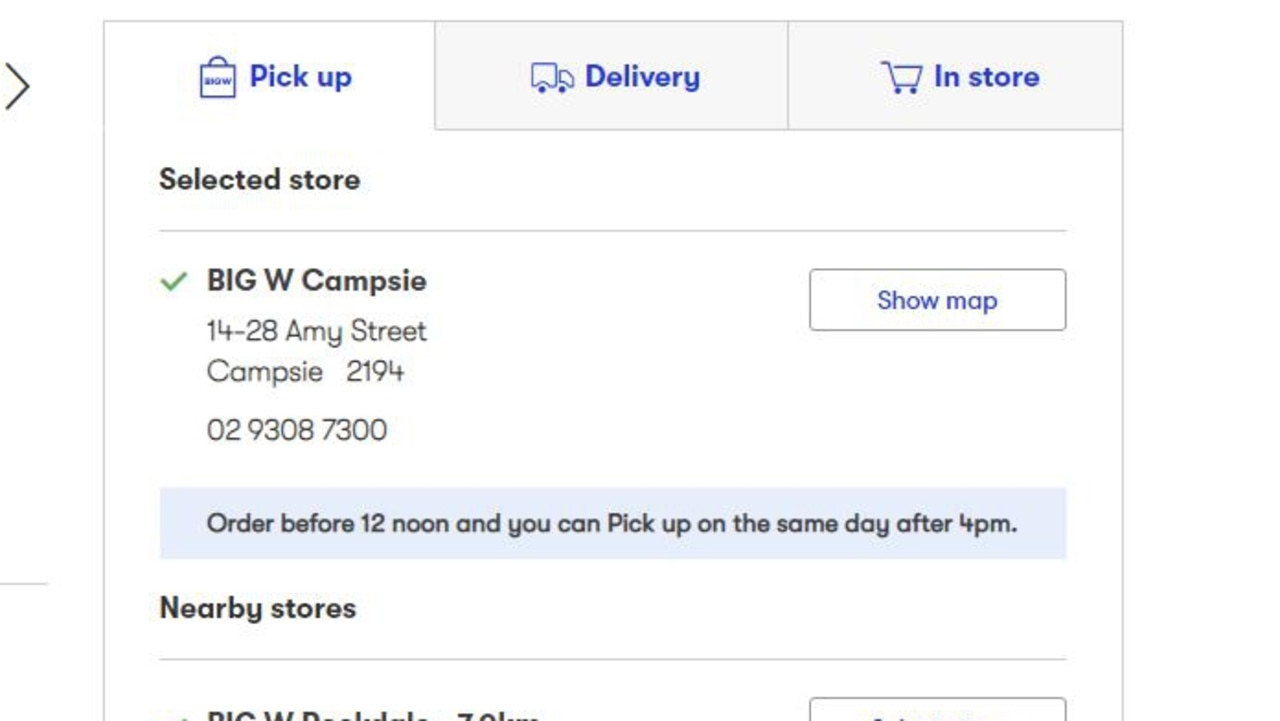

Yet elsewhere, this feature seems standard. Kmart, Big W and Target all let you search for products by store. One had a traffic light system: red for sold out, amber for limited stock and green for available.

ONLINE AND OFFLINE NOT SO SEAMLESS

It’s an ongoing issue. Just a few days before there was the case of the amazing disappearing carafe. Looking for a wedding gift in another Myer store, I spied the hefty crystal homeware on a dusty shelf. But, I hesitated again, should I buy that or the brass oversized salt and pepper mills from the shop next door for the bride and groom?

A day later I decided on the carafe; but not only could I not see if it was still in stock, it wasn’t online at all. A total of 74 carafes were listed on Myer’s website, not one of them the one I wanted. Myer has said it was continually adding more products, brands and functionality to its website.

But the gaps in the online experience are adding to a torrid time for department stores.

Last year, Myer recorded a near half billion loss. For the first half of 2019, sales fell further but the store banked $38.4 million and online sales were up 18.6 per cent. David Jones has fared better with an annual profit of $127m, but that’s 25 per cent down on the year before.

STORES PLAYING CATCH UP

Brian Walker, head of retail consultancy Retail Doctor, said customers were changing the way they shopped and retailers were struggling to keep up.

He told news.com.au that rather than only shopping online or, alternatively, only going into stores — most of us are doing a bit of both, often in the same transaction.

“It’s called ROPO: researching online, purchasing offline. Over 85 per cent of bigger ticket items are influenced in some way by digital, and that’s primarily an online search, but 90 per cent of retail expenditure is done in the physical shops.

“Retailers have to make it easier for customers to shop in any way they choose — online, instore and to have access to a product at any time in any way they choose.”

Mr Walker cited his own example: he saw a jumper online and called the shop to pay for it and request it be set aside for his next visit. No dice, said the shop — they couldn’t do a transaction over the phone. No sale then, he said.

The big traditional retailers, like Myer, were all on a journey to having a seamless shopping experience but how advanced they were varied, said Mr Walker.

“At one level customers are moving more quickly them many retailers able to adapt to.”

European furniture giant Ikea now has smaller stores that have less stock but are more responsive to customers. If you’re a regular, Ikea can even track your spending and browsing online and if you come into the store, staff can suggest products you might want to buy.

But it’s an expensive business, he said.

“It’s a big opportunity but the challenge for retailers is that the capital expenditure of the information technology that enables the visibility of all their inventory at all the various points on the path to purchase is huge.”

QUT retail expert Gary Mortimer said retailers were racing to match customers’ expectations.

“It is incumbent on a retailer to create the ideal, seamless shopping experience across all channels, simultaneously. This is difficult and retailers are playing catch up,” he told news.com.au.

“For a retailer, trying to balance demand for inventory from shoppers wandering into physical stores and buying online can be changing, as there are too many variables at play. If you have 12 jackets on hand at 10am, you could sell three in the next hour, one online and two instore.

“Inventory management systems need to connect seamlessly with online platforms.”

A Myer spokesman told news.com.au the retailer had continued to see sales growth through its website.

“Whether customers shop instore or online, we want them to have the best possible shopping experience with us,” he said.

The firm was working on getting “as many as possible” of its existing brands online and now demanded all new brands were available on its website.

“(We) are currently working on further improvement to the site so that customers have greater visibility of where products are located across our store network to either purchase in-store, or click and collect,” the spokesman said.

A David Jones spokeswoman said instore visibility was a “key element of our multichannel customer experience”. However, the feature was “temporarily disabled” for routine website until later this month.

Similar to Myer, DJs said it was “focused on continuing to align our online and instore offering” with, for instance, same day click and collect and delivery.

But there were limitations: “Some specialty items and brands are carried exclusively instore in line with our partnership with those brands,” the store’s spokeswoman added.

As for me, well unable to be sure the jacket was in Myer, I went to Zara instead.