Sixteen companies and thousands of Aussie jobs gone in six months as collapse crisis rages on

Australia is in the grips of a construction industry crisis, with 16 firms and countless jobs disappearing – and it’s only going to get worse.

It started in the dying days of 2021 – and since then, Australia’s construction bloodbath has been relentless, with at least 16 firms going bust and others now hanging on by a thread.

Privium and BA Murphy both folded in December last year, and in January 2022 about 40 families were left in limbo and tens of thousands of dollars out of pocket after Hotondo Homes Hobart collapsed with liabilities of more than $1 million.

A month later, building giant Probuild was placed into voluntary administration, leaving 750 jobs in the lurch.

It was quickly followed by Condev the following month, with the firm entering liquidation after failing to secure a reported bid for $25 million from developers.

And that grim list has continued to grow as a number of other high profile companies also collapsed, including Inside Out Construction, Dyldam Developments, Home Innovation Builders, ABG Group, New Sensation Homes, Next, Pivotal Homes, Pindan, ABD Group and Solido Builders.

This week, yet another firm joined the ranks, with Geelong-based building company Waterford Homes entering into liquidation with at least $600,000 in debt.

Thousands of jobs have already been impacted – although the total number of job losses is almost impossible to calculate – along with the dreams of would-be homeowners, and meanwhile, the fates of several other high profile construction firms continue to hang in the balance.

A question mark hangs over building juggernaut Metricon’s future, despite the company injecting $30 million into its business to allay fears about its survival and company representatives meeting with the Victorian government late last month for crisis talks about the escalating issues plaguing the sector.

Meanwhile, Victorian building company Snowdon Developments Pty Ltd is also believed to be on the brink of collapse, with sources revealing employees haven’t received their superannuation since October, leading to more than half of the staff quitting.

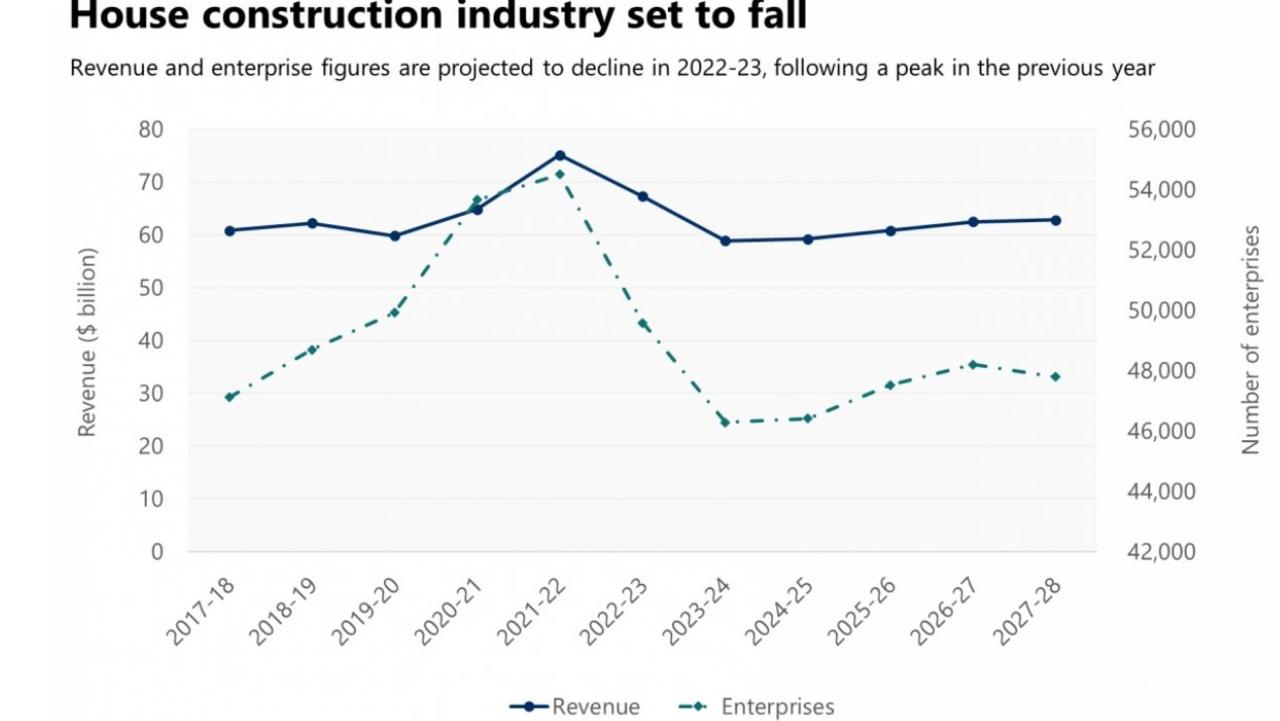

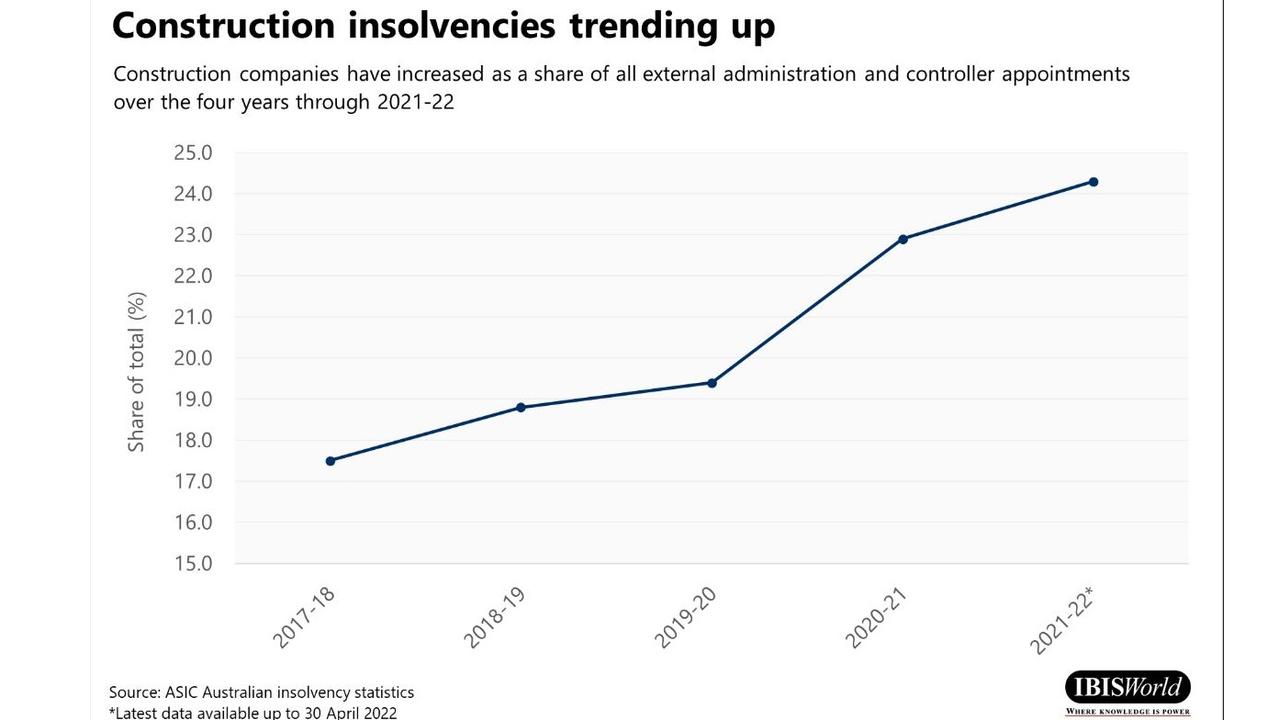

Experts agree it’s likely just a taste of things to come, with research company IBISWorld this month confirming that insolvencies are “trending upwards” in the House Construction industry, and predicting that house construction enterprise numbers will decline by 9 per cent in 2022-23, “contracting for the first time in a decade”, while NAB has stated that construction is now the “most worrying” industry in the bank’s portfolio.

And it doesn’t stop there, with construction failures also set to have a trickle-down effect on other industries like plaster product manufacturing, hardware wholesaling, advertising agencies and employment placement and recruitment services, according to IBISWorld, with collapses also to impact housing supply, and “potentially increasing per-unit costs charged by residential property operators and real estate services firms”.

What caused the crisis?

The crisis is the result of a perfect storm of conditions hitting one after the other, including supply chain disruptions due largely to the pandemic and then the Russia-Ukraine conflict, followed by skilled labour shortages, skyrocketing costs of materials and logistics and extreme weather events.

The industry’s traditional reliance on fixed-price contracts has also seriously exacerbated the problem, with contracts signed months before a build gets underway.

That meant that once a build actually began, prices had already exploded, but firms weren't able to renegotiate the contract with the customer, leading to financial losses.

Andrew Spring from insolvency firm Jirsch Sutherland told news.com.au there had been “plenty of signs” trouble was brewing for the sector.

“We saw in the very early days rising costs of timber and issues with logistics and shipping lanes so there were plenty of signs, and industry such as construction works on fixed price contracts and when there’s a large spike in material and labour costs it’s going to create losses when the contracts are played through,” he explained.

He added that “historically, construction has been a really challenging industry to be able to succeed in” for a range of reasons, including an above-average number of companies that engaged in anti-competitive behaviour and illegal “phoenixing”, which is when a company is liquidated to avoid paying its debts before a new company launched to continue the same business activities without the debt.

“It’s only a small percentage of the entire construction industry, but it’s a larger percentage than other industries, and you end up with businesses quoting for work that’s ultimately impossible to be profitable,” he said.

“Legitimate businesses that are sitting in the space are then really chasing revenue rather than profit because … in order to win work, they have to underquote and ultimately only accrue losses over a long period – that’s why we’re seeing a lot of insolvencies.”

He said there were also a huge range of pressures beyond the industry’s control that had hit “back-to-back”, including soaring costs, a labour shortage and Covid shutdowns and restrictions.

“Even when the industry came back online (after Covid shutdowns), there was a cash flow issue from not working for a four-, six-, eight-week period, and that created a level of desperation which led people to accept work they wouldn’t have accepted before,” he said.

“People locked themselves into whatever work they could get … and then when they started to deliver work it was already probably unprofitable because of the increase in labour, material and logistics costs which meant whatever reserves of cash a business had were being eroded.”

More recently, the east coast of Australia was pummelled by never-ending rain thanks to La Nina, which Mr Spring said was “another big challenge”.

“This is a really unique set of circumstances that came and blindsided everybody,” he said.

“The mood has changed dramatically – we’ve seen it in our company, we’re advising companies and individuals who find themselves in financial distress and it’s been completely different over the last couple of months. Everybody is worried now – it feels like musical chairs, and when the music goes off, some people are going to be left without a chair.

“Who knows what’s around the corner? We didn’t predict the double flooding event on the east coast that was a knife in the back, and I expect we haven’t seen the end of it yet.”

Can the sector recover?

Construction and commercial lawyer Nelson Arias-Alvarez from Sydney firm Eakin McCaffrey Cox told news.com.au that while an increased risk of company collapses had been on the horizon, many were taken by surprise by the sheer speed in which companies had folded, and also because so many larger companies had fallen.

“We certainly didn’t expect some of the large companies to go under so quickly … most people thought the writing was on the wall and that something had to give, but the speed in which it is happening is almost self-fulfilling, because the more it happens, the less likely people are to be willing to work through contracts,” he said.

People are worried and jittery about which will be the next one to go under.

“The concern is the flow on effect – what we’re seeing now is really the beginning of what’s likely to happen. It will intensify in a couple of months’ time.

“At the moment large companies have gone under and others are trying to keep their head above water, but it’s like a Band-Aid, all that happens is they are safe for the moment, but the contracts downstream are all at risk unless there’s a longer term solution.”

He said there “will be more” collapses and that the only solution was for parties to renegotiate earlier contracts and come up with fairer terms, although he conceded it was a “tall ask”.

“Insisting on having contracts honoured will just see companies go under,” he said.

Mr Arias-Alvarez said another “telltale sign” of trouble within the industry was that the State Government had been “parking a lot of projects at the moment”.

“One reason is that I imagine they’re worried about what’s going to happen – are they actually going to be able to complete projects?” he said.

“And the other thing is shortages – stimulus packages, more so in the residential space, created a lot of work, but now people can’t finish the work because there’s a shortage of skilled labour available.

“The government can see that and because of that the government is parking projects themselves. But what sort of message does that send out? It doesn't seem like the most positive message.”

Mr Arias-Alvarez said he believed things would begin to settle once prices started to pull back again, and said principals and owners of projects would start to realise there would be better outcomes all around if they worked with contractors and subcontractors instead of litigating over contractual issues in the current climate.

And Mr Spring said one thing that could help the industry was moving away from fixed price contracts to more flexible and fairer terms.