Letters from ASIC, a robbery and a director’s body on a Queensland beach at centre of $91m Ponzi scheme mystery

A baffling financial mystery in Australia has been brought into the spotlight as its victims demand answers nearly a decade after they lost everything.

EXCLUSIVE

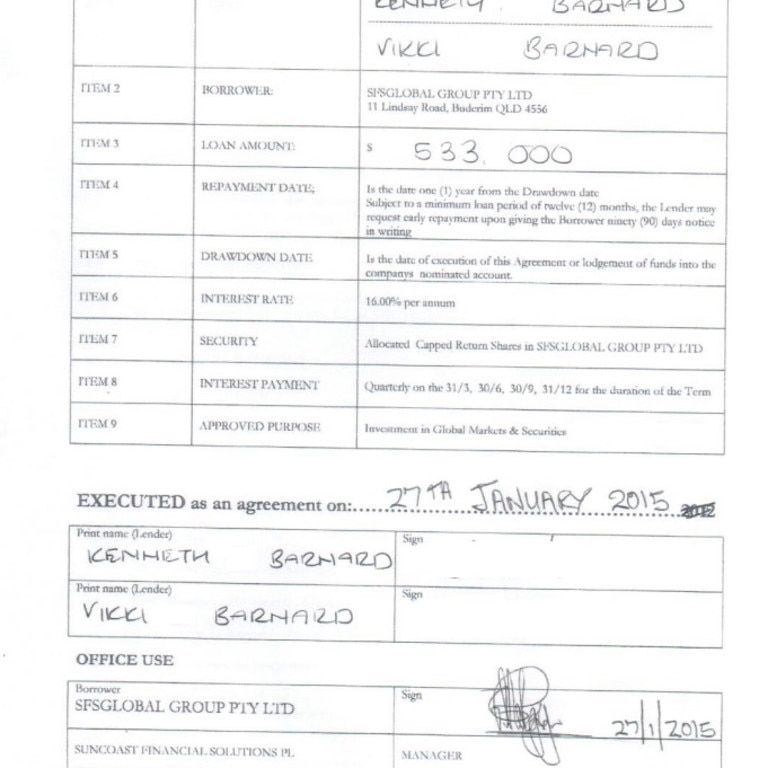

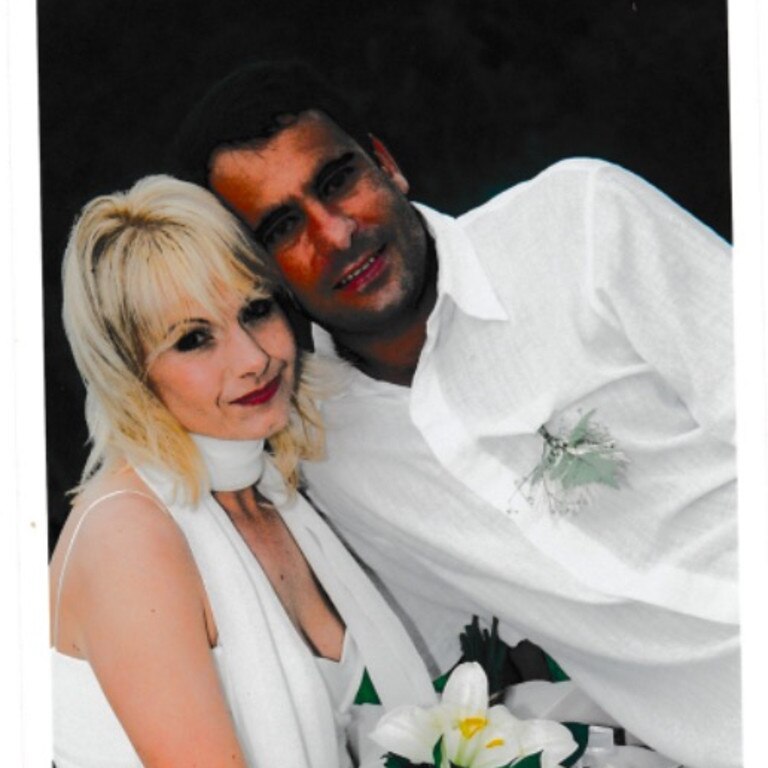

When Vikki Barnard and her husband Kenneth handed over $650,000 in life savings, they had absolutely no idea they would never see it again.

That decision would lead to the bank repossessing the Queensland couple’s land and both of them contemplating ending their lives just one year later. If not for their son, they say they might have.

“The money was absolutely everything. We basically started again. It’s been six-and-a-half years since we lost everything,” Ms Barnard, 54, told news.com.au.

In 2015, after selling their thriving bed and breakfast business for a substantial sum of money, the duo put their cash into an investment company called Suncoast Financial Solutions, run by local Sunshine Coast man Stephans Halgryn.

But a year later, police were called as a man’s body had been found on a small Queensland beach in a seemingly unconnected event. It was later identified as Mr Halgryn.

The company director’s death from a suspected heart attack brought the investment scheme crashing down as revelations emerged that he was running an unlicensed managed investment fund with 696 investors owed $91 million.

In another bizarre twist, 10 days before his death, his office was robbed, and all the company’s financial records disappeared. This made it an impossible task to track down the missing cash and to this day the case remains a mystery.

The Barnards have given up on ever seeing a cent of their money but they blame the corporate regulator, ASIC, and its failure to stop the scheme from carrying on.

Mr and Ms Barnard invested their cash into Suncoast Financial Solutions at the beginning of 2015, after one of their friends recommended the investment fund.

They were promised annual returns of 16 per cent. Other investors were offered returns of up to 24 per cent yearly at the sister company, SFS Global Group.

The couple, who now reside at Airlie Beach in far north Queensland, started with a $533,000 investment, then added an additional amount.

“In the long term we thought we would end up buying another business, we were just parking the money there,” Ms Barnard said.

But on April 19, 2016, Mr Halgryn died at Warana beach. A coroner’s report ruled he had died within a 24-hour period of his body being found from a heart attack.

Following his death, the company went into liquidation, with Paul Nogueira from insolvency firm Worrell’s appointed as the liquidator of both Suncoast Financial Solutions and SFS Global Group.

Investors thought it would be a simple case of their core funds being returned to them in the companies’ winding up processes. What happened instead is that aside from $145,000 in company and personal assets, the liquidator was unable to locate any of the tens of millions of missing dollars.

Now, years after Mr Halgryn died and the company was liquidated, investors have not recovered any of their money.

Mr and Ms Barnard were shocked to discover that ASIC had investigated Mr Halgryn’s investment fund twice prior to their investment.

Ultimately, the corporate watchdog did not shut down the investment scheme. If it had, the Barnards’ fortune would be fully intact.

The pair submitted their story to Andrew Bragg’s parliamentary inquiry into ASIC in February. Submissions have now closed. The inquiry is currently under way and executives at ASIC are expected to face Senate Estimates later this month.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

ASIC investigated Mr Halgryn and his investment business in 2013 and 2015 “concerned” he was operating a company that was not compliant with Australia’s financial laws.

“It has come to the attention of ASIC that the company … may be: engaging in a credit activity (and) carrying on financial services business” without the required financial licences, ASIC wrote to Mr Halgryn a decade ago, in 2013.

They accused him of offering mortgage planning, debt consolidation, insurance and investment opportunities to clients without a credit licence or a financial services licence.

“ASIC reserves its rights in respect of any further action as it considers appropriate,” the regulator finished its letter.

But ultimately, the director was able to explain.

“At present the company is solely used for marketing mortgage broking and loans,” Mr Halgryn responded.

“I do not believe the company is engaging in any activities that require it to hold an ACL or AFSL (the relevant licences).”

That was despite having $91 million in investment funds at the time of his death.

“After considering his responses and assessing the information available at the time, ASIC determined that further investigation was not warranted,” an ASIC spokesperson told news.com.au when contacted.

During the investigation, the liquidator, Mr Nogueira wrote “It would appear, on a prima facie basis at least, that an AFS license may have been warranted given the nature of the companies’ operations.”

Ms Barnard lamented: “I would never have invested if ASIC had done their job.”

In an even more bizarre twist, right before Mr Halgryn’s body was found on the beach, his office was broken into and all financial records were stolen.

On April 8, a thief or thieves broke into the Buderim office. Queensland Police never charged anyone over the incident and neither did they ever recover the stolen materials.

“All the companies’ pertinent records regarding the assets of the trading syndicate, investments made, trading histories, broker/ investor institutions utilised or asset registers were reported stolen prior to the director passing away,” the liquidator, Mr Nogueira, said in an affadavit submitted to the Supreme Court of Queensland, obtained by news.com.au.

This then meant there was no record of where the missing $91 million had gone.

“We didn’t have any records except a bunch of bank statements that had limited descriptions on there,” Mr Nogueira said in conversation with news.com.au.

“The whole situation was unusual, the way he was found deceased, all the records were stolen, even the way the whole thing was set up.”

The liquidator added “We never got to the bottom of it, it possibly was a Ponzi scheme” but ultimately had to end his investigation.

Upon learning the company owed $91 million, “you go ‘oh my God’,” Mr Nogueira said. “When I was appointed trying to piece it all together, I reached dead ends continuously, I couldn’t work it out.”

“From late 2015 to early 2016 investors started experiencing issues with the companies in the sense that they started to have difficulties withdrawing funds from the company when desired,” Mr Nogueira wrote in his affadavit, in a typical sign of a Ponzi scheme collapsing.

But unlike other Ponzi operators, the director appeared to have minimal assets. No fancy cars, multiple properties, private boats, nothing.

There was just $118,603 left in the company’s assets that the liquidation process was able to salvage.

On top of that, Mr Nogueira found about $20,000 from Mr Halgryn’s deceased estate. An additional $6724 turned up in the director’s personal bank accounts.

The director had bank accounts in Switzerland, the Isle of Man, the USA, South Africa and Jersey.

“My investigations and a number of comments on Facebook have indicated that the companies/director may have engaged in gambling/betting,” Mr Nogueira wrote.

He identified four betting accounts at Sportsbet, Crownbet, Topsport and William Hill with several thousand dollars in them under the name of Stephans Halgryn.

And that was it. No more money has ever been uncovered.

The pool of investors was made up of half Australians and half foreign nationals, mostly from Mr Halgryn’s native Zimbabwe.

“SFS Global was incorporated on 22 February 2013 and it appears that the trading syndicate was transitioned to this entity around that time,” Mr Nogueira wrote.

“That transition was not documented in any material fashion.”

There was also a US entity of the company called SFS Property Group TN with 71 investors owed $5,558,556 after Halgryn’s death.

As for the Barnard family, they don’t expect to ever recover their money. At first, they lived with relatives while they tried to build their savings back up.

They now live in Airlie Beach “because I could only afford to live in Airlie”.

Their son is now 17. He was 9 when they first invested with the companies.

“We have moved on, we’ve both got jobs and health and family,” Ms Barnard added.

They are hoping for more answers about ASIC’s conduct.

alex.turner-cohen@news.com.au

Read related topics:Brisbane