Damning credit history lays bare Victorian construction company Snowdon Developments

CreditorWatch has painted a “dire” picture of a Victorian building firm feared to be on the brink of collapse owing more than $2.5 million.

Concerns are mounting over an embattled building firm as a damning credit report has concluded that the company will likely collapse.

Earlier this week, clients, creditors and staff came forward to news.com.au with fears that Victorian construction company Snowdon Developments Pty Ltd was on the brink of collapse.

Several employees revealed they haven’t received superannuation payments since October, while some customers’ builds have stalled for months, leading several to financial ruin. News.com.au understands there are more than 200 residential homes in the pipeline to be built.

On top of that, Snowdon Developments has 15 creditors chasing it for debts of more than $2.5 million who are demanding the Supreme Court of Victoria impose a winding up order to force the company to go into liquidation “on the grounds of insolvency”.

It’s understand some of those debts have been paid off and the company claims it can afford to pay off the rest of its expenses after the sale of a property asset next month.

One Snowdon subcontractor is working past retirement age as he tries to support himself while he waits for a $480,000 payment from the company and another creditor says he is struggling to feed his family.

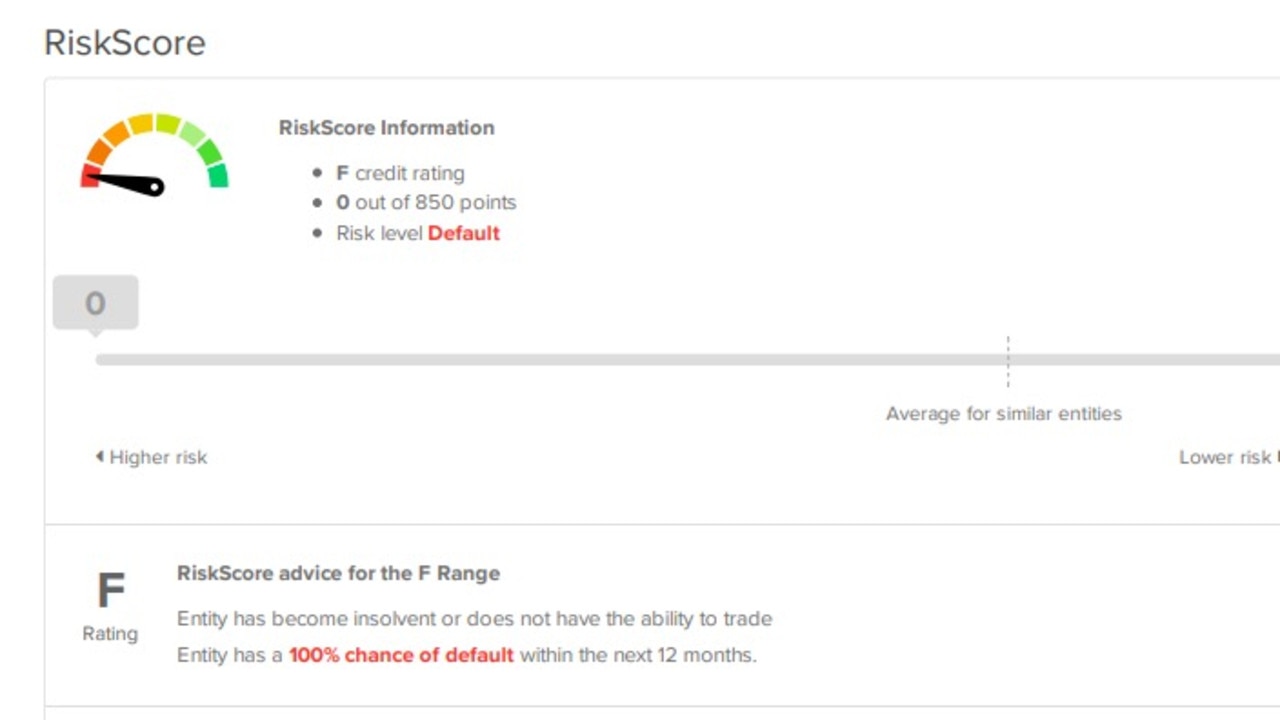

Now news.com.au has obtained a report from CreditorWatch which found Snowdon’s payment times have blown out over the last year and it also has a risk score off the scale, scoring a zero or an ‘F’ rating.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

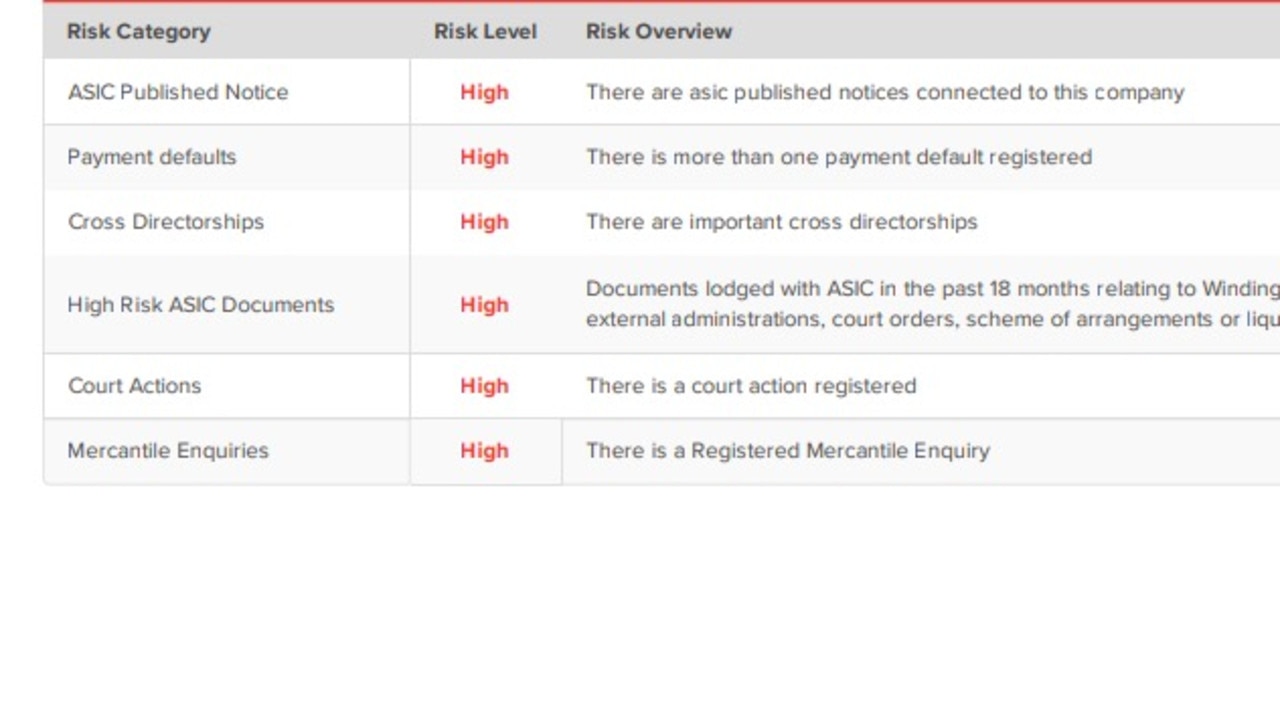

Snowdon is currently embroiled in one court action and has five registered defaults against it.

Another company Snowdon’s directors are involved with, Pivot Construction Group Pty Ltd, is also facing defaults and court action, which CreditorWatch said was cause for concern.

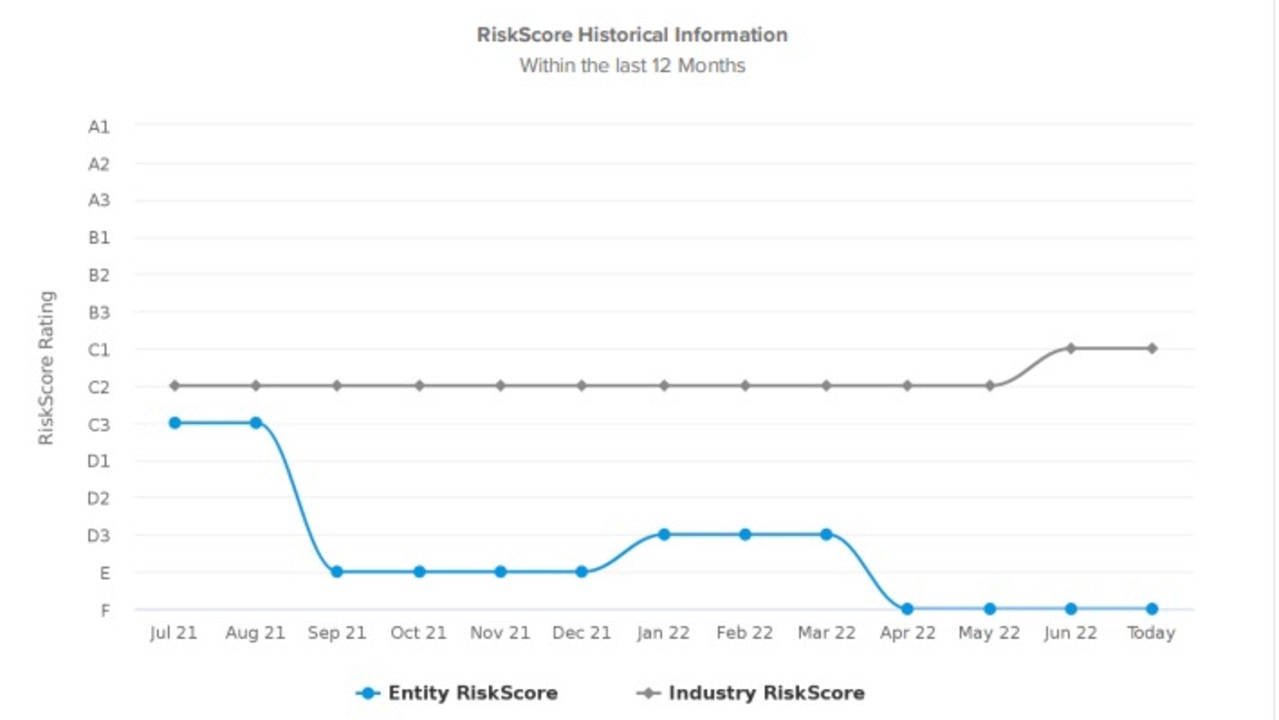

Since April, when legal action was first taken against Snowdon, the company’s credit risk score dropped to an ‘F’, which means “One or more creditors has initiated legal proceedings or other significant actions in response to unpaid debt obligations, or the entity is entering or has entered insolvency”.

Snowdon Developments maintained a steady credit score over the past three quarters, but quickly plummeted from a score of 510 out of 850 in March to zero by April 2022, “indicating likely failure within the next year”, according to CreditorWatch.

Its payment rating isn’t much better, sitting at a D, with the report warning that it “has high repayment risk” and that “Cash-on-demand trading is recommended”.

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.au

Snowdon is on average 40 days overdue on its payments when the industry average is just seven days.

“Businesses with average arrears of more than 30 days are among the worst 15-20 per cent of payers nationally,” CreditorWatch said.

“Small to medium sized businesses in this category are on average three times the insolvency risk of businesses that pay on time.”

It comes as CreditorWatch has warned that the state of the construction industry is in a “dire” situation.

“Construction has the worst late payment of any industry,” they said in a paper.

“About 12 per cent of construction businesses are more than 60 days in arrears on their payment to suppliers.

“The risk is that construction collapses cascade down, creating a chain reaction of failed businesses. That could have a serious impact on Australia’s economic recovery.”

One creditor news.com.au previously spoke to, Nick Mihajlovic, has been waiting for more than three years for a $480,000 payment from Snowdon for his bricklaying jobs.

Since 2019 he’s been demanding he be paid for the work he did and the materials he sourced for Snowdon.

“I’m financially ruined,” he said. “I’m 67 years of age and I’ve got to keep working … I’ve got to make money, all my debts to pay.”

Michael Hassan’s company MD Demolitions is one of the 15 creditors taking Snowdon to the Supreme Court after waiting for more than a year for $103,000 owed to be paid back.

Mr Hassan, with three young kids to support as well as 30 staff who work for him, has visited Snowdon’s Keilor Park office six times trying to get his money.

“There was no money coming into the account to feed the family or pay off the workers,” he told news.com.au earlier this week.

He is refusing to work for them anymore until his debt is paid.

A third subcontractor who spoke to news.com.au, John*, said he mostly had to wait between 45 and 60 days for Snowdon to pay him since beginning working with them in 2019.

But for the past eight months he’s been waiting for $30,000 owed to him and said that any builder taking longer than 90 days to pay a subcontractor was a “red flag”.

“Then when it starts stretching to 90 days, we stop working for them,” he said.

“We pulled the pin because the signs show us it could be in trouble, jobs sitting unfinished, when you start hearing that, it’s time to stop.”

There have been 765 credit inquiries into Snowdon over the last five years, but 564 of those have come through in the last 12 months.

A mercantile agent — a debt collection agency with a Mercantile Agent Licence — also viewed Snowdon’s credit history. This type of inquiry has left Snowdon with a mark on its credit file.

The mercantile inquiry was lodged on June 20, the same day that news.com.au first revealed Snowdon appeared to be on the edge of disaster.

Casabene Plumbing first initiated legal action against Snowdon in April after the builder did not pay $38,000 owed to them.

The plumbers began winding up proceedings against Snowdon and although the construction company swiftly paid the debt, by then 14 other creditors had joined the case.

Court documents show East West Roofing applied to appear in the hearing because they are owed $936,192, while Home & Industrial Soil Test Pty Ltd wants $685,255 to be paid back.

The Office of State Revenue is owed $262,444.54, Tamar Cabinets wants $174,348 and then MD Demolitions claims it is entitled to $103,096.

Other creditors include Just Metal Roofing, Dahlsens Building Centres, Waco Kwikform Limited, Top Cat Installations, Mitek Australia, Bingo Waste Services, Aria First Homes and On Trax Earth Moving with their money owed ranging from $24,00 to as much as $91,000.

Two individuals are also owed $11,511.83 who joined the case.

Other creditors who have not yet joined the court action include Jumbocorp, claiming Snowdon owes them $54,158.50 in outstanding payments and Specialised Plumbing Drainage Roofing, claiming to be owed $102,398.82.

When added up, out of those creditors, Snowdon owes more than $2.5 million.

Pivot Construction Group, a sister company of Snowdon’s with the same directors and staff and registered to the same location on ASIC files, also has two registered defaults and one court action taken against it.

Wilson Plumbing Bendigo took Pivot to court at the end of May for a $39,000 default judgment hearing.

It’s understood some of the money Snowdon and Pivot owes creditors has already been paid off after they were taken to court, including to the State Revenue Office and Casabene Plumbing.

Ace Fencing & Outdoor Constructions also registered a default payment against Snowdon in August last year but it’s understood their $19,000 debt has been settled.

Bestbar was another creditor chasing Pivot for $111,000 but that money has also been paid.

Snowdon claims other expenses can be paid after July 4 once they have sold a property.

The next hearing for the winding up order is on July 13.

News.com.au has made repeated requests for comment from Snowdon.

Logan*, a current Snowdon employee, said that the company owed substantial sums to at least 50 suppliers who were all now refusing to do business with them.

“There’s a list, it’s an extensive list,” he told news.com.au earlier this week. At least 50 suppliers aren’t completing jobs for Snowdon in the hopes of getting paid, he added.

Snowdon staff are beset by problems on all sides, according to Logan, with his colleagues being accosted by angry creditors or customers.

“We get trucks parked in the car park blocking our cars so we can’t go out because they [the tradies] haven’t been paid,” he explained.

More than 50 per cent of staff have quit in the last few months, with the firm going from 70 employees to just 30 remaining.

Superannuation in particular was one reason for the massive staff exodus, with some staff claiming they haven’t received super payments since October last year in another sign of how much Snowdon is struggling financially.

Logan, who has worked at the company for a number of years, said staff learnt several months ago that they were not receiving the money supposed to be going into their superannuation.

Although it appeared super was being deposited according to their pay slips, one staff member went into their superannuation fund and realised no money was being put in. They then alerted the others.

“Then we asked [the company and it] confirmed that no super was being paid. And then nothing much has been said about it since,” Logan said.

News.com.au has sighted a document which confirms Logan has not received a super contribution from his employer since October.

Australia’s building industry is in crisis, with many companies going into liquidation so far this year amid rising costs for construction materials and ongoing supply chain issues, putting them out of business.

Two major Australian construction companies, Gold Coast-based Condev and industry giant Probuild, already went into liquidation earlier this year.

Smaller operators like Hotondo Homes Hobart and Perth firms Home Innovation Builders and New Sensation Homes, as well as Sydney-based firm Next have also collapsed.

At the end of last month, two firms from Queensland collapsed just days apart, Pivotal Homes and Solido Builders.

And last Friday, news.com.au reported on Victorian building firm Waterford Homes appointing liquidators.

An industry insider told news.com.au earlier this year that half of Australia’s building companies are on the brink of collapse as they trade insolvent.

There are between 10,000 to 12,000 residential building companies in Australia undertaking new homes or large renovation projects, a figure estimated by the Association of Professional Builders.

*Names withheld over privacy concerns

alex.turner-cohen@news.com.au