Insurer backflips after couple’s big fat zero shock in wake of building company collapse

The Queensland couple had just six weeks left before their dream home would be fully completed when their builder collapsed into liquidation.

The insurer who brutally rejected a Queensland couple impacted by a collapsed building company and left them to foot the $180,000 bill themselves has backflipped.

Last week, news.com.au reported that parents-of-seven Valerie and Stephen Kenner, from Logan, had just six weeks left before their dream home would be fully completed when their builder collapsed into liquidation.

The Kenners were not overly concerned as they knew they were insured but last month, they received an email from the QBCC, which handles the state’s last resort insurance scheme.

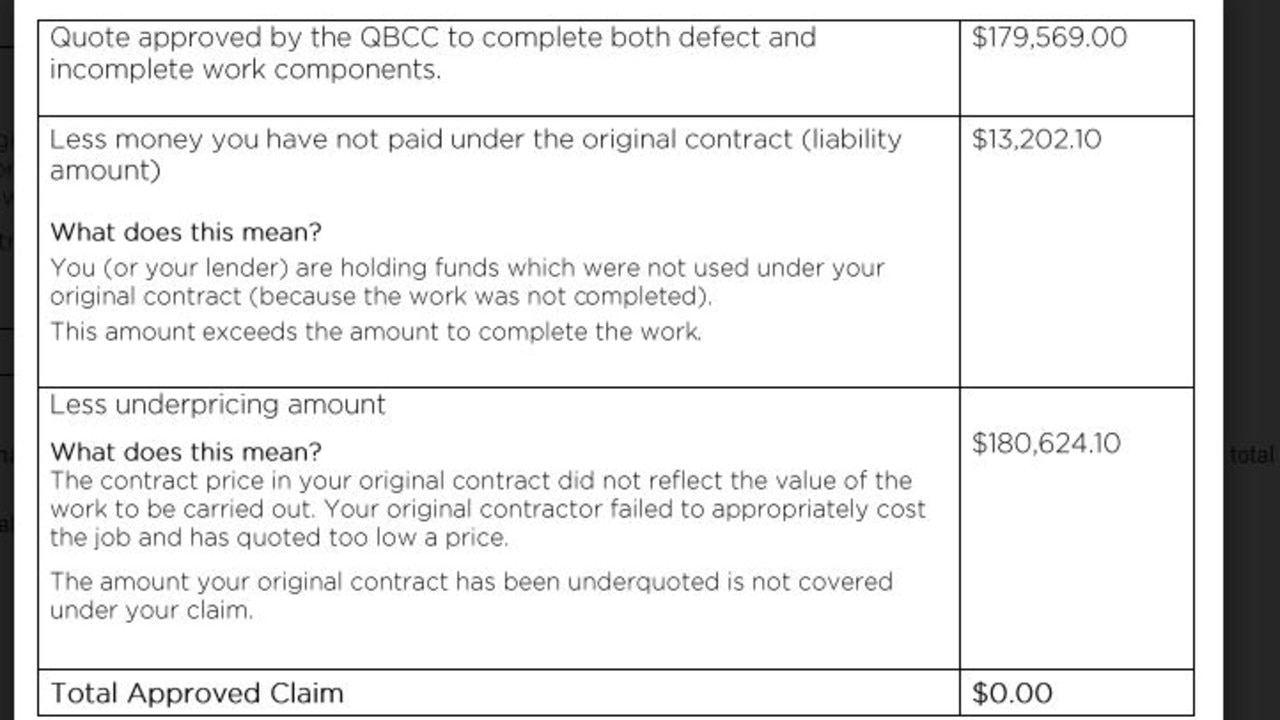

In that email, the QBCC informed the pair that the total amount for their approved claim was $0.0 and that they would have to pay for the rest out of their own pocket.

It’s “basically ruined us financially,” Ms Kenner told news.com.au at the time.

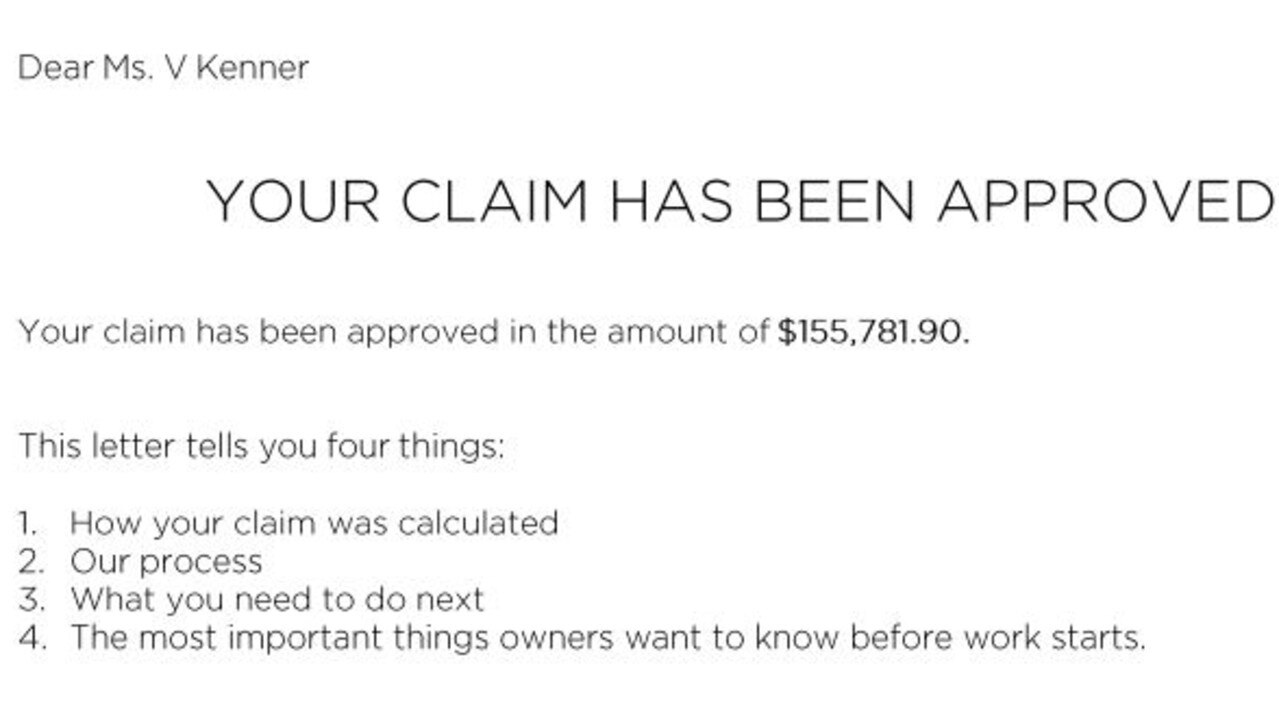

But now news.com.au can reveal that just a day later, the insurance company backflipped on its stance and agreed to pay most of the Kenners' expenses.

On Wednesday, they received the new and improved claim approval in writing.

“Your claim has been approved in the amount of $155,781.90,” part of the document read.

The Kenners told news.com.au they were “so happy” and said that they had not yet lodged their appeal when the insurer contacted them with the good news.

Mr and Ms Kenner signed the contract with Landmark Building & Developments for a $299,000 build in Flagstone, in the City of Logan, at the end of 2021.

They had just $28,000 left in payments to the construction firm when it went into liquidation.

Originally, the QBCC said it would not pay them a cent on the basis that their original build price was “underquoted”, meaning the insurance did not cover them as the cost should have been much higher.

The QBCC “does not compensate consumers for the risk they take when entering into a contract which is significantly undervalued,” a spokesperson previously told news.com.au.

The state insurer said the contract should have been for $501,974.10.

As a result, there was still an additional $180,000 needing to be paid.

But now the QBCC is honouring their original contract price.

The Kenners will only have to pay $28,000, which they had originally budgeted for, with the insurer forking out the rest to complete their dream home.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

Since their builder went under, the couple have been struggling to get by while they waited for an outcome on their insurance claim.

They are paying rent for an extended period of time while also paying off the mortgage for the partially-completed house.

They also continue to pay water bills, electricity bills and council rates for a house they cannot yet use.

“We’ve had (other) builders use our electricity as well. We had to change the locks. They just plugged in their extension lead (to our power-points),” Ms Kenner added.

Ms Kenner also enrolled her kids into a school at Flagstone, thinking they would be living in their dream home by now.

The problem is, they are renting in another suburb, Sunnybank, so it’s a 40-minute drive each way every day to take their children to school.

In that period of time, Ms Kenners' eldest daughter also moved out of home thinking it would be “easiest” as her other six siblings are currently crammed into a small rental.

Ms Kenner has picked up six different casual jobs to keep the family afloat and also looking after the kids, while her husband continues to work full-time.

Andrew Weatherley of insolvency firm WCT Advisory Group, the appointed liquidator of Landmark Building & Developments, said in a report submitted to the corporate regulator that others were in the same boat.

“My analysis established the costs to complete outstanding projects exceeded the remaining balance payable under each contract,” he wrote.

“The significant number of QBCC claims submitted further supports this view.”

alex.turner-cohen@news.com.au

Read related topics:Brisbane