China and extraction costs are impacting iron ore price fall

The price of this valuable Aussie resource has plummeted by 42 per cent and there are signs of more uncertainty ahead.

Markets discounted a fall in iron ore prices for much of 2021 by refusing to lift the value of mining equities.

Now that the iron ore price has been smashed by 42 per cent, Australian miners are generally faring much better than the underlying price, suggesting that we are somewhere near the bottom for iron ore.

Is the market still right? Very likely not. There are three parts to the problem.

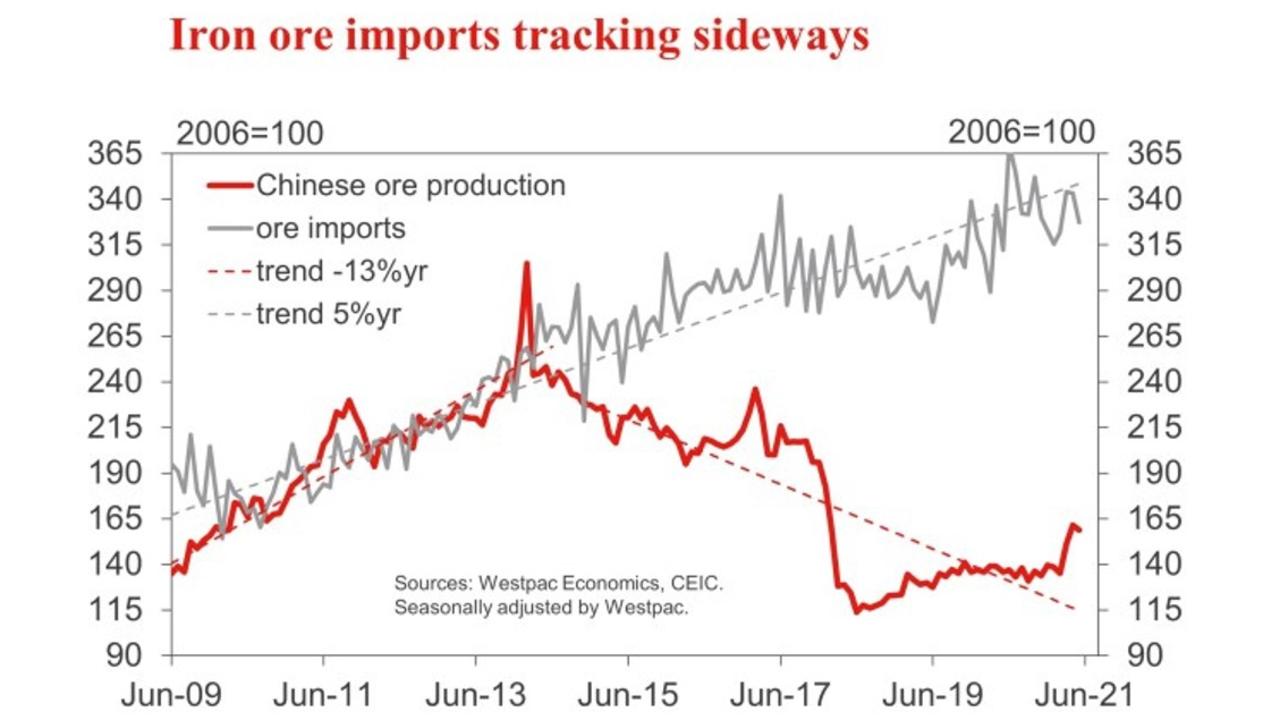

We know why the iron ore price is being belted. Chinese consumption of steel is slowing very fast as its property development market goes bust. There is little sign that this is about to end and demand from this segment will fall materially further.

Given Chinese empty apartment construction constitutes nearly half of Chinese steel demand (and therefore about one-third of global seaborne demand for iron ore), weakness in this market is all that matters.

Secondly, this weakening demand is being jammed upstream into raw materials prices more quickly than usual by mandated steel production cuts in China. There is no end in sight to this policy, either.

Thirdly, despite a grand pretence by major global miners, iron ore supply is rising short and long-term, and will continue to do so for many years to come.

The conclusion, then, is that there is too much iron ore. The market has swung to a glut and excess production must be cleared.

The last four months of Chinese new property under construction is down 10 per cent year on year and getting worse. This scale of downdraft would equal a drop in steel output of 45 megatonne and roughly 70 megatonne less iron ore in the year ahead.

Added supply over the next year is 60 megatonne so there’s a big swing to surplus in the range of 130 megatonne.

When these kinds of conditions prevail in commodity markets, the outcome is easy to predict. The price must fall to the highest marginal cost producer in the Chinese and seaborne markets. That is, the most expensive producer of iron ore must be rendered uneconomic to stop its output and reduce supply, and in the process, stabilise prices.

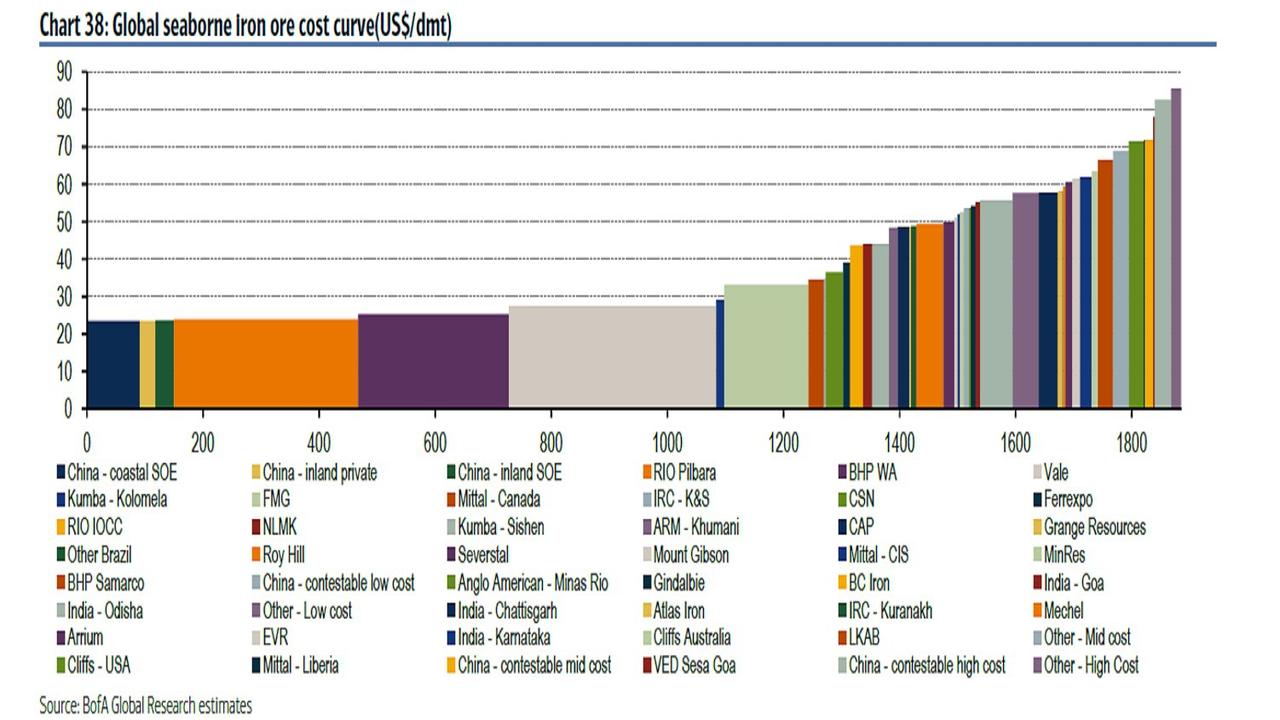

We can estimate this marginal cost price of seaborne iron ore by looking at what is called the mining cost curve, which measures the relative price of extraction for everybody in the market.

As you can see, there is nobody that produces seaborne iron ore for more than $90 per tonne. So to knock the most expensive supply out of the market we’ll need a price of $80. To knock out $100 megatonne, the price will need to be more like $60.

There is also Chinese iron ore to consider. It is expensive and poor quality so it will be knocked out by cheaper imports in any glut as well. But there’s simply not that much of it. China could knock out perhaps 40 megatonne of production if it wanted to.

So that may slow the price descent a little, but it’s unlikely to be enough.

There is another factor to consider too. As prices rise, so do extraction costs as royalties, taxes and expansions lift. When prices sink, these costs drop so the cost curve starts to fall as well. That is, the process is pro-cyclical so that means more downside.

Price will continue to fall

The iron ore price is likely to keep falling for many months yet. And China appears to be determined to push it forward at all speed.

My best guess is we’re going to see $100 before this year is over and $60 in 2022.

If Beijing doesn’t rescue its property development market with stimulus at all this time (which is a big “if” given its GDP growth fall away to 4 per cent and below) then all bets are off for bowel-shaking iron ore lows.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.