Nearly 1000 less apartments were approved in 12 months

An undersupply of apartments will cause a worrying trend for affordability once again, a property group has warned.

A property group is calling on the NSW Government to manage the dramatic fall in apartments being approved for construction, saying an undersupply of homes will result in property prices again rising aggressively by the end of the year.

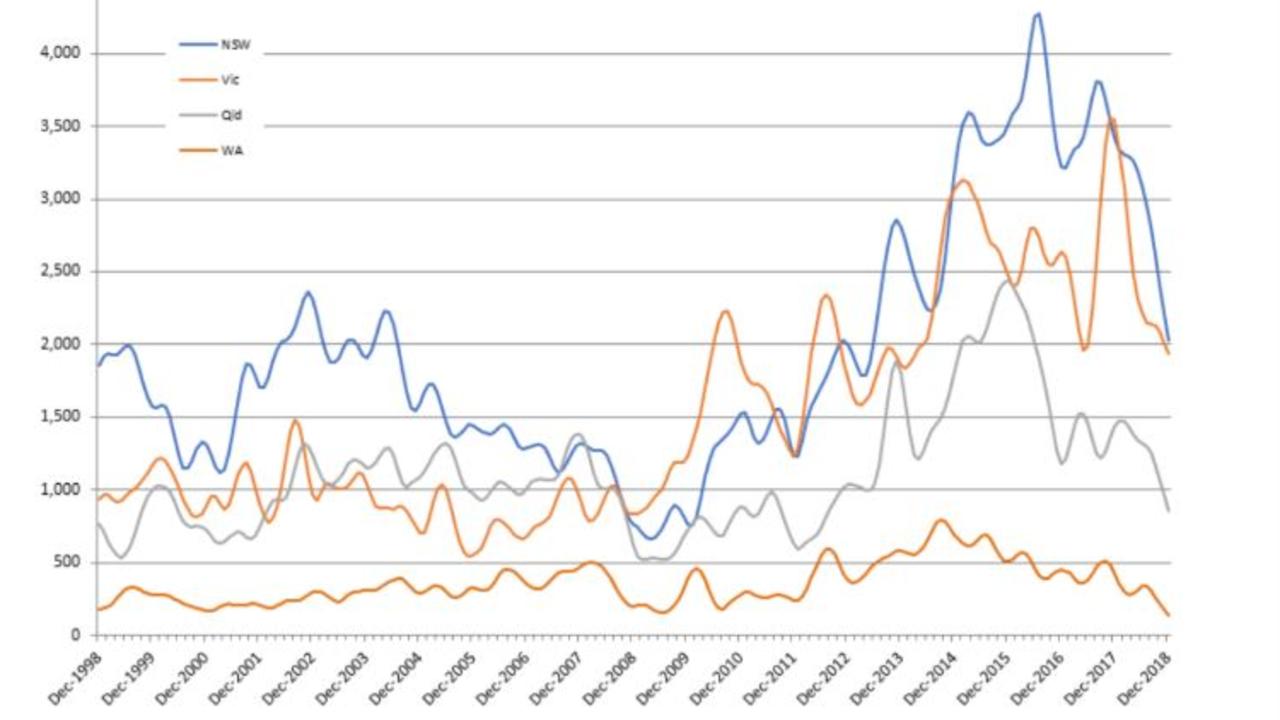

Apartments being approved in Sydney fell 33 per cent in 12 months, nearly 1000 less from December 2017 to December 2018.

Tighter lending restrictions being imposed on both borrowers and developers as a result of the banking royal commission has contributed to the fall, but Urban Taskforce chief executive Chris Johnson said negative sentiment towards construction from both sides of state government had also hindered developments.

He said less interest from onshore and offshore Chinese buyers was also a major factor.

“There needs to be more management by government to make sure we’ve got a more even approach to the supply of new homes, which then keeps a lid on the dramatic increases in price and equally the dramatic drops in price,” he told news.com.au.

“Because there won’t have been enough supply for a long time, the number of approvals won’t be there.

“The supply chain will be going up, and therefore there won’t be enough new homes on the market for the population growth, so prices will go back up again.

“Whoever wins the state government election in March should look to implement new housing policies to encourage the supply of homes and ensure that jobs and investment in the property sector is maintained.”

But CoreLogic head of research Cameron Kusher said dwelling approvals had been above long-term averages for a number of years, and developers were seeking fewer approvals because the property market had turned.

“There are a number of reasons for this: prices are falling so there is less certainty on determining a price for a property that doesn’t yet exist, particularly new units,” he said.

“If there is less demand, which there is, it is more difficult for developers to sell sufficient (homes) before construction commences in order to secure finance.

“And, finally, laws have changed whereby only 50 per cent of a new apartment project can be sold offshore, so new developments have to be more reliant on local buyers than they were in the recent past.”

Mr Kusher said the decrease in projects being approved was more a reflection of the changing market cycle but agreed an undersupply would eventually drive prices back up.

“It means there will be less new housing stock,” he said

“Over time it will create a shortage of new housing stock and eventually trigger a new wave of development, but that will occur further down the track.”

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au