‘Long, cold road’: Grim sign ‘iron ore Ice Age’ is coming as China crash hits

Australia has spent 25 years riding its China luck – but that is all about to come crashing down as a terrifying “iron ore Ice Age” looms.

Australia has spent 25 years riding its China luck, but that is about to end.

This week, China’s largest steelmaker, Baowu Group, which is responsible for 7 per cent of global steel production, declared that its business is entering a “harsh winter”.

Baowu noted that Chinese steel demand will fall for a long time as its real estate bust continues and that its steel exports will come under intensifying pressure worldwide via tariffs.

To this, we can add pressure to decarbonise, which will shift demand from iron ore-fed pig iron to scrap steel-fed recycling.

A long, cold road

At the centre of the unfolding iron ore crash is Chinese real estate.

For 25 years, Chinese urbanisation has demanded steel and iron ore. But that dream is over.

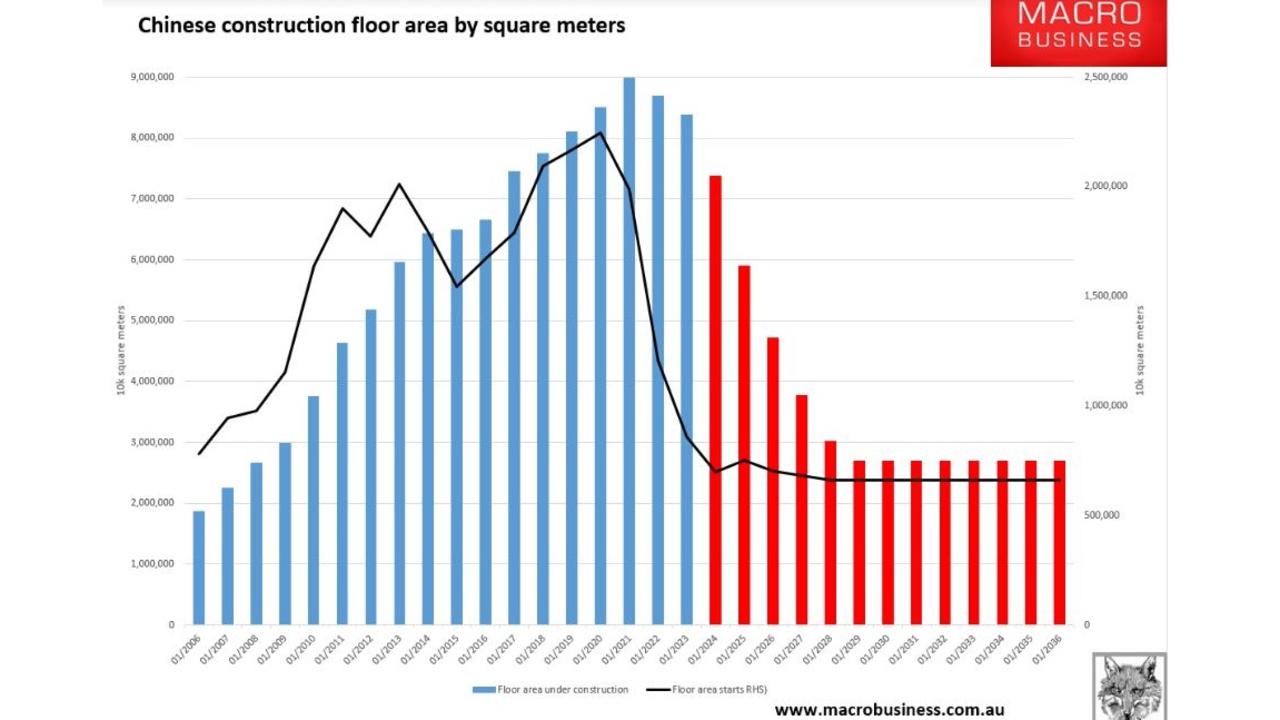

New Chinese property construction is down by nearly three-quarters. Existing Chinese construction is down only 13 per cent. These two must meet and will meet over the next few years, meaning much lower demand for construction inputs.

Unlike previous busts in Chinese steel, such as in 2008 and 2015, there is no prospect of Beijing delivering property stimulus.

The urbanisation story in China is over. There are still tens of millions to shift to cities from the country, but the property needed is already built or in the pipeline.

Meanwhile, 50 million apartments have been purchased but have yet to be built, while another 60 million are vacant.

Beijing knows this and has taken steps to prevent the oversupply from becoming far worse by curtailing credit in the property sector.

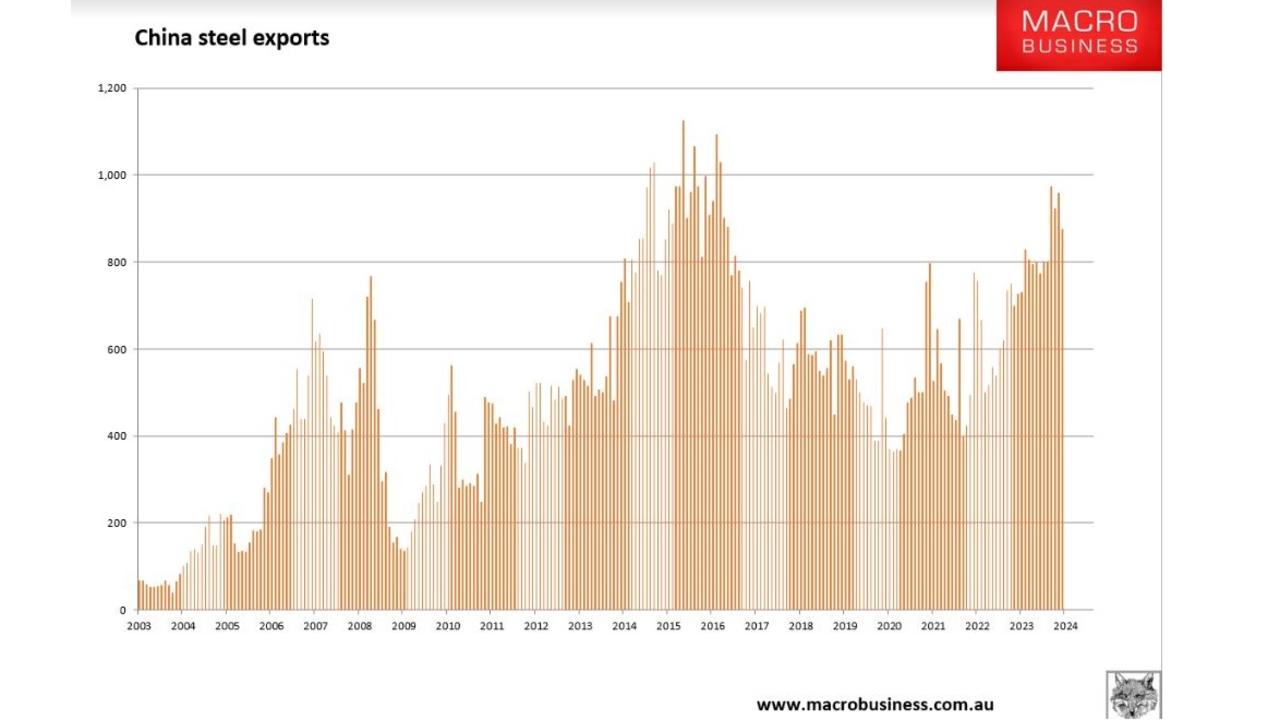

Second, over the past few years, the biggest pressure release valve for Chinese steel has been exports of excess steel production.

But these volumes are coming under intense geopolitical pressure as local steelmakers worldwide push back against the tsunami of cheap Chinese steel.

Areas as diverse as the United States, Europe, Brazil and Turkey are all moving to impose harsh sanctions on Chinese steel dumping.

As the outlet is cut off, Chinese steel makers will keep dropping prices to compete, and the entire steel and iron ore complex will deflate into a morass of excess output.

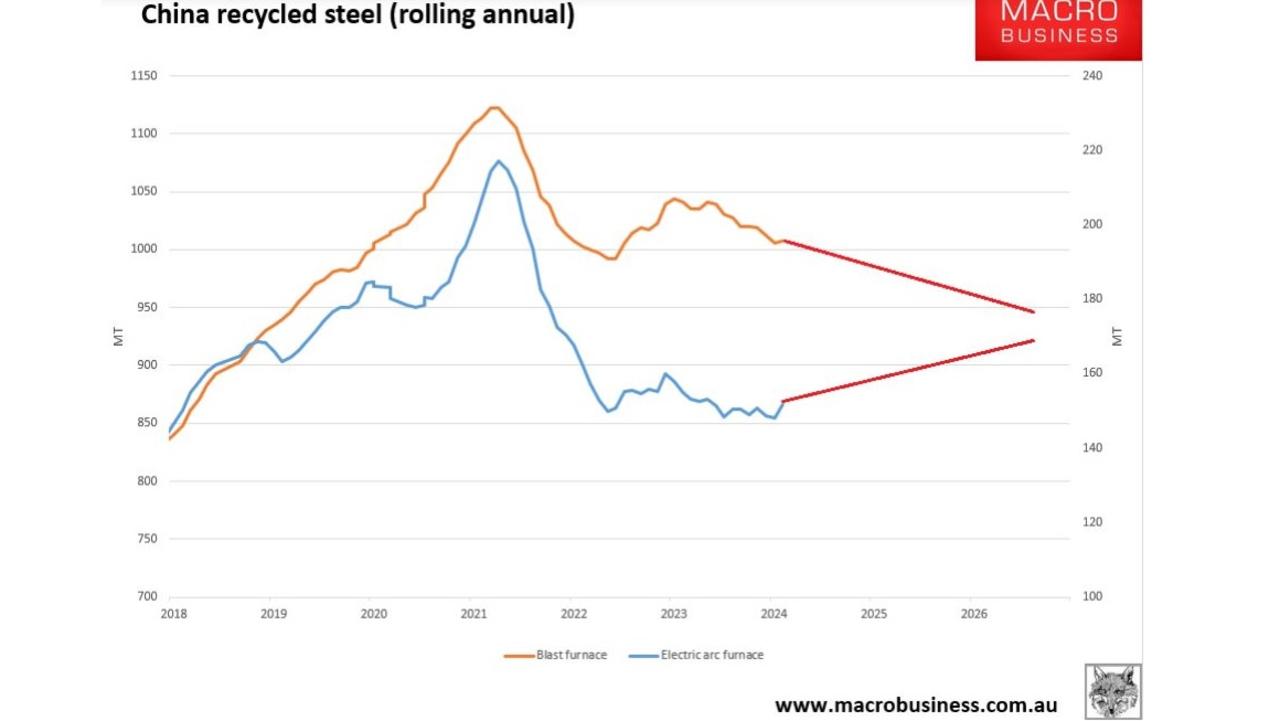

Third, China and other countries are moving to decarbonise the steelmaking process. If steelmaking were a country, it would be the fourth largest carbon emitter in the world.

Focusing on China, the plan is to lift steel recycling through 2025 and each tonne that shifts from blast furnaces to electric arc furnaces displaces 1.6 million tonnes of benchmark iron ore.

Mad rush of supply

As usually happens in commodity cycles, miners have completely misjudged demand.

Instead of preparing for the Iron Ore Ice age, they have been madly investing in expanded output from Brazil to Africa to the Pilbara.

The poster child of this supply rush is Rio Tinto.

It currently has a large expansion project underway in the Pilbara for 25 million tonnes, ironically in conjunction with Baowu.

Then, next year, it helps bring to market Simandou, the most spectacularly mistimed supply expansion in the history of commodities, in which 120 million tonnes of premium African iron ore lands upon rapidly diminishing demand.

Adding other expansions, including from Brazil, as demand shrinks while supply expands, more than 300 million tonnes of seaborne iron ore will have to be rationalised from the market.

We have seen this before

After the great Japanese catch-up boom of the 1970s and 1980s, which was also fed by Aussie iron ore, our wondrous bulk commodity fell for almost an entire decade to lows around $20.

This analogy is pertinent today.

Like Japan, China relied overly on urbanisation and exports for its growth.

When it ran out of people to build for and countries to export to, its growth model collapsed into 20 years of deflation.

China is the new Japan and the Iron Ore Ice Age has begun.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.