Collapsed Melbourne pool company owes $146k to customers after going under

Another swimming pool company has collapsed this month, leaving customers thousands of dollars out of pocket and with holes in their backyards.

Residents in Victoria have been left with a gaping, muddy hole in their backyard after another pool company collapsed earlier this month.

Bannockburn-based swimming pool manufacturer Pools and Spas Pty Ltd in the state’s outer southeastern suburbs, entered external administration on June 9, eight days after another Melbourne company, Pools R Us, went bust.

Also known as its trade name Dreamtime Pools and Spas, an initial report by liquidator Malcolm Howell from insolvency firm Jirsch Sutherland, shows more than 130 creditors have been impacted by the company’s collapse.

However, according to the Geelong Advertiser, the company’s director Doug Constable says he has not engaged in any wrongdoing, rather alleging a campaign of “innuendo and half truths” has been set up against him.

Documents seen by news.com.au shows the company owes thousands of dollars to its staff, customers and suppliers.

According to a seven-page liquidator report, Pools and Spas Pty Ltd, owes its 15 staff a projected total of $139,883 in superannuation, redundancy and annual leave payments.

Meanwhile a long list of unsecured creditors - which it’s understood includes both customers and suppliers - are owed a projected amount of about $146,562 .

A second document titled “Report on Company Activities and Property”, shows a number of fence installation jobs were in the works just days before the company entered external administration, with at least five due in the fortnight prior to Pools and Spas shutting its doors.

Mr Constable says the liquidation of his company came as a surprise to him.

“It was devastating, particularly in the current economic climate, to have to firstly tell the staff they no longer had jobs, and the realisation that we would not be able complete our commitments,” Mr Constable told the Geelong Advertiser.

Mr Constable, who is also a “pre-insolvency advisor” describes himself as a “conductor” who helps “clients orchestrate a smoother financial transition”.

He is also the author of the book What to do When You Can’t Pay Your Debts, which explores personal bankruptcy and company insolvency, according to his website.

“This is the first book of its kind in Australia, because it does not focus on the legal and financial rules and laws but focuses on the individual,” an ‘about’ section on the book explains.

“It’s a guide book if you like, to help you avoid financial calamities. And, if they aren’t avoidable, how to minimise the damage they can do to your emotional health, your relationships and your attitude to the future.”

It is not suggested that Mr Constable is facing any financial problems in his personal capacity.

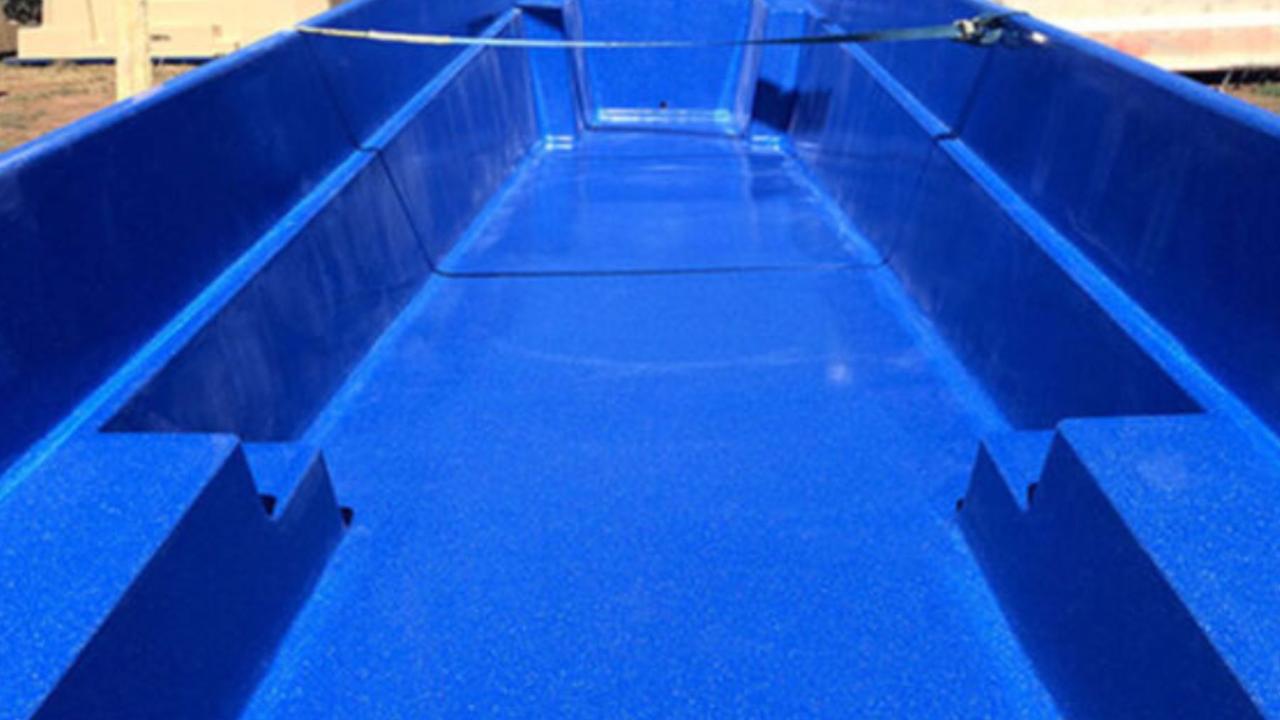

Dreamtime Pools and Spas emerged during the pandemic, which Mr Constable claimed had rapidly flourished with two to three orders coming through each week.

The businessman also added the company had installed at least 200 pools since it was founded.

“However, over the past six to 12 months there has been a concerted media and social media campaign, staff shortages, supply delays, material cost blowouts and logistics costs,” he said.

Currently, there appears to be little sign the company has collapsed, with its website still online and displays an option to apply for a quote.

However, the company’s social media presence tells a different story, with the last Facebook post dated in December last year.

Meanwhile, in Facebook group Pool Owners Australia, several customers alleging thy’ve been impacted by the collapse have shared their experience with the company, with many left thousands of dollars in debt.

News.com.au has contacted a couple of these customers for comment on their experience.

Despite these claims, Mr Constable told the Geelong Advertiser “many deposits” had been refunded by the company.

“We have refunded many deposits where clients have genuine changes in economic or personal circumstances,” he said.

“What has eventuated now is clients cancelling through innuendo and half truths on social media.

“These clients have signed a contract and we in good faith have expended time, staff and work to proceed with honouring our part of the contract – surely they are not entitled to a full refund just because they change their mind because of a largely false media campaign.”

News.com.au has contacted Mr Constable for comment.