REMI Capital debt jumps from $70m to $124m with 433 Australian investors impacted

The company went under last month leaving employees short by $1 million and with hundreds of people impacted around Australia.

The debt owed by an Australian investment company that collapsed at the end of last month has ballooned from an estimated $70 million to a whopping $124 million, liquidators have revealed.

The company called REMI Capital, was placed into voluntary administration on May 25, with Chris Baskerville from specialist insolvency firm Jirsch Sutherland appointed as administrator.

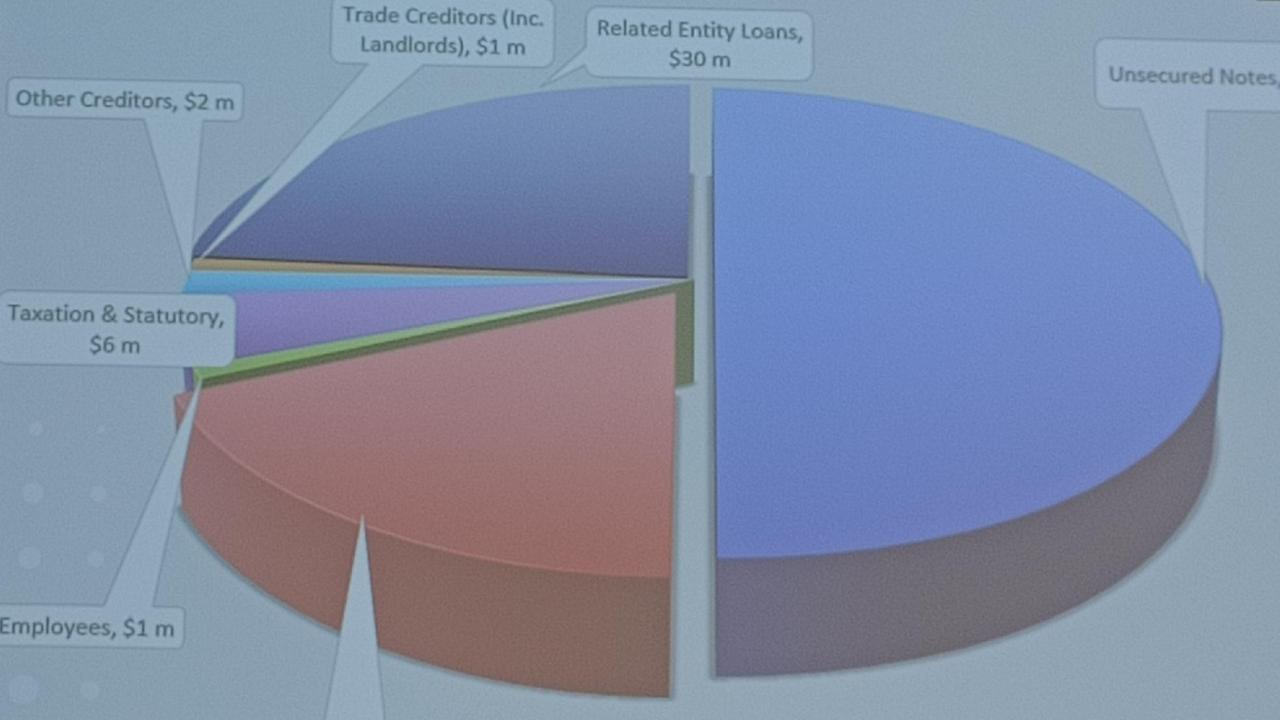

At the first creditor’s meeting held on Monday, the liquidator’s report showed that from the $124 million in outstanding debt, $1 million was owed to employees and $62 million to unsecured creditors.

Meanwhile, 433 impacted investors have been identified across Australia.

This included 259 investors in Victoria, 110 in Queensland, 43 in New South Wales, eight in Western Australia and Tasmania and a handful in South Australia and the NT.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The preliminary investigation by the administrator also uncovered that $6 million was owed to the Australian Taxation Office and other statutory bodies and there was $30 million in debt to related entity loans.

The independent investment company had promised access to “responsibly and ethically managed investments” and included a range of boutique property developments, its website showed before it was shut down following its collapse.

One of the 433 investors impacted was a Melbourne dad of two, who had been left “shocked” and “heartbroken” after REMI Capital collapsed owing his family $300,000.

“This is heartbreaking. I am going home at the end of day and both my wife and I, we are in tears separately driving back home from work,” *Richard told news.com.au at the time.

“It’s very emotional, it’s impacting my relationship with my wife.

“This is torture. We don’t know how long this is going to go on for.”

A bombshell email leaked to news.com.au revealed the extent of the company’s problems well before it went into liquidation.

Peter Kral, chief financial officer at REMI Capital, sent the email on March 25 that said the company had “experienced several delays in making” repayments in recent months.

He said the company was “proposing a payment plan to you of amounts owed” and blamed a number of factors for the delays including “forfeiture on the repayments of loans/monies by external parties to Remi totalling approximately $4 million (Aus) which was expected to be repaid to Remi late last/early this year”.

The email also revealed that the sale of properties was “time consuming and prone to significant delays” and there was a “failure of promised funding to effect settlement and unlock existing equity within current projects”.

There is no suggestion of any wrongdoing by Mr Kral.

Following the creditor’s meeting, Richard said it was “disappointing” to hear about the level of debt and he still did not know if any of his $300,000 would be returned. His wife was very upset, he added.

“It’s a lifetime effect with us, it breaks our relationship, I’m not sure how the relationship is going to go with my wife,” he said.

“We’ve gone from financial freedom to financial prison. My wife is angry that I could not see this was a (problem), but it was backed by real estate and everything looked legit but now it has collapsed badly … and there is no protection for investors.”

After the collapse Mark Prestige, who had been managing partner at REMI Capital for close to four years, acknowledged there had been a “lack of communication” from the company in recent weeks.

“Remi had been advised by external legal counsel not to communicate over recent weeks until the modelling was complete that allowed this difficult decision to be made,” he wrote in an email addressed to investors, shareholders and ex-staff members.

“REMI apologises for any lack of communication in recent weeks. We ask you rely on any reports to creditors and not rely on any speculation you may hear.”

The administrator’s report showed that Mr Prestige had $45 million worth of funds “written” while he was managing partner and Peter Terrill, who was formerly a director of the business including when it was known as C2 Capital, had $83 million.

When appointed as administrator, Mr Baskerville said one of the solutions was a Deed of Company Arrangement (DoCA) proposed by the directors.

A DoCA attempts to maximise the chances of the company to continue to operate and aims to provide a better return for creditors then an immediate winding up of the business, according to the Australian Securities & Investments Commission.

REMI owned two properties and had an option to buy another one, the administrators found.

Mr Baskerville said current options being explored included undertaking a marketing campaign to sell the properties in situ or seeking a refinance package.

* Name has been changed

Do you know more or have a similar story? We want to hear from you sarah.sharples@news.com.au