Australian iron ore earnings to fall almost $40 billion by 2026 - with nickel and lithium also taking a battering

New forecasts show Australia’s resources and energy sector earnings are set to plummet, as a dire consequence of EV sales emerges.

Australia’s iron ore exports are projected to fall by almost $40 billion over the next two years, with a global slow down on EV sales expected to hit the price of nickel and lithium.

The official resources and energy quarterly has revised the sector’s earnings would fall to $372 billion at the end of June 2025, and again to $354 billion in the following 12 months.

That includes a projection of iron ore export revenue falling from $138 billion last year to $99 billion by June 2026.

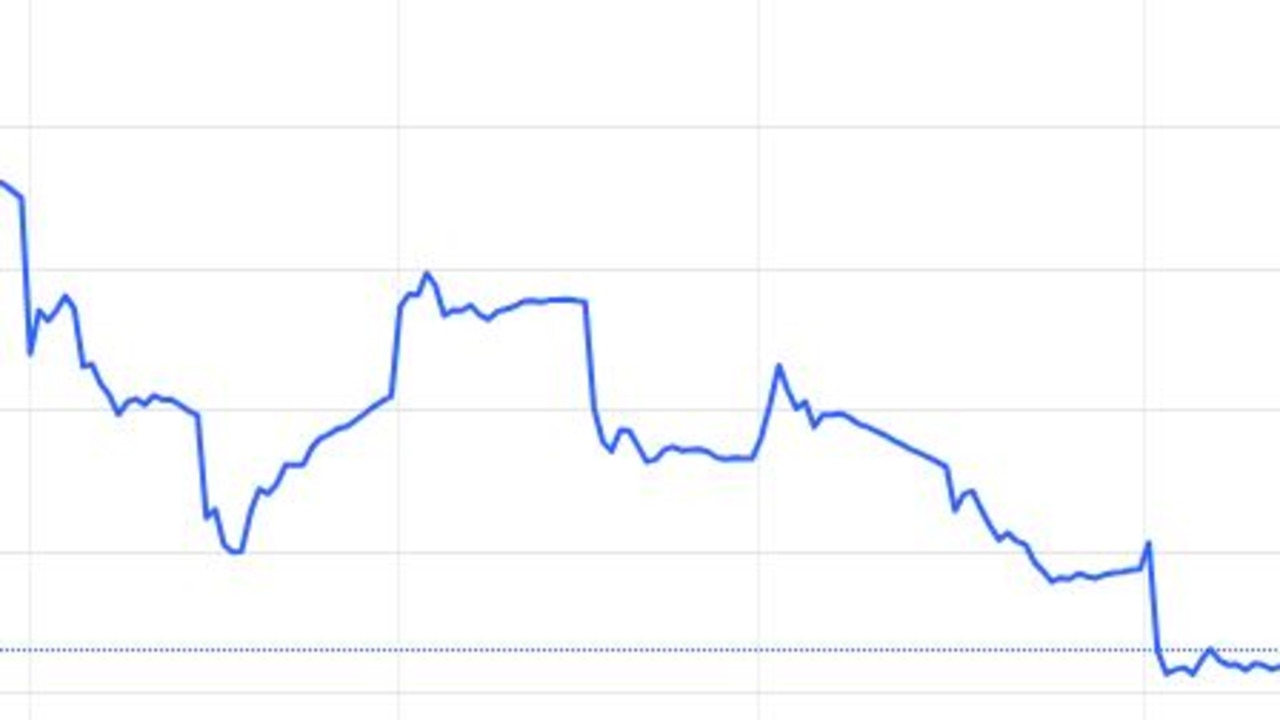

The Department of Resources’ September report says continued “volatility” in iron ore prices saw it fall to two-year lows in August, leaving it down by a third since the start of 2024.

“The falls reflect weakening steel demand in China, strong growth in iron ore supply and high stockpiles,” it found.

The department said Australia’s resource and energy commodity exports had worsened since its last report in June, but it was hoped the world’s economy could improve in 2025 and 2026.

“The gold price has hit a new record high, but iron ore prices have declined as the Chinese property sector remains weak,” the report states.

“Nickel and lithium prices remain weak.”

Treasurer Jim Chalmers is expected to announce a budget surplus of $15.8 billion on Monday, just six weeks after warning the iron ore price plunge could reduce tax receipts by $3 billion.

“Softness in the Chinese economy and the recent fall in iron ore prices are another reminder that we are not immune from volatility and uncertainty in the global economy,” Dr Chalmers said in August.

“This is exactly why we take such a cautious and conservative approach to treasury’s forecasts for resource prices and revenue.”

The resource department’s report also predicts nickel prices to drop alongside slowing EV sales “and improvements in nickel-free chemistries”.

“World demand for nickel remained robust in the June quarter 2024, however weakness in stainless steel production and EV sales means growth may slow for the rest of the year,” the report states,” it states.

“Global EV sales growth is forecast to slow to 17 per cent in 2024, compared to an average of 46 per cent a year between 2018 and 2023.

“EV adoption faces challenges from rising trade barriers and supply chain concerns in an environment of ongoing geostrategic competition.

“The required reorientation in supply chains is likely to slow EV cost declines in major vehicle markets around the world.”

It said EV sales growth is predicted to recover to around 25 per cent in 2025 and 2026.

There has been some uncertainty surrounding the EV industry in recent days with news the US was exploring a ban on Chinese models due to national security concerns.

Australia is the world’s biggest exporter of iron ore but economic factors including the poor health of China’s economy has hit the sector hard.

A report from the Institute for Energy Economics and Financial Analysis in July warned the global steel industry is also undergoing a fundamental shift.

“Simply digging and shipping has worked very well for Australia in recent decades,” the report reads.

“(But) a revenue hit is approaching for Australia’s biggest export, and there is growing international competition in the high-grade ore and green iron space.

“Australia needs to seriously consider, and plan for, what its iron ore sector needs to look like from the next decade onwards.”

Nickel operations in Indonesia have also provided a surge in global supply for the mineral, forcing some Australian mines to shut.

Mining analyst Tim Treadgold told the ABC in July he could not see the industry recovering from BHP’s decision to close its Kwinana nickel mines and refineries in WA this year.

“This is very close to being the death knell,” he said.

“It has a degree of inevitability to it … and it’s just such a shame for all those people are going to lose their jobs.”

Mr Treadgold said the supply of cheaper Indonesian nickel had seen the price go from $50,000 a tonne to $17,000 a tonne in the space of a few years.

Resources Minister Madeleine King said the department’s report had predicting a higher demand for resources essential for low-emissions technologies such as copper, aluminium and lithium.

“Despite reductions in some bulk commodity prices, there have been record gold prices and ongoing gains in iron ore export volumes,” she said.

“The resources and energy sector continues to underpin Australia’s economy and support more than a quarter of a million direct jobs.”