Bad news for Australia: Iron ore plunges below $US50, budget facing $3 billion writedown

AUSTRALIA’S economy could be in for another massive blow, with the news that we’re about to lose billions of dollars. Here’s why everyone is worried.

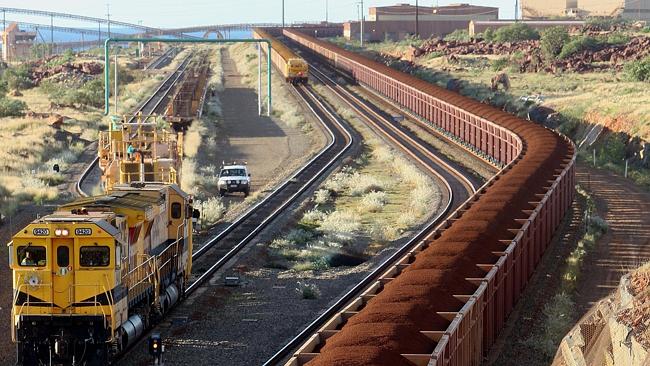

IRON ore has fallen below $US50 a tonne, extending a run of losses that began a week ago.

Iron ore for immediate delivery to the port of Tianjin in China fell to $US49 a tonne, from $US51, while iron ore at the port of Qingdao was $US49.53.

The world’s fourth-largest iron ore miner, Australia’s Fortescue Metals Group, could be losing money at those prices, with its iron ore earning less than that benchmark figure.

Losses for smaller junior miners will also increase.

It is the lowest price in nearly a decade and compares to the record $US185-plus reached by the steelmaking commodity, Australia’s most valuable export, during 2011.

Deloitte Access Economics director Chris Richardson told The Australian that if the iron ore price plunge was sustained, revenue could be up to $3 billion lower in 2015-16 than forecast by the government in its midyear budget update in December.

“What we’re now seeing is that commodity prices around the world are going back to normal,” Mr Richardson said. “That is a big problem for Australia. It’s an old mistake to assume that a boom is permanent. In this particular case it was a very large boom and both sides of politics spent a lot.”

The price plunge is due to a combination of the world’s largest miners such as Rio Tinto and BHP Billiton flooding the market with supply as demand from China’s steel producers has fallen.

Fortescue chairman Andrew Forrest, who controversially called for a cap on production last week, has again criticised those iron ore majors, saying they were incinerating shareholder value, Fairfax Media’s Australian Financial Review reported.

Commodity forecasters say the price will get worse before it improves, with Deutsche Bank predicting a fall to $US40.

The falls have sparked speculation the Reserve Bank of Australia will cut interest rates again next week to boost the economy.