Collapsed builder owing $5.6m could possibly be saved

A collapsed building company that left behind a trail of hundreds of creditors could soon be saved.

A collapsed building company that left behind a trail of hundreds of creditors could soon be saved.

In February, Cubitt’s Granny Flats and Home Extensions announced that it had made the “devastating decision” to put itself into voluntary administration.

Most of its 80 staff were stood down immediately while 120 projects across NSW and the ACT were impacted.

The bust construction firm has $5.6 million in liabilities, and $2.6 million of that is owed to 77 tradies.

But over the weekend, appointed administrators Richard Stone and Brett Lord of insolvency firm RSM Australia, indicated that its future is “looking brighter”.

The administrators have been urgently seeking a buyer and recently their search has borne fruit. They said that 40 people had submitted expressions of interest to buy the company and of that, 12 applications have progressed to a formal intent to purchase.

“It’s an encouraging development, but it’s still early days,” Mr Stone said.

The directors of Cubitt’s are also planning to put forward a deed of company arrangement or DOCA to take back control of the company and pay back a fraction of the debt.

Administrators said they were keeping their options open to either possibility but said they believed the DOCA was a better return for creditors.

The next creditors meeting is being held this Wednesday April 10.

According to the administrators’ initial investigations, the company has $1.67 million in assets.

That includes has four display homes in Sydney, Newcastle, Wollongong and Canberra, which have been locked up.

In 1994, Ian Cubitt launched his eponymous business and said he had trained 120 carpenters between then and now through working with his business.

Cubitt’s said it was unable to continue because of the economic downturn flattening builders across the country.

“Due to bank lending conditions, supply prices, taxation changes, insurance prices, Covid recovery and lengthy weather events, Cubitt’s company has suffered more than it can shoulder,” the company said.

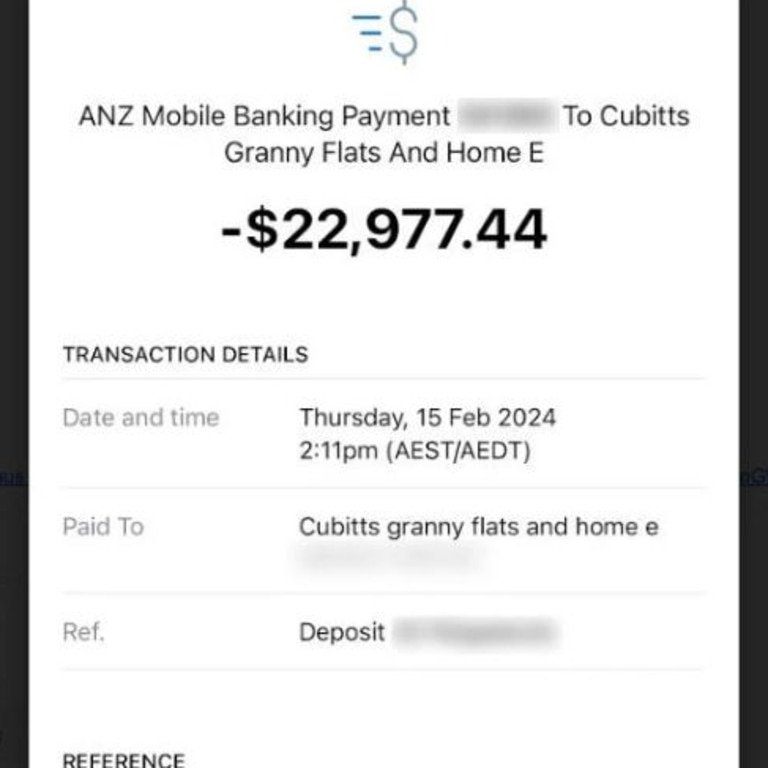

News.com.au previously reported on a customer who was left absolutely floored to learn of the collapse of Cubitt’s, as just 12 days earlier they had forked out a $23,000 deposit.

Vince*, who did not want to share his last name, and his wife Katherine, 49, were toying with the idea of building a granny flat in their backyard as another stream of income.

After months of umming and ahhing and back and forth with their preferred builder, Cubitt’s, the Sydney couple finally transferred a $23,000 deposit to the business.

But less than two weeks later, the business went under.

Vince, a dad of three, has now been left wondering how the business was able to take his money at such a late stage if the company had known it was in financial strife.

“It came as a shock,” he told news.com.au. Based on his interactions with staff, he said it appeared to have been a surprise to them, too.

Vince said he only found out about the collapse of Cubitt’s because site surveyors were supposed to visit his backyard this Tuesday, the same day the builder went into external administration.

He said the surveyors called him before they arrived asking if he’d be willing to pay them directly.

When he asked why, they said it was because Cubitt’s had gone under.

“We looked at their display homes, we were excited, we were trying to provide a future for our kids,” he said. “Now we’re just hit with this.”