Australian online retailer Redbubble suffers 40 per cent collapse in share price

A popular online Australian retailer has seen its share price collapse by 40 per cent amid a blowout in staff and investment costs.

An Australian online retailer has been slaughtered on the stock market with its share price plummeting by a whopping 40 per cent after it revealed ballooning costs and a loss of customers.

Redbubble, an online art marketplace, also warned that extra costs for next year would further hit its profits as it expected staff costs to jump from $14 million to $18 million in 2023, while investment around the brand would also rise from around $8 million to $12 million.

The company also revealed that its profit of $31.2 million for 2021 had dived to a loss of $24.6 million for the current year.

Meanwhile, its revenue also sank by 12.8 per cent to $482.6 million.

The online marketplace’s report for the past financial year showed it was struggling to stem a loss in members, which fell by 7 per cent, down to 14.4 million compared to a year ago.

Just a few hours after it reported its earnings, Redbubble’s share price had 47c wiped from it which saw it fall to $1.02.

Overall, Redbubble’s share price is down 70 per cent over the last 12 months and 72 per cent for the year to date.

The battering on the stock market could see the retailer shares become the most punished for the current reporting period.

The company also revealed that its fourth quarter losses accelerated blowing out to $10.7 million from $8.7 million in the same period last year.

Motorcycle gang’s $78,000 payday from retailer

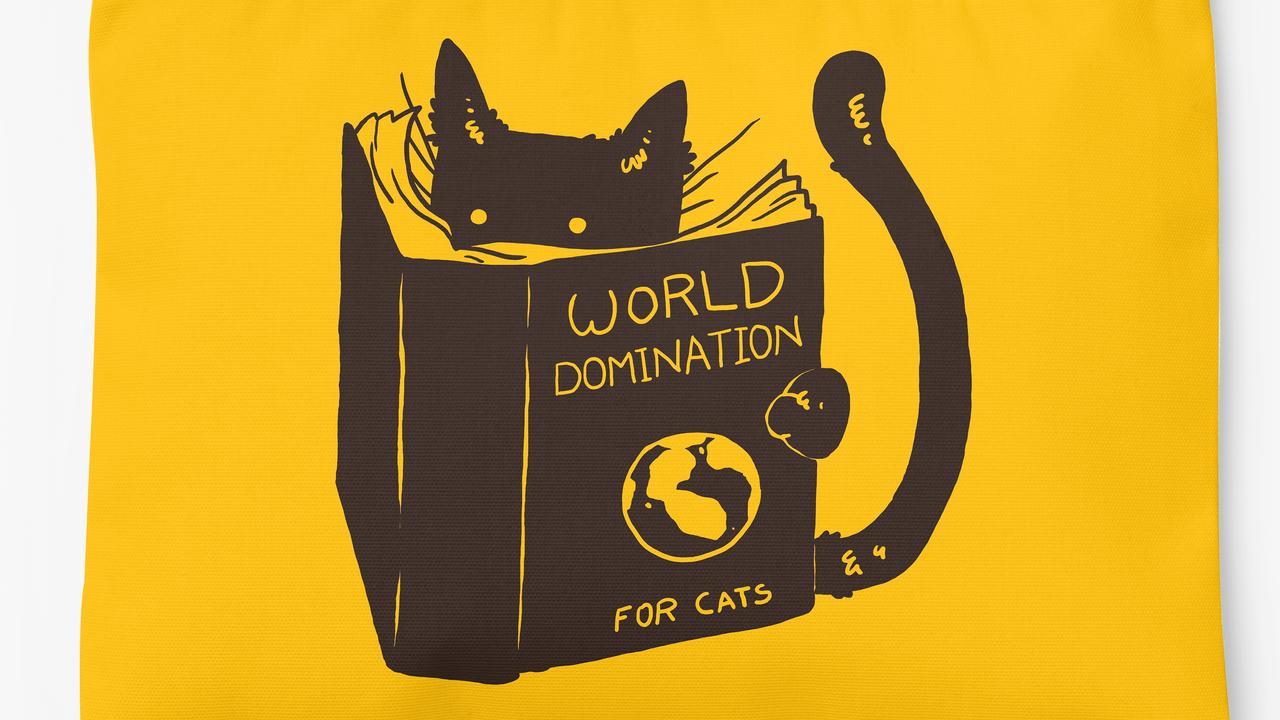

Earlier this year, it was ordered to pay thousands of dollars to the Hells Angels Motorcycle Club after the gang discovered its artwork was for sale on the Redbubble website.

The online marketplace was sued by the Australian arm of the bikie gang over claims it infringed on the Hells Angels trademark when novelty items bearing the group’s logo were displayed on the Redbubble website.

The Federal Court on Wednesday ruled in favour of the bikies, finding Redbubble had infringed on the club’s trademark, and ordered it to pay $78,000 in damages.

Meanwhile, Redbubble said 60 per cent of its marketplace revenue came from organic or unpaid channels in the financial year 2022, with 46 per cent of revenue from repeat purchases, while driving its multi million dollar investment in brand awareness.

Chief executive’s positive spin

Redbubble chief executive Michael Ilczynski said the company’s results reflected its move to improve the experience for artists and customers, while also investing heavily in the business.

It also introduced a price rise of about 6 per cent in May 2022.

“Actions taken by Redbubble during financial year 2022 remain focused on continued investment in our technology platforms, experiences for artists and their customers, and more recently our brand,” Mr Ilczynski said.

“This reflects our disciplined approach to investing to drive sustainable growth for the medium and long term. Overall, the group’s outcomes demonstrate continued resilience across all three sides of the marketplaces, and importantly, financial performance and operating momentum improved in quarter four of financial year 2022.”

Warning from investment bank

Redbubble said it also plans to significantly slash its employee growth, down to 4 per cent this financial year from 30 per cent in 2022 and wants to grow its transaction value to more than $1.5 billion.

But global investment bank RBC Capital Markets has slapped Redbubble with a “negative” sentiment, noting that operational expenditure was expected to grow by about 27 per cent in 2023.

In a note to clients, the bank said the company had declined to provide revenue guidance apart from indicating that year-on-year growth was expected.

“In the medium term the company has pushed out its aspirational targets from calendar 2024 to fiscal 2026-2027 while providing little visibility in the interim,” RBC wrote.