Popular pub collapses owing $1.2m

The pub had just 63c in the bank at the time of its collapse and pointed to three key issues for its demise.

A popular pub that said it would need to charge $20 for a beer to survive has collapsed owing $1.2 million, a report from liquidators has revealed.

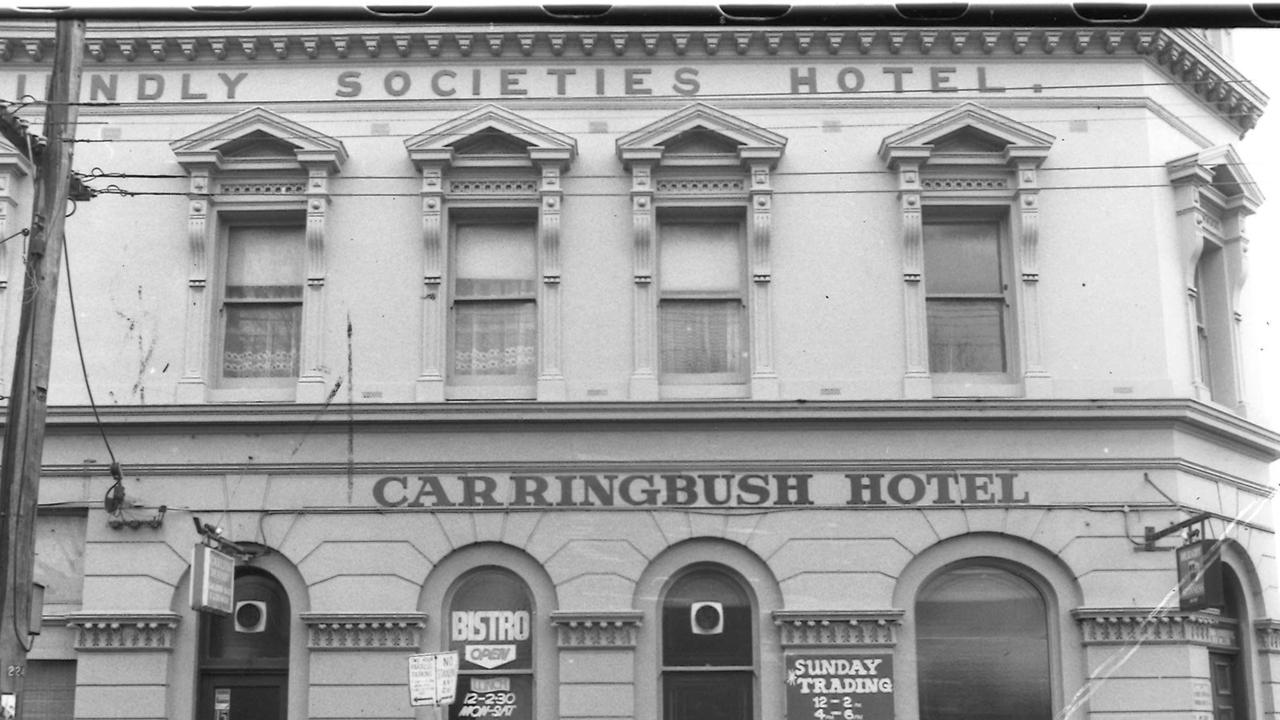

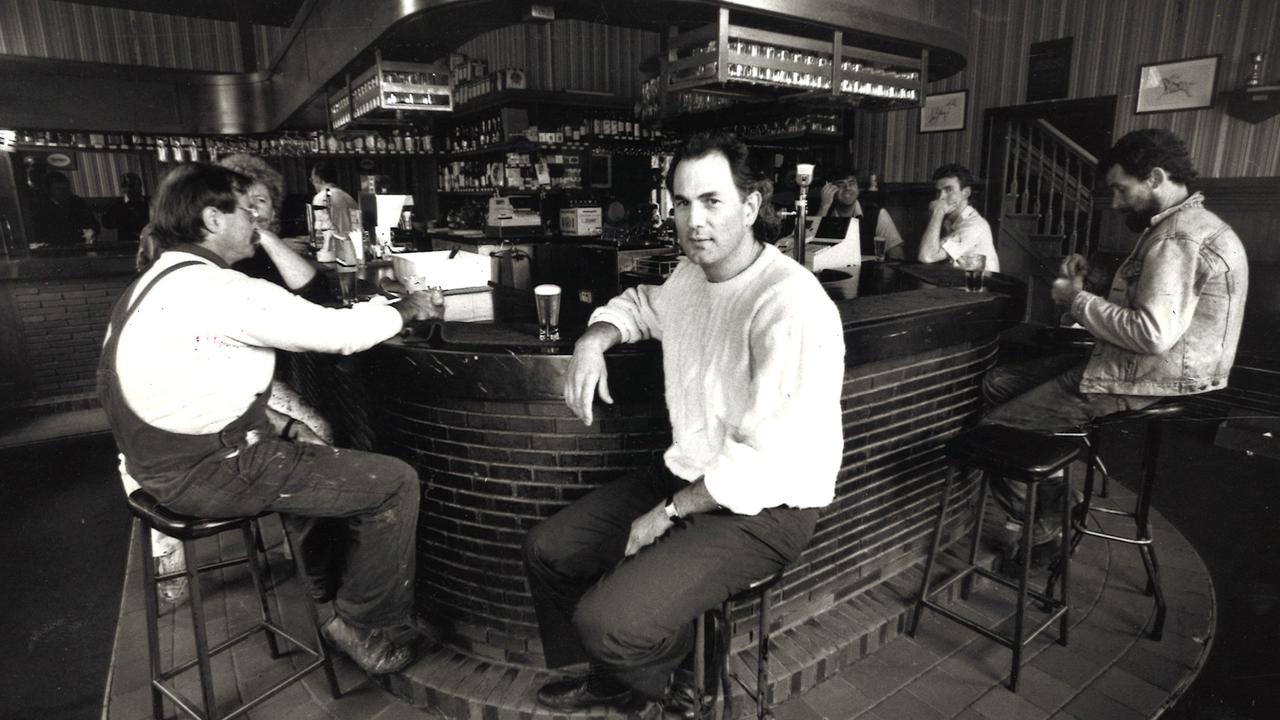

The 135-year-old pub called The Carringbush Hotel, which was based in Melbourne, was shuttered at the start of June but still fell into liquidation.

A final report to creditors from insolvency firm CJG Advisory released in September, which was leaked to news.com.au, has revealed the extent of The Carringbush Hotel’s financial woes.

It found The Carringbush Hotel had outstanding debts worth $1.28 million and just 63c left in the bank at the time it went into liquidation, the report filed with the Australian Securities and Investments Commission found.

This included $1.17 million owed to unsecured creditors with $411,000 outstanding to the Australian Taxation Office.

Secured creditors were owed $21,000, while preferential creditors had outstanding debt of $83,000.

The report noted a return to creditors of any money was unlikely.

The owners of the Carringbush Hotel blamed trading losses, poor economic conditions and Covid-19 as the reasons for it shutting down the business, the report noted.

The liquidator Matthew Gollant said investigations revealed that the company’s business was severely impeded by the Covid-19 pandemic.

“Following its inception, the company incurred significant expenses improving the premises to an appropriate trading condition, however was only able to trade for approximately 12 months prior to trading restrictions being placed on the business due to the Covid-19 pandemic,” he wrote in the report.

“Following the pandemic, a number of disputes between the company and the landlord of the premises resulted in various VCAT cases being brought against the company. Facing the rising costs for supplies, the directors formed the view that the business may be unprofitable and took steps to wind up the company.”

Between July 2021 and to June 2023, The Carringbush Hotel made a loss of $460,000. Prior to that between July 2019 and June 2021 it made a profit of $384,000.

News.com.au previously revealed that The Carringbush Hotel operators had been locked in a bitter legal battle with its landlords.

The liquidator’s report noted that the landlord had claimed the property was damaged and a $40,000 debt was outstanding.

A combi oven and a beer tank, with an estimated worth $31,000, was left on the premises but the liquidator found prospect of repossession and achieving a commercial return for the assets was unlikely.

The landlord also purchased The Carringbush Hotel liquor licence for $1000, according to the report, and had expressed an interest in buying the business name.

Mr Gollant “formed a preliminary view” that the Carringbush Hotel may have traded while insolvency from as early as 30 June 2022.

“From this time, the company incurred further debts totalling approximately $480,000,” he added.

Mr Gollant also found that between 5 December 2023 to 4 June 2024, The Carringbush Hotel paid a total of $72,338 to the ATO.

“I am currently awaiting further information from the ATO, however it appears that the company and the ATO entered into a payment arrangement at a time when the company may have been insolvent,” he wrote. “I have formally issued a claim against the ATO however, I am yet to receive a response.”

He added he had submitted his report to ASIC who had advised that they do not intend to take any further action at this stage.

It comes at a time where the Australian hospitality sector is battling with tough economic conditions with a list of collapsed companies mounting, as well as for businesses generally.

Figures from the Australian Securities & Investments Commission (ASIC) revealed there were just over 11,000 insolvency appointments in the 2024 financial year, skyrocketing by 39.1 per cent increase in the year prior.

The appointments had also soared by a massive 124 per cent more than 2022.

In July, one of the last pillars of an award-winning Queensland chef’s hospitality empire went bust, just a month after seven other sister venues collapsed. Cuisinier Australis Pty Ltd trading as Montrachet called in administrators.

In May, popular Sydney restaurant Lucky Kwong, headed by iconic chef Kylie Kwong, announced it was shutting down.

That same month, the Botswana Butchery chain which operated as a high-end steak restaurant across three cities went bust, with debts of more than $23 million and more than 200 staff sacked.

Earlier this year, after 18 years in business, Melbourne Asian fusion restaurant Gingerboy shut down blaming “market pressures since Covid lockdowns”.

In September, news.com.au revealed Melbourne’s lavish Lobster Cave is facing the possibility of being forced into liquidation after a creditor began court proceedings to have the business wound up.