Liquidators pursue homeowners of collapsed Victorian builder owing $23m

Liquidators are chasing homeowners at a collapsed building company for money even though some have been left almost $180,000 out of pocket.

EXCLUSIVE

Homeowners from a building company that collapsed last month owing $23 million have been dealt another devastating blow.

In a creditor’s report released last week and obtained by news.com.au, the appointed liquidators have revealed they are pursuing customers for money.

That’s despite most homeowners having to fork out hundreds of thousands more to build their homes as costs have skyrocketed and state insurance only covers 20 per cent of the contract price after the company’s demise.

In early July, Victorian residential builder Brurob Nominees Pty Ltd, also known as Langford Jones Homes, and its sister company Woodside Building Services Pty Ltd, went into liquidation.

The builder’s failure impacted 66 homes and more than 400 creditors. While initial estimates put the debt at $10 million, the latest report shows that the amount owed has snowballed to $23 million.

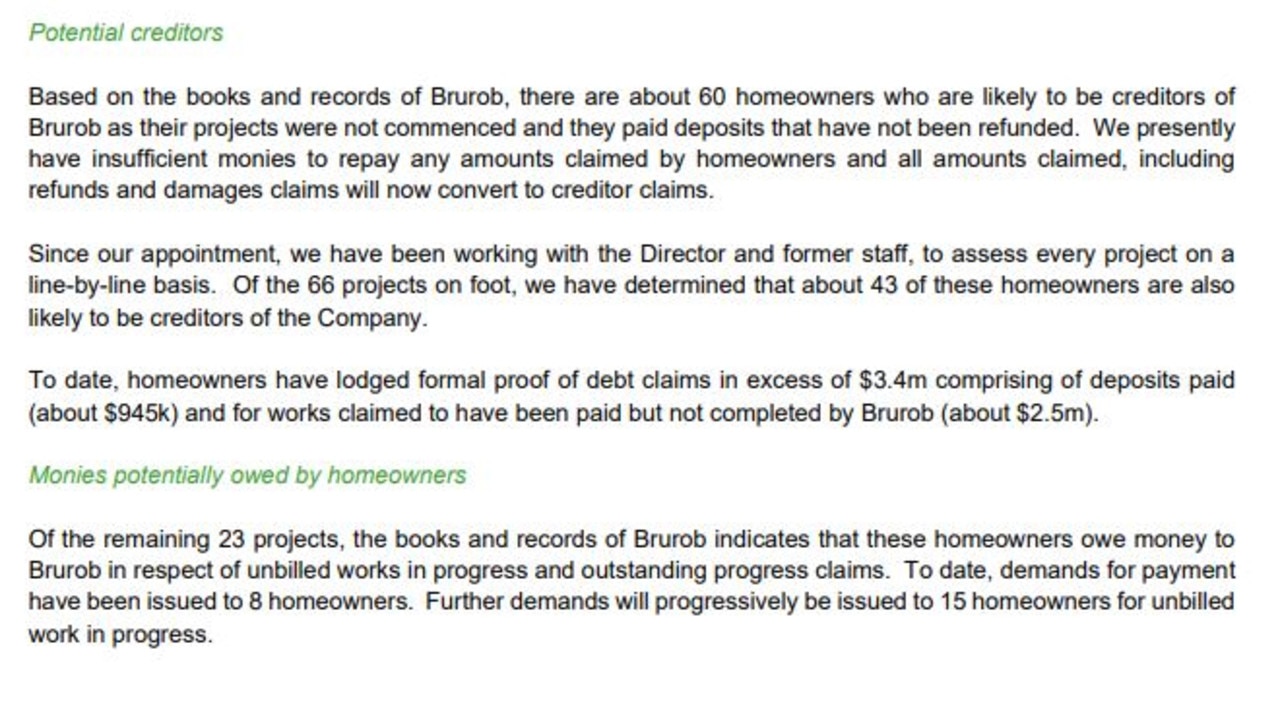

That same report found that 23 homeowners — a third of those affected — actually owe Langford Jones Homes money as they never paid for the latest instalment on their homes.

Eight homeowners have already been contacted and letters will soon be sent out to the others demanding payment.

Donna Taylor, a postwoman in Phillip Island south of Melbourne, expects to receive one of those letters even though she has been left $180,000 out of pocket from the whole ordeal.

“They’re probably going to send me the bill for a retaining wall, I’ll tell them to get f**ked,” she told news.com.au.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Ms Taylor, 53, signed with Langford Jones in 2020 and only has a frame after a year and a half on her $365,000 build.

She forked out $155,000 in progress payments before Langford Jones Homes went bust.

Now the aspiring homeowner is worried her frame needs to be entirely torn down as it has been uncovered for four months during heavy rain and some of the wood has turned black.

Unfortunately, Victoria’s Domestic Building Insurance only pays back up to 20 per cent of the building contract price.

“The builder’s insurance will only cover me for $70,000,” Ms Taylor said.

“I’ve already got a builder’s quote (and I'm) going to be $180,000 out of pocket.

“I had $210,000 left to complete the house. To complete it now is costing something like $460,000.”

When it comes to the 23 homeowners being personally pursued by liquidators, Ms Taylor said she had a “feeling that I might be one of them”.

Do you know more or have a similar story? Continue the conversation | alex.turner-cohen@news.com.au

The builders put a retaining wall into Ms Taylor’s home several months ago, which cost nearly $6000.

“They never billed me for it,” she said.

“It’s just too scary, I start crying when I think about money.”

The $180,000 extra she will now have to shell out to complete her home will effectively eat away the profit she made from selling her previous home.

“That’s nearly my whole last mortgage from the last house,” she explained.

“I was going to be mortgage free and semi-retire, now I’m probably going to have to do a full time job plus an extra job, I’ll have to take a mortgage of $100,000 (to afford that).”

Richard Stone and Jonathon Colbran of RSM Australia Partners were appointed as joint liquidators of Langford Jones Homes in July.

In the report sent out to creditors, they stated they had “issued demand letters to a number of customers and began collecting amounts owed to the companies”.

“The books and records of Brurob (Langford Jones Homes) indicates that these homeowners owe money to Brurob in respect of unbilled works in progress and outstanding progress claims.

“To date, demands for payment have been issued to eight homeowners. Further demands will progressively be issued to 15 homeowners for unbilled work in progress.”

Mr Stone admitted that the letters so far had received “mixed reviews” from customers.

“It’s been a mix, some (of those customers) have paid, some have offered a compromise figure, some have indicated they’re not happy,” he told news.com.au.

The liquidator revealed that they had sold the company’s “limited physical assets” which was mostly vehicles, although many were subject to finance.

“There’s no other known physical assets available to be realised,” Mr Stone said.

As a result, the company has just $30,000 from the net proceeds of the sales.

That’s $30,000 to share between more than 400 creditors cumulatively owed $23 million.

The insolvency firm has also estimated it should receive remuneration of $200,000 to $300,000 for Langford Jones Homes and $30,000 to $50,000 for Woodside Building Services.

Liquidators haven’t ruled out personally pursuing the director of Langford Jones Homes, the eponymous Bruce Langford-Jones and his son Sam.

“A search of the National Personal Insolvency Index confirms that the directors are not bankrupt,” they stated.

Mr Stone said he was investigating Mr Langford-Jones and considering whether to take the matter further.

“That’ll be subject to further investigations, to identify if there are any claims against the director, for breaches of duty or insolvent trading,” he said.

In order to access the director’s personal assets, it would have to go to litigation, he added.

Bruce Langford-Jones said in a written statement to the ABC last week that he had been wiped out from his company’s collapse.

“Our family have lost everything — my son has lost his house. My wife and I have lost our family home and holiday house,” Mr Langford-Jones said.

“Builders throughout Australia are just hanging on.”

He blamed the company’s failings on two cyber attacks in December 2019 and January 2020, which he claimed drained the building firm of $2 million.

Ms Taylor has called on government regulators to do more rather than relying on company directors to do the right thing in what she called an “honesty system”.

“There’s no protection for the consumer,” she said. “How many of us have lost our houses and our future and our dreams and our money? Builders have got to be held more accountable.”

Last month, news.com.au spoke to a number of other affected homeowners, former staff members and contractors who had been left in the lurch and in some cases financially ruined by the Langford Jones Homes collapse.

Brody* runs a small business with three other employees and claims he is owed $150,000 from Langford Jones Homes after outlaying his own money to buy materials.

The contractor, based in Victoria’s Mornington Peninsula, said that was the sum total of his life savings.

“I really don’t have any money, I’m having to borrow money from my father,” the 49-year-old told news.com.au.

“Six months ago, just before Christmas, they allege they were hacked [which was why] they didn’t pay anyone.”

However, the tradie claims the company had problems way before they were hacked or when the Covid-19 pandemic came along, as Langford Jones Homes always struggled to pay him.

“I started working for them in 2019, for the first six months I wasn’t paid,” he added.

James* was one of several site supervisors for Langford Jones Homes who quit en masse once they understood the scope of financial problems the company was facing.

“It was the worst time of my life,” he said.

Another employee, Vincent, said: “I could see the writing on the wall. I couldn’t face clients, you know people are paying deposits and not getting their house built.”

David Drummond and his wife, in their late 60s, said they are “devastated” and that the company’s winding up “will be a huge financial loss for us”.

More Coverage

“We will sell and move on and not proceed with the build with anyone else. This has also destroyed our plans for a retirement by the sea,” he told news.com.au.

*Names withheld over privacy concerns