‘Ruined’: Nightmare move cost family $200k

A horror car crash and the loss of a transplanted kidney were devastating. Yet a family’s plan for a $754,000 payout left them “totally ruined”.

Deb Houlahan thought the worst thing to happen in her life would be when a semi trailer hit the family car, while her two young daughters were in the back, causing her devastating injuries including losing a transplanted kidney.

Her husband, Bryan Houlahan, and two children emerged unscathed but life delivered another blow in 2017 when she was diagnosed with cancer. But still, this wasn’t the worst thing for Deb.

The couple received a $754,000 compensation payout as a result of the car accident, but a decision that was supposed to secure the family’s future has instead “totally ruined us”, she told news.com.au.

The couple came across a company called V.I.P., which markets itself on its website as the “very first home services franchise company in Australia and only the third franchise company in the country”.

It was established in 1979 and claims to have more than 1000 franchises across Australasia. One of its franchise businesses is offering gardening and landscaping services – something that appealed to the couple.

Deb said they believed a franchise would give her husband the freedom to take her to treatments and doctors’ appointments if needed.

“I was also prone to severe virus attacks that would see me back in hospital so having his own business would allow time for that,” she told news.com.au.

“We never expected to become millionaires, but after talking with V.I.P. we did expect to earn an average income that would sufficiently supplement payments from the payout.”

Do you have a story? Contact sarah.sharples@news.com.au

$200,000 sunk

The Queensland couple initially forked out tens of thousands of dollars for a franchise in 2019, signing up to run it for a period of seven years.

Deb claimed the cost of the franchise was more than anticipated as they had to replace tools and the tyres on the ute. They also paid for an existing client list.

“By the time we had sorted out which clients belonged to which contact details we found that the clients had moved on to other maintenance companies, so we had paid for nothing,” she claimed.

“During the three plus years that we ran the franchise we were given two further client lists from people pulling out of their franchises and they were in the same state ending in the same outcome.”

In 2020, the Brisbane couple spent more money on a second V.I.P. franchise for Bryan’s brother to run.

But they claim both franchises never made much money and the couple saw themselves dipping into the accident payout money before sinking deeper into debt.

“We spent about $200,000 supporting ourselves because we weren’t getting enough to cover fees, petrol and expenses,” Deb said.

“We paid my brother-in-law a weekly salary, which also ended up coming from my accident payout because the franchise just never earned enough to cover costs, never mind bringing in enough money to support us.

“My brother-in-law passed away the following year and we closed the franchise but we had to sell the trailer for half the cost.

“We took a loss there but it was too late as by now everything was going downhill fast and couldn’t be stopped.”

‘Just unbelievable’

Bryan, aged 55, said the business was based in the Brisbane suburb of Coorparoo when he purchased it in 2019. He is critical of VI.P. fees such as marketing costs, which he didn’t believe delivered a result.

“Marketing of the V.I.P. product is all but non-existant as it appears on the second page of Google, a page which very few people bother to go to,” he wrote in an email to the company when he was closing the franchise.

Then there were the jobs provided by V.I.P.

“I was getting job leads 40 minutes’ drive away from my core area and V.I.P. were counting that as providing a good service. I was trying to operate in as small an area as possible so I was not spending hundreds of dollars in fuel,” he said.

“I would drive for 40 minutes and might make $50 or $60 out of it and I would have to drive back to where we were working – it was just unbelievable.”

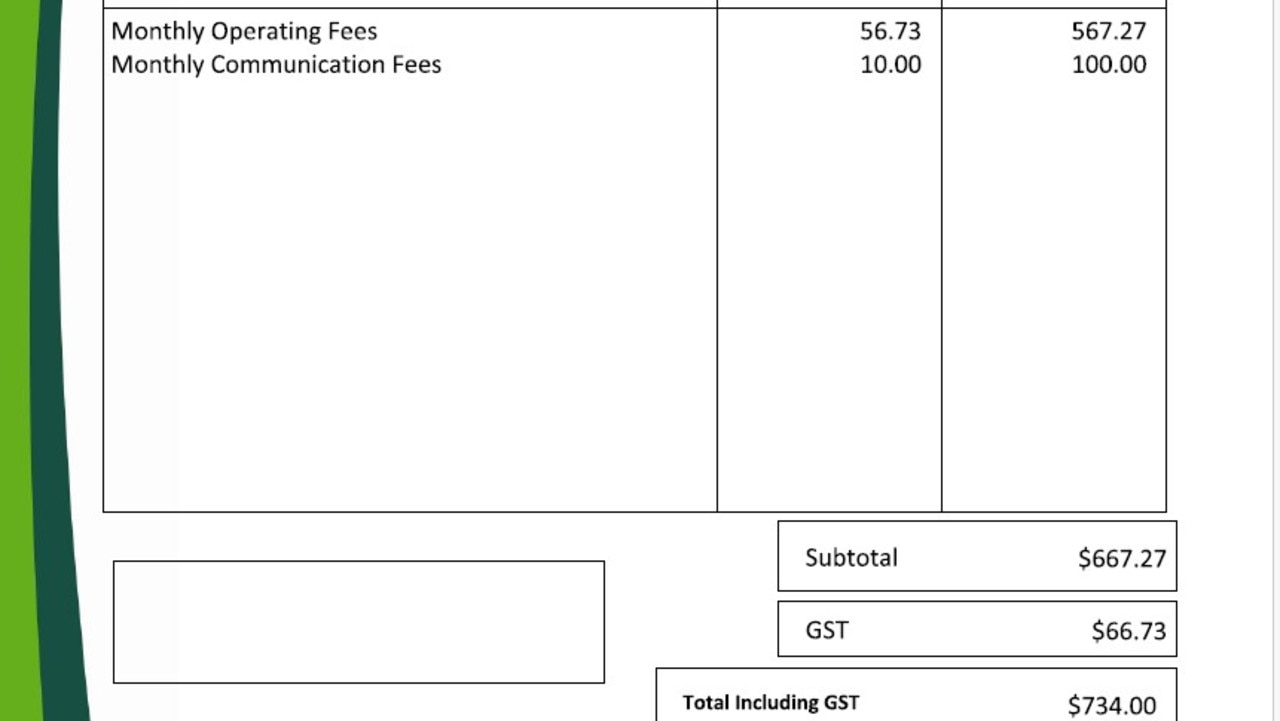

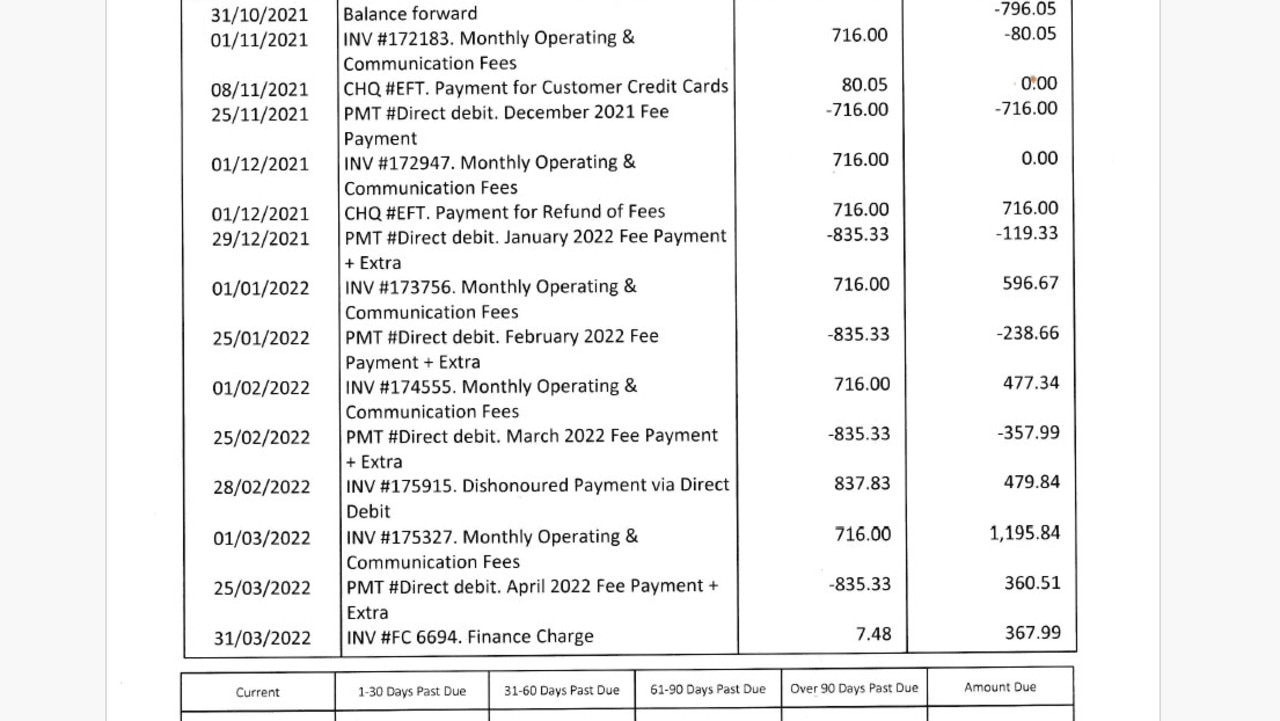

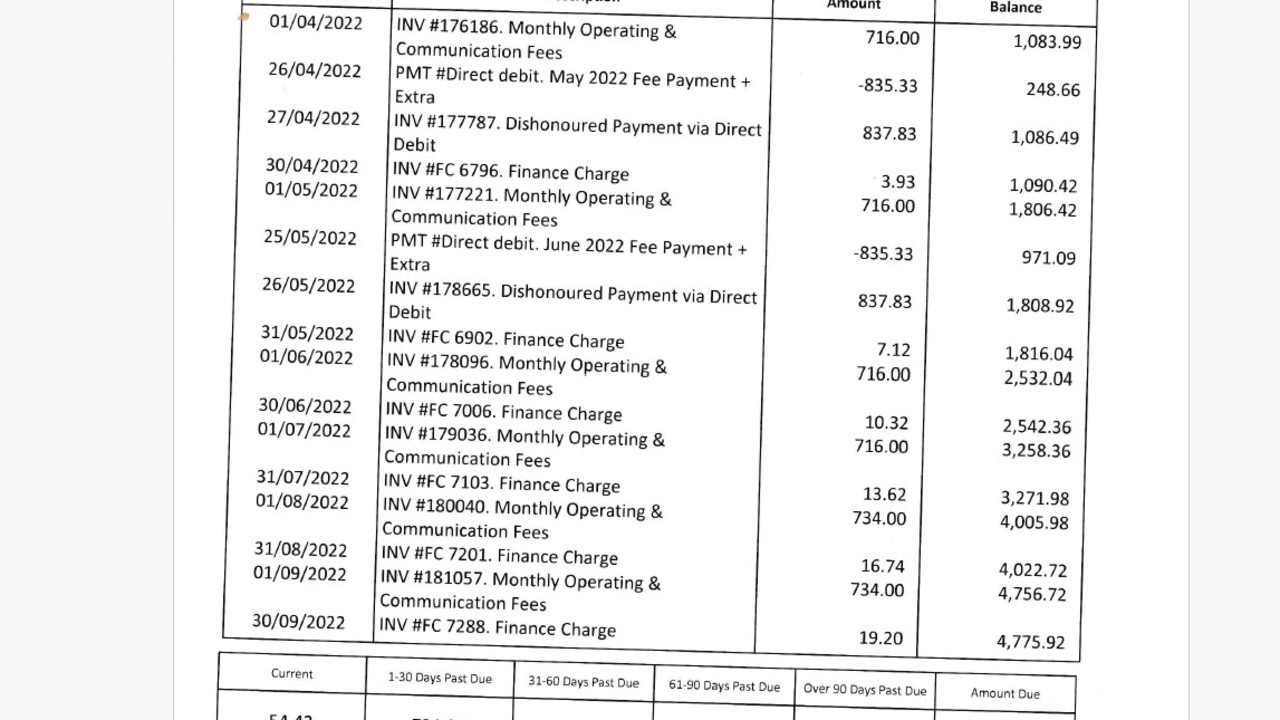

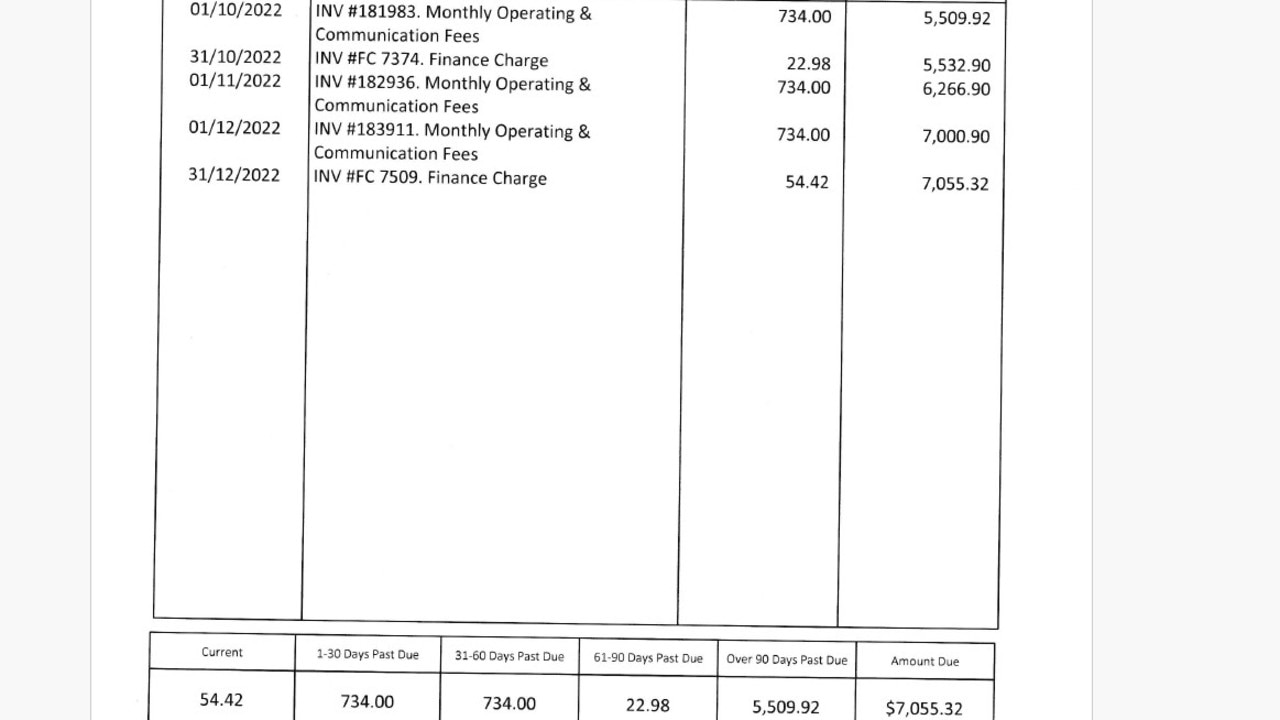

Deb claims things became increasingly difficult as they became unable to pay franchise fees of $734 a month, she claimed.

As the business problems accelerated and the unpaid franchise fees piled up, the couple’s debt snowballed to more than $7000. But Deb claims they were told over the phone they didn’t have to pay the fees until business picked up.

In a brochure advertisting is franchises, the company said it’s backed “by strong brand recognition” while “V.I.P.’s dedicated national support centre often has more work than their franchisees can service”.

It adds that the the company has an expert marketing team and franchisees receive personalised marketing materials along with their very own web page.

“The V.I.P. brand has developed through decades of exceptional customer service, and is backed by strong marketing and national TV advertising campaigns that keep the brand at the front of customers’ minds,” it adds.

Debt piles up

The tipping point came when the motor in the work ute blew up in December 2022 and they hired a car which cost $1000 for two weeks – money they didn’t have as they could barely put food on the table, the couple said.

“I rang V.I.P. and said ‘I can’t do this, I am not getting enough leads or work to sustain the franchise. I can’t afford to repair the ute, I am going to have to shut down then and there’,” Bryan said.

“We had sunk everything we have into this supposedly profitable business and nothing has come out of it except all of our income and all the money from the car accident settlement is just gone.”

The Houlahans claim they were advised by V.I.P. over the phone that it would be fine to cease operating the business but it needed to be put in writing.

‘Her heart stopped’

In the email from January last year, Bryan poured his heart out to V.I.P., sharing how he didn’t make anywhere close to the $70,000 annually that was “indicated” when he was sold the franchise.

He revealed he had a $17,000 business loan in default too, adding he also thought he would lose his wife in 2023 when “her heart stopped and I had to perform CPR till the ambulance arrived”.

In a brochure on its website, V.I.P. said the majority of its franchisees are making “an above average income and some have built businesses that employ over 20 people, with a staggering turnover of more than $800,000 per annum”.

It added that the franchsies offer a “fantastic earning potential, the desirable lifestyle so many people long for and they are affordable and realistic for most people to take that step into being their own boss”.

However, the mum-of-two, aged 58, describes the whole experience as a “nightmare”.

“It has totally ruined us, where before this happened we could have bought a house and had a secure future for ourselves and children,” she said.

“I now have to get a second job for us to just make it through each week, when I am not in any condition to work at all and our retirement prospects are bleak at best.”

Yet, almost two years later the ordeal hasn’t ended for the couple.

Periodically, the couple have been chased for the $7000 outstanding debt by V.I.P. for what it says is operating and communication fees, interest and bank fees for dishonoured payments.

Legal claim for $21,000 flagged

But now V.I.P. has flagged a claim for $21,000, sending Deb and Bryan a notice of intention to commence a legal claim.

The franchise outfit told the couple they didn’t seek permission to close the business and had instead abandoned it.

In the letter from August, V.I.P. outlines that the $21,765 owed includes the $7000 in outstanding fees, $5500 in liquidated damages, $550 for administration fees, $8000 for shortfall fees and $660 for costs.

It went on to declare that action would be brought in the Magistrates Court of South Australia for the amount owing as well as costs and interest if it was not resolved in 21 days.

V.I.P. also put forward an offer of settlement if the $7000 is paid instead, the letter said.

‘We can barely put bread on the table’

Bryan said the demand for $21,000 was “ridiculous”, particularly as the couple never even operated in South Australia — arguing any legal action should be commenced in Queensland.

“We haven’t got $21,000, we can barely put bread on the table every day. I didn’t do grocery shopping the other week as we are broke,” Deb added.

“We don’t have the business anymore. We sold the trailers as we needed the money to survive. The V.I.P. know the signage is off, they can have Bryan’s old uniforms if they want – they are in pretty bad shape.”

On November 25, V.I.P. extended the time to resolve the matter by another 21 days.

The couple said so much time has elapsed they can’t understand why V.I.P. continues to pursue the matter when they simply don’t have the money.

“We have nothing left. We are in a rental property, we own a car but had to sell the car we had and get a second hand car. We had to sell all the business equipment just to put food on the table and pay the electricity,” said Deb.

“I have dialysis at home, I’m on a disability pension and we are in arrears on the electricity but are lucky as they would have cut it off otherwise.”

A V.I.P.’s spokesperson said the franchise has been corresponding with Bryan since he advised of his decision to close his business on 31 December 2022.

“During this time, meeting and mediation requests have been proposed by V.I.P. to resolve this matter,” they said.

A meeting is scheduled for Tuesday to discuss the situation, they noted.

“Given this matter is ongoing, we will not be providing a response at this time,” they added.

sarah.sharples@news.com.au