NSW widow loses $750,000 to sophisticated scam

A mum has become the latest Aussie to be ripped off by the same scam, with the common link being a man with a British accent.

A Melbourne widow who had only just come to terms with her husband’s shock passing is reliving a new trauma after scammers stole $750,000 from her.

Mum-of-three Michelle Lowry, from coastal NSW, was devastated when her husband Mark died in a car crash at the end of 2019.

The schoolteacher sold her husband’s business in the wake of the tragedy for $250,000. She was looking to invest the $250,000 as well as pooling together $500,000 from her and her husband’s self-managed super fund.

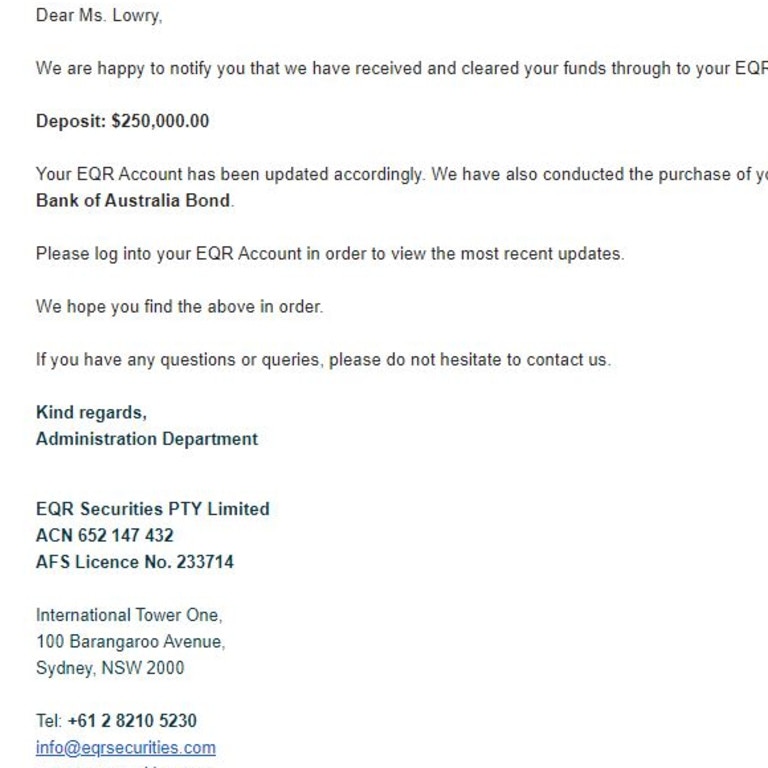

It was here she stumbled across EQR Securities, which was selling government bonds with a slightly higher return than she could find elsewhere.

After a lot of back and forth, including checking the company’s details with her accountant, she transferred her money over right before Christmas.

However, at the beginning of last month, the website — along with her money — had completely disappeared. She realised it had all been fake.

A real EQR Securities does exist — but this wasn’t it. Cyber criminals had pretended to be the company and even stole its business numbers.

“For me I was just coming back from a really good break, that was part of my healing process, I was finding a new path,” Ms Lowry told news.com.au.

“This has just put me back into this mad world, this big black hole, [now I’m] trying to claw my way back.”

News.com.au has previously reported on this same group of scammers, who posed as Barclays and Macquarie Bank and also an ANZ entity called Capel Court. As far as this publication knows, these fraudsters have stolen $2.3 million from five Australian victims.

Want a streaming service dedicated to news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Ms Lowry filled out an expression of interest form on the fake EQR Securities website in November last year and was contacted by a man with a UK accent who called himself William Hughes.

This British man is a recurring presence among all victims, using multiple aliases including David Jones, Ben Davis, Jacob Price, Oliver James and of course William Hughes.

He was “not pushy at all”, Ms Lowry recalled, adding that there were “no red flags” as far as she could see.

“We did our due diligence.”

In fact, Ms Lowry’s accountant helped her sign up to the bonds scheme and even jumped on a three-way call with her and the scammer, Mr Hughes, to discuss her investment.

Finally, in late December, Ms Lowry transferred her money over in two instalments of $250,000 and $500,000 to buy the Commonwealth Treasury Bonds and Commonwealth Bank Bonds.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

Ms Lowry went into her local NAB branch and by teletransfer, she moved her money into a bank account from an instant payment system called Cuscal.

“It was Cuscal, we checked, Cuscal was an APRA-approved ADI [authorised deposit-taking institution],” she added.

On the website portal immediately afterwards, the bonds appeared in her account, prompting her to think everything had gone smoothly.

Four months later, in April, William Hughes rang her to confirm EQR Securities had the right details to deposit her dividends into at the end of May.

“I don’t know why, it was a very suss conversation,” she said, explaining how it gave her the urge to immediately check her money.

“That’s when I found out the website was down, I tried to ring, everything went to voicemail.”

Realisation dawned on her that it was a very elaborate scam.

“There was panic, tears, I was thinking ‘what can I do?’, ’What have I done?’”

It was the beginning of May by this point so it had been four and a half months since she deposited her money.

Ms Lowry said her funds had been moved from Cuscal into a cryptocurrency exchange called ED Australia. From there, it went into international accounts and disappeared.

“My husband and I, we both worked hard all our lives,” Ms Lowry continued. “It’s put a huge dent into our super.

“Basically the proceeds of the sale of the business are gone.”

Ms Lowry has lodged reports with police and with the fraud team at NAB.

She has also gone to the Australian Financial Complaints Authority (AFCA) because she believes more protections should have been put in place with her bank.

Simon Smith, an Australian cyber expert and investigator, is assisting Michelle with her AFCA and cybercrime complaint and told news.com.au: “I am confident the bank will step up, learn from this case, better their processes and recognise the importance and responsibility they owe to their customers and all Australians.

“The cyber crime epidemic in Australia is rampant, and in my experience, it is the banks that are the first, and best equipped to recognise, deter and prevent the early signs of online fraud and scams.”

Sadly, this is not the first time this scamming syndicate has duped Australians out of hundreds of thousands of dollars.

They scammed one Melbourne man out of $700,000, another schoolteacher out of $500,000, a retired couple lost $200,000 and an accountant fell for it too, losing $160,000.

In October last year, retired Queensland couple Antje and Bardhold Blecken had $200,000 stolen from them when they mistakenly believed they were investing in a Barclays Bank term deposit.

Then in March, melbourne man Andy* thought he was investing $700,000 into bonds with ANZ entity Capel Court. It was fake and he lost his life savings.

Robert*, an accountant, also sank $160,000 into the fraudulent Capel Court group while NSW couple Jody and Corey Bridges lost $500,000 to the same scam.

“They will do it again if they’re not behind bars, these guys are clever,” Robert, in his late 40s, warned news.com.au earlier this month.

The Bridges said they had almost been left bankrupt while the Blecken couple now must get by on an aged pension.

Last month, news.com.au reported on Melbourne widow Jacomi Du Preez, who lost $760,000 from the life insurance payout of her husband in an elaborate Macquarie Bank term deposit website that turned out to be fake.

Luckily, Ms Du Preez realised it was a scam within a day and was able to recover all her money.

It’s likely she was targeted by the same group as she dealt with a “slick” man with a British accent called Mark Dickinson.

How to spot investment scams

Investment scams have “exploded” in the last two years against the backdrop of Covid-19, according to a cyber security expert.

Low interest rates have made Aussies look elsewhere to put their money and scammers are all too happy to oblige.

So far in 2022, Australians have collectively lost $157 million in investment scams, according to the ACCC’s Scam Watch.

Nick Savvides, Chief Technology Officer for APAC at Forcepoint, told news.com.au these particular scams were so “sophisticated” and “well-resourced” that it was likely they had a group of at least 20 people working together to steal large sums of money from Australian victims. The money has likely ended up overseas.

There are ways to spot investment scams, he said, which includes calling numbers independently, checking everything with a financial planner and insisting on a face-to-face meeting.

“Never go to a website that they [the scammers] control,” Mr Savvides explained. “Find the website of the organisation independently, search for a website on Google, don’t follow any links on emails they sent you, don’t trust phone numbers they give you, look them up on the bank or financial institution’s main website.”

Investment companies have to lodge a Prospectus on the ASIC website outlining how they can ensure financial security for potential investors, which means the Prospectus the scammers give you won’t match with the real thing.

“If the scammer is providing a Prospectus search for it on ASIC Offer Notice Board,” Mr Savvides explained. “They’ll give you a very detailed Prospectus, they’ll make it look really good, check everything matches an existing offer.”

ASIC also lists companies you shouldn’t deal with as well as naming and shaming fake regulators or exchanges.

“If you’ve been asked to transfer to different destination accounts, that’s a sign that mule accounts have been shut down,” he continued. “An investment bank will only ever ask you to put money into a single receiving account.”

He also said to insist on coming into the office at least once to check it out.

“There are scammers who will meet you face-to-face, but the chances of being caught are much more likely. If they’re always giving you an excuse [not to meet] become very, very suspicious.”

Police and banks respond

NSW Police said it would not be commenting on the matter as an investigation was still underway.

Chris Sheehan, NAB Executive Group Investigations & Fraud, told news.com.au in a statement: “This matter is currently being reviewed by AFCA and NAB is co-operating to ensure the complaint is fully investigated.

“We’ve seen a significant increase in scams in recent years and it’s upsetting to see the devastating effects these can have on the impacted victims.

“Investment scams in particular continue to feature in the top four types of scams that our customers report alongside romance scams, business email compromise and remote access scams.

“We will always make every attempt to prevent these scams and recover funds where possible. However, once the funds have left a victim’s account, it can often be difficult to recover them due to the sophistication of these criminals.

“We encourage everyone to remain vigilant and alert on what to look out for to keep themselves safe from scams. We have a dedicated team that monitors customers’ accounts 24 hours a day, 7 days a week for suspicious activity, provide dedicated training to our bankers and regularly run customer education webinars with tips and advice on what to look out for.

“Never be pressured to paying immediately for something during an unsolicited call or conversation, and be sure to confirm the identity of the person you are sending money to before completing a transaction. It’s best to treat these transfers like handing cash to someone you don’t know.

“If anyone out there believes they have been victim to a scam or notice any fraudulent activity, take action and contact your bank immediately.”

*Names withheld over privacy concerns

alex.turner-cohen@news.com.au