Gold rally hits fever pitch as price could reach $US6,000 an ounce

The precious metal could double in price as central banks continue to cut interest rates.

Gold has smashed the returns of the stock market so far in 2024, with experts predicting the price still has plenty to run.

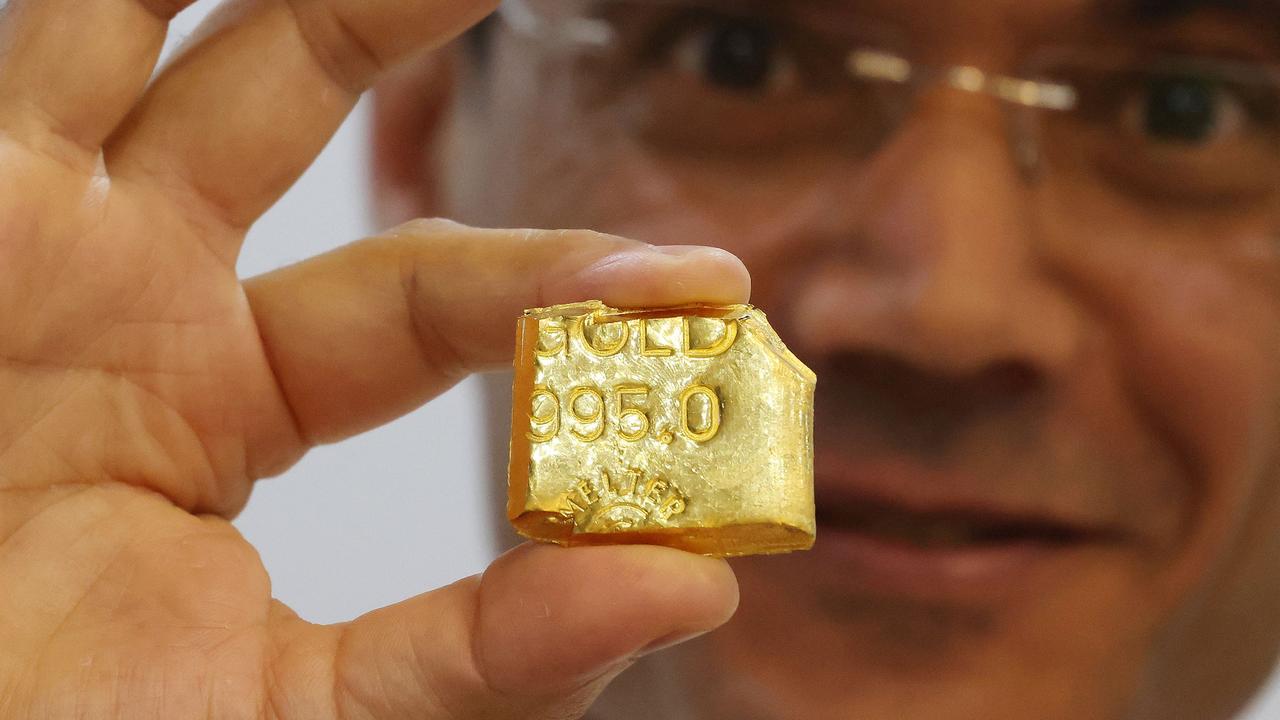

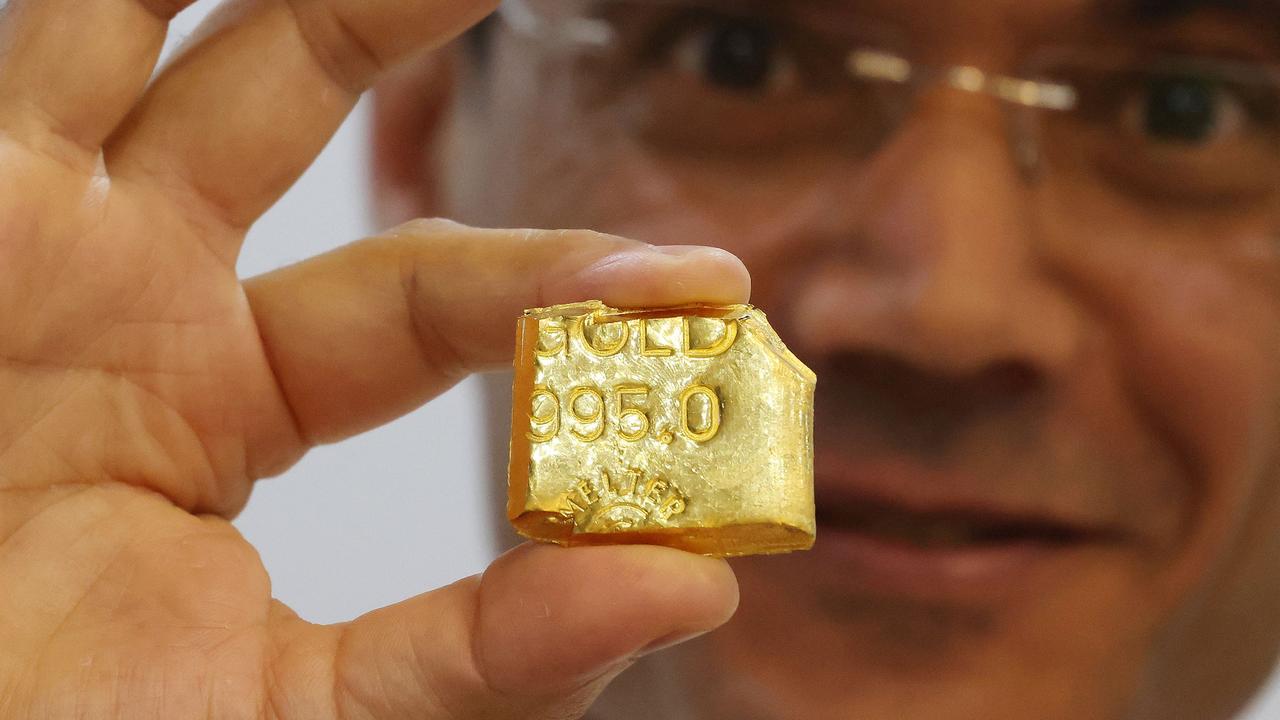

Gold bullion (or bricks of the precious metals) surged again this week, up to $US2,700 ($AU4,070) per ounce last week for the first time and is now up 31 per cent since January.

“There is a reality where gold could be reaching $US6,000 an ounce if history repeats itself.

While history doesn’t repeat, it does rhyme,” Moomoo’s market analyst Jessica Amir said to NewsWire.

According to the experts, the price of gold is rallying off the back of a number of factors, most telling the US cutting interest rates.

Ms Amir said the price of gold has an inverse relationship to the US dollar, meaning when rates are cut, the price of gold usually rallies higher.

“The last three times the Fed (US Federal Reserve) cut interest rates, gold rallied on average 100 per cent from the beginning of the rate cut cycle to gold’s new record all-time high”, she said.

“There’s a concern that regardless of who wins the US election, they are going to pump stimulus into the US economy, which will cause US debt to rise and could cause a credit crunch. Every time there are credit concerns globally, we see gold do well.

Meanwhile, Kinesis senior metals analyst Frank Watson believes the price of gold has plenty of support.

“Something of a ‘perfect storm’ has emerged in recent weeks for precious metals as lower borrowing costs combined with safe-haven flows amid uncertainties over conflict in the Middle East and the upcoming US election on November 5,” Mr Watson wrote in an investment note.

Ms Amir said retail and institutional investors are starting to put gold into their portfolio as they “wake up to the price of gold rallying, and there’s nothing like a higher price to fuel more momentum.”

“This is the real game changer, the last couple of times the Fed cut interest rates gold didn’t begin to really take off until the institutional flows picked up because that is what drives the sustained move.

AMP deputy chief economist said the gold price rally continues to be supported as investors move from one concern to the next.

“The rally in gold has been phenomenal. Over the past two years, it was initially an inflation hedge, now it’s a hedge against lower interest rates, geopolitical risk and central bank denominated currencies,” she said.

“It is an additional asset that is independent of all those central bank movements.”

In the meantime, IG London’s chief market analyst Chris Beauchamp thinks ​the current rush for investors to buy the precious metal “shows no sign reversing course”.

He did express some caution though, as investors profit take.

”A close below $US2,685, the September high, might trigger some short-term weakness.”