Queensland building company collapses, leaving staff and hundreds of homeowners in limbo

A mother and daughter duo have been caught out in a devastating building company collapse, after one sold a house to the other.

Staff and homeowners at a collapsed building company have revealed the devastating loss they have incurred hours after the firm went into liquidation.

On Wednesday morning, William Cotter and William Robson from Robson Cotter Insolvency Group were appointed as joint liquidators of Queensland residential builder Oracle Building Corporation Pty Ltd.

Oracle Building Corporation trades under a number of names including Oracle Platinum Homes.

In a statement to news.com.au, liquidators revealed that the company’s demise has left 70 staff and 200 suppliers and subcontractors out in the cold, as well as 300 homes that were in the pipeline to be completed.

Liquidators would not say how much money was owed by the Logan-based builder.

Staff claim they were blindsided when they received a call informing them the construction firm had gone bust while homeowners are now faced with rising build costs to complete their homes.

In a tragic twist, a mother and daughter are among those impacted, after the mum sold an Oracle home to her child to help her buy a house.

Montana Wilkinson, 28, and her husband have forked out $211,000 for a partially completed house while her mum, Boz Thurtell, has been left jobless and owed nearly $50,000 in commission fees from the company.

“They (Oracle) just dragged down everyone’s lives,” Ms Wilkinson told news.com.au.

Ms Wilkinson was looking to buy her first home and ended up using her mother as a sales agent, signing her contract with Oracle Platinum Homes in December 2020.

Although they were warned about delays to her $304,000 house near Ipswich, because of Covid-related supply chain issues, Ms Wilkinson said she started to grow suspicious.

She grew concerned when the builder asked her for an extra $70,000 in variations to the original build and she saw other houses from different building companies be completed in the same period of time.

Even with the delays, the house should have been finished by late last year – but for the last few months, it’s been stuck at the enclosed stage.

In progress payments, the couple have shelled out $211,000 but still have another $90,000 to go.

Do you know more? Continue the conversation | alex.turner-cohen@news.com.au

Meanwhile, Ms Wilkinson’s mother was in tears on Wednesday morning when she received a call from her boss around 9am saying there was no point going into work as she was no longer employed.

Ms Thurtell, who worked for Oracle for more than three years, said the collapse of her employer is “heartbreaking”.

“It’s heartbreaking, it’s terribly worrying,” she told news.com.au.

“After I cry a little bit, I will ring some recruitment agencies, try to compose myself, suppose get on with life.

“I’m a single income household, I’m 56, this is what I’ve done most of my life, the construction industry is in a bad condition anyway, I might have to go work in Coles to support myself in the interim.”

She claims she is owed around $50,000 in unpaid commission fees as well as two months of unpaid superannuation.

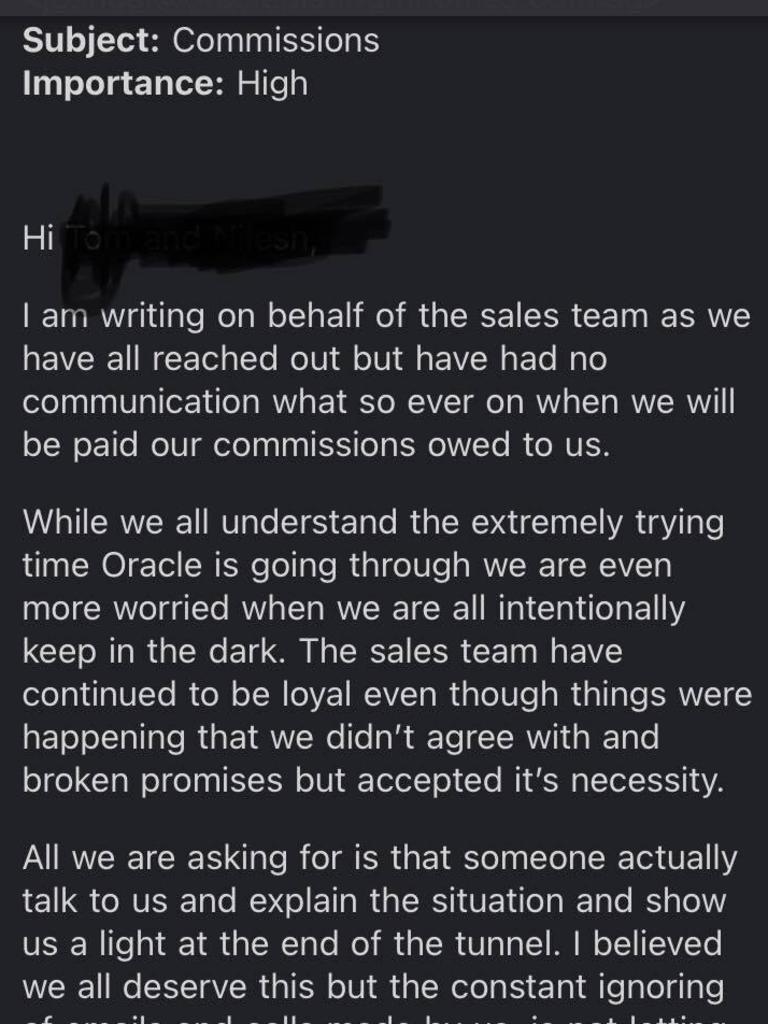

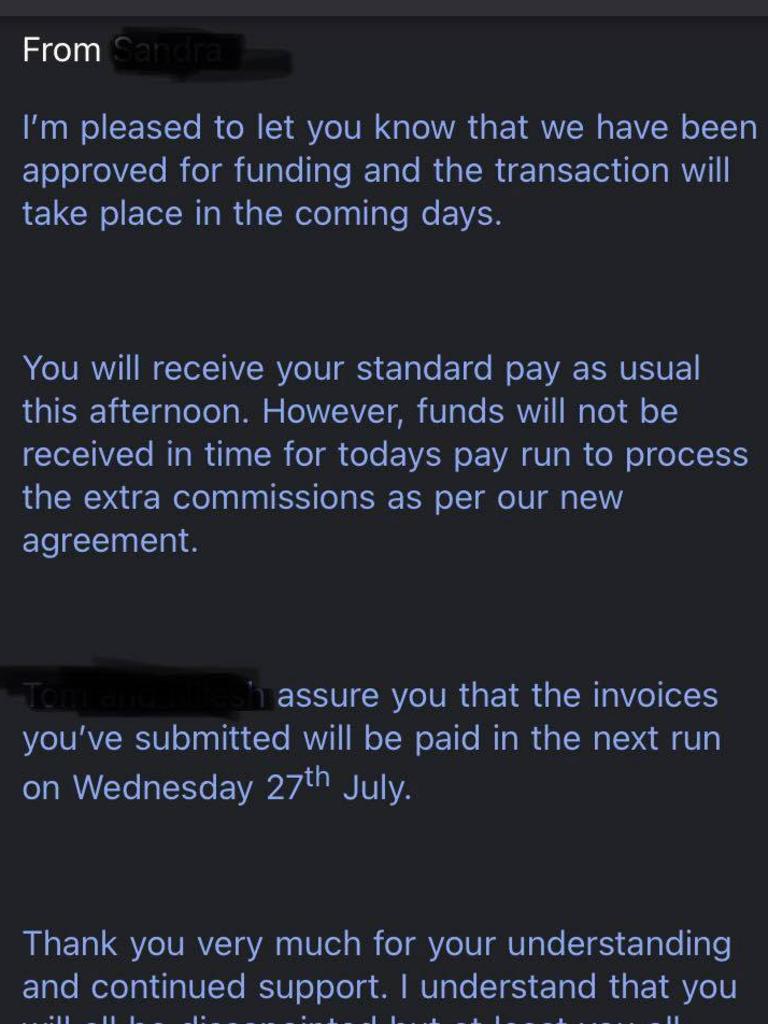

For months, the 56-year-old said she had been chasing up about her commissions and was concerned as she knew tradies had not been paid for works done on houses.

Last month, Ms Thurtell sent an email laying out her concerns and she claims she was assured Oracle was doing fine and that it was selling assets to pay back debts.

Oracle also told her if the company did go under, workers would be given four weeks’ notice – but this did not end up happening.

The building firm appears to have had money troubles for some time, with news.com.au reporting in April that Oracle Platinum Homes had tried to charge customers more for builds, in one case hiking build prices to more than $100,000 than the original agreement.

It appears that Oracle’s website and Facebook pages are down as an error code appears.

“The Director … is fully co-operating with the Liquidators with a view to maximising the prospects of recovery for all classes of creditors,” liquidators said in a statement.

It comes as Australia’s building industry is in crisis, with more than a dozen companies going into liquidation so far this year amid rising costs for construction materials and the ongoing supply chain crisis alongside fixed price contracts, putting many out of business.

Queensland has been particularly hit hard, with major building company Gold Coast-based Condev going into liquidation this year.

Earlier this year, two firms from Queensland collapsed just days apart, Pivotal Homes and Solido Builders.

The most recent construction liquidation was another Queensland builder, Besse Construction, that collapsed only last week owing $1.7 million.