Aussies told to buy Christmas presents now as shipping crisis threatens deliveries

As the global shipping crisis continues, Australians have been warned to get their Christmas shopping done now to avoid disappointment.

Australian consumers have been warned to get their Christmas shopping done now to avoid disappointment, as the global shipping crisis continues to cause long delays.

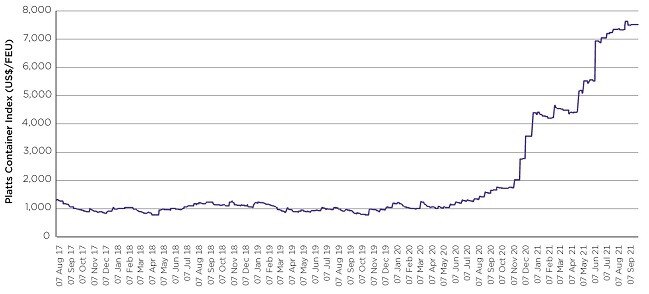

Freight costs on key global container routes have increased around seven-fold compared with this time last year off the back of a perfect storm of Covid-19 related supply chain disruptions, labour shortages and rising consumer demand.

Despite the increased costs, shipping lines have struggled to deliver goods on time, causing major headaches for Australian businesses.

A number of Australian exporters are struggling to meet their contractual obligations, and some large retailers are so concerned that their cargo will not arrive before Christmas that they are buying their own shipping containers and chartering their own vessels, according to a new report into the container crisis released today by Australia’s competition watchdog.

“International shipping line movements normally run lean and just-in-time, but a surge in demand and Covid-19 outbreaks that have forced numerous port operations to temporarily shut down have caused congestion and delays with a cascading effect across the globe,” Australian Competition and Consumer Commission chair Rod Sims said in a statement.

One stevedore told the ACCC that only 10 per cent of vessels arrived in their designated berth windows in 2020-21, which is their lowest rate on record.

“Pre-pandemic, the sector would have likely been able to manage such a surge in containerised demand, but the simultaneous destabilisation of almost every part of the supply chain has left them without any spare capacity and struggling to cope,” Mr Sims said.

“The margins of Australian importers and exporters are being squeezed, as they are all around the world, and the current situation is very challenging for businesses that rely on container freight.”

According to the S&P Global Platts Container Index, average prices of standard 40-foot containers on key global routes have skyrocketed from around $US1000 to more than $US7000 since last year.

Speaking to The Sydney Morning Herald, Mr Sims said the ACCC had heard reports that Nike was now paying as much as $20,000 to ship a container of sneakers, rather than the typical $2,000, making it effectively unprofitable to sell some sneakers.

“Either consumers wear [those costs], or the importers or exporters,” he told the newspaper.

Tony Srnec, operations director at Sydney-based freight forwarding firm Summit Global Logistics, last month told news.com.au some of his clients had already stopped bringing products into Australia because it “just wasn’t viable anymore”.

Barbara Stokes, a director at Melbourne-based logistics firm Stokes and Bell, warned Australians should expect to “pay a little more for their Christmas goods”, if they can get them at all.

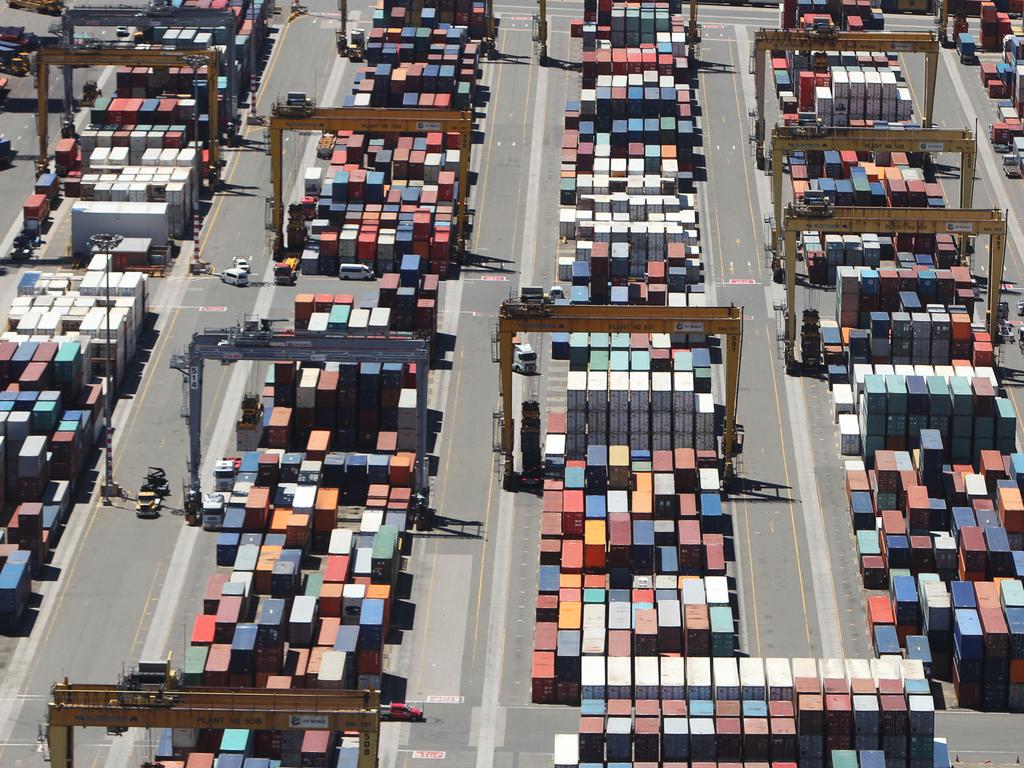

Aussie ports ‘below’ standard

Even before the recent disruptions, Australia’s container ports were “relatively inefficient” and “well below” international best practices, according to the ACCC’s report.

A recent study by the World Bank and IHS Markit ranked Australia’s largest container ports, Melbourne and Sydney, in the bottom 15 per cent and 10 per cent respectively, of the 351 global ports in the study.

According to the United Nations Conference on Trade and Development, the median in-port time for container ships visiting Australia in 2019 was three times longer than Japan, twice as long as China, and 50 per cent longer than Singapore or New Zealand.

“We were told that some shipping lines were already withdrawing services from Australia before Covid hit,” Mr Sims said. “Australia needs to take decisive action to remain an attractive destination for global shipping lines.”

The watchdog points the finger at the powerful Maritime Union for industrial actions and “restrictive work practices” that cause further supply chain disruptions and exacerbate delays.

“For example, a shipping line informed the ACCC that the delays at Port Botany in September 2020 cost it around $25,000 a day per ship,” the report says.

“In addition, an exporter stated that it had to deliver its cargo to another port for a period of three weeks due to industrial actions. This cost the exporter $200,000 and resulted in delays, which caused the exporter to miss shipping windows and risk exceeding contracted time frames.“

Data obtained by the ACCC shows average idle hours, which is the length of time a ship spends in berth, at Port Botany increased from 11.9 hours pre-pandemic to 21.2 hours in 2020-21.

The watchdog says congestion at Port Botany has become so bad that some shipping lines are skipping the port entirely.

It notes that “the fact that shipping lines cannot obtain adequate access to Australia’s most populous city is making the situation even more challenging for many Australian businesses”.

“Industrial action on top of pre-existing congestion has unfortunately put enormous strain on our international container ports at a time when they can least cope with it, and in the case of Port Botany, some shipping lines have decided the delays make using the port commercially unviable,” Mr Sims said.

The ACCC says the MUA has used industrial actions to push for restrictive work practices included in enterprise agreements.

In July this year, for example, Hutchison Ports Australia – which operates terminals in Sydney and Brisbane – signed an enterprise agreement that requires 70 per cent of new recruitments to be “family and friends” of existing employees, or people chosen by the MUA.

The provision “gives significant control to the MUA and Hutchison’s employees in employee appointments, severely limiting Hutchison’s ability to recruit the most suitable and qualified people for its company”, the ACCC report says.

The union wants a similar provision in its agreement with Patrick Terminals, which operates container terminals in Brisbane, Fremantle, Melbourne and Sydney.

But Patrick Terminals last week applied to the Fair Work Commission to terminate the agreement on the basis that it is no longer fit for purpose and restricting its ability to meet customer requirements.

The report makes a number of recommendations to address the crisis, including that governments, industry and unions work together to address industrial relations issues and restrictive work practices.

“As has become evident over the past 12 months, Australia is heavily dependent on maritime trade,” it says.

“A more productive waterfront, facilitated by more flexible labour arrangements, would benefit Australian businesses and consumers.”

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said the report showed that the MUA’s “chokehold on Australian stevedores must be stopped”.

“With our ports system already on the ropes, the MUA’s opportunistic industrial action is driving up the costs for business which will be reflected in higher prices for all Australians,” Mr McKellar said in a statement.

“The industrial action we are seeing in our ports isn’t about the money. Indeed, the existing agreement in Sydney means waterfront workers are already paid on average $172,000 a year for just 200 days of work.”

MUA national secretary Paddy Crumlin hit back at the ACCC’s report, describing the comments as an “unhelpful and inaccurate intervention into a lawful bargaining process” with Patrick Terminals “that has been underway for almost two years”.

“The ACCC should not recklessly conflate the astronomical international shipping costs, port congestion and Covid-19 related pressures on Australia’s supply chains with waterside workers seeking fair pay, job security and safety at work,” Mr Crumlin said in a statement.

The MUA said the ACCC report contained “several contradictions and errors of fact”, adding that benchmarking Australian shipping terminals using the length of time at berth metric was “subject to so many variables as to be completely unhelpful”.

“The ACCC’s union bashing is unhelpful and unwarranted when in fact it is the impacts of Covid-19 and entrenched shipping company cartel behaviours that are affecting Australian consumers’ access to imported goods,” Mr Crumlin said.