Melissa Caddick disappearance: Strategy to allegedly con friends out of millions

Melissa Caddick was living the high-life before she caught the eye of cops for allegedly stealing millions from her friends – this is how she did it.

Melissa Caddick allegedly spent the better part of a decade duping her close friends and family out of millions of dollars, in order to maintain her high-flying lifestyle.

Ms Caddick, who disappeared from her $7.25 million Dover Heights mansion on November 12, had allegedly spent years running a Ponzi-style scheme through her finance business Maliver Pty Ltd.

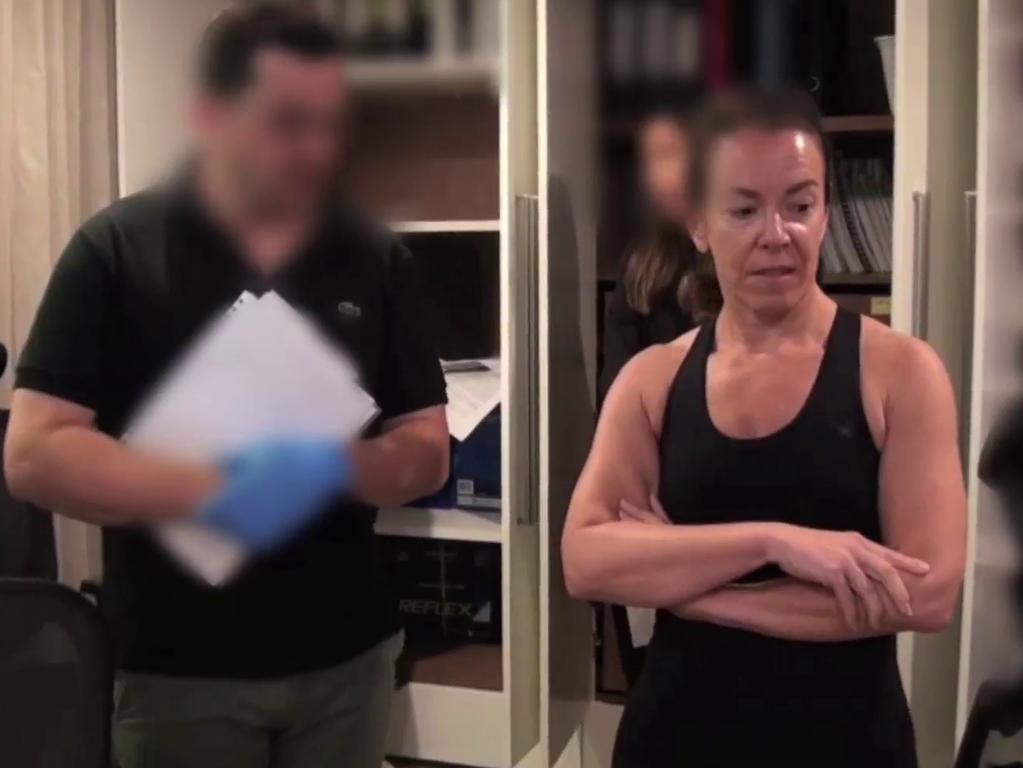

The alleged con came to an end on the night of November 11 last year, when investigators from the Australian Securities and Investments Commission raided her Sydney home, ordered her to hand in her passport the next morning and informed her all her assets would be frozen.

Leaked documents, obtained by news.com.au, detail exactly how investors were duped into giving their hard-earned money to Ms Caddick.

Each of the investors happily gave their money following a “strong personal recommendation from people they trusted”.

All of her investors – that helped Ms Caddick eventually amass a $20 million fortune – were long standing friends of Ms Caddick or her family members.

In almost all cases of those who chose to invest, their relationship with Ms Caddick or a family member had spanned for more than 20 years.

And in a further tragic twist, often the person who made the recommendation to invest had already been unwittingly sucked in.

Over the years, no red flags with Ms Caddick or her business were ever raised.

Any investor who wanted to withdraw their funds had done so with ease, and on repeated occasions.

The withdrawal requests were typically actioned overnight.

RELATED: Charges against suspected conwoman ‘weeks’ away

RELATED: Suspected conwoman spent years ‘living large’ on investor funds

The sophistication of the alleged con even saw some of Ms Caddick’s former finance colleagues investing in the business.

In a few cases, investors were former work colleagues, who had known her for decades and had personally witnessed Ms Caddick jump from success to success as a financial planner.

Ms Caddick was also allegedly piggybacking off a former colleague’s valid Australian Financial Services License (AFSL).

In order to conduct the financial activities she was doing, Ms Caddick needed to hold a valid AFSL.

Ms Caddick’s documentation to investors was meticulous, showing a valid AFSL, however the license was not hers.

A check on the ASIC website showed the license was valid.

While the person whose license Ms Caddick was using denies knowing or giving permission for her to use the license, the two former colleagues did allegedly maintain a working relationship through the referral of clients needing insurance brokering services.

The only way investors would’ve been able to uncover Ms Caddick was allegedly using someone else’s AFSL license would’ve been for the investor to directly contact the holder and ask if Ms Caddick was in fact validly working under a different license.

The huge step is not something lawyers believe many, if any, investors would’ve taken.

Investors also took solace in investing their money in Ms Caddick due to her apparent link to a big four bank, those being Westpac, Commonwealth, NAB and ANZ.

Ms Caddick allegedly gave her investors extensive documentation that appeared to be original documents issued by one of the big four banks and showing a link to its well-known and trusted share trading platform.

Some investors were even given internet log-ins that allowed them to review their share trading information online.

However, investigations have now allegedly uncovered all of the information linked to the big four bank, including investors’ ability to log-in and see their shares, was completely fabricated.

In order to uncover the alleged fabrication, investors would’ve had to have called the bank, the share trading organisation and their share registries to verify all of the apparently legitimate documentation.

Investors’ trust in Ms Caddick, built on their years of personal friendship or family relationships, meant most of them did not take these steps.

The uncovering of the alleged con has also caused investors a years’ long headache.

Based on the financial information given to them by Ms Caddick, investors, for many years, lodged their tax returns and paid taxes as appropriate.

The investors must now take massive steps to unwind their many years of lodged tax returns.

To make matters worse, Ms Caddick allegedly produced detailed monthly reports, on time, every time, that perfectly reconciled with the original share trading documentation she’d given to investors.

The monthly reports were meticulously maintained, mirroring share prices listed on the Australian Stock Exchange and included share statements and certificates and dividend statements.

To verify if these documents were completely correct, investors would’ve had to contact several share trading organisations and registries.

In the final tragic twist, investors would’ve likely made impressive returns on their savings, if Ms Caddick had made the investments legitimately.

In one example, an investor was told Ms Caddick had purchased them shares in Afterpay on November 21, 2018 for $10.63.

Shares in Afterpay are now worth $148.87.

And another investor, who believed Ms Caddick had bought them shares in JB Hi-Fi on October 7, 2014 at a price of $14.92, would’ve seen a 246 per cent return on their investment.

Shares in JB Hi-Fi are now worth $51.59, according to the Australian Stock Exchange.

To add to the pain of the alleged con, investors are now being forced to pay for their own legal fees, to try and recoup a portion of their lost funds, while also supporting the dependants of Ms Caddick.

Police are still hunting for Ms Caddick, with the alleged conwoman almost notching up three months on the run.

Her husband Anthony Koletti is continuing to live in the family’s Dover Heights mansion while her brother Adam Grimley attends court, after he was given power of attorney.

There is no suggestion either of them knew or had any involvement in Ms Caddick’s alleged crimes.

Dominic Calabria, a partner at Bridges Lawyers, who is representing a number of victims that trusted Ms Caddick with their savings, earlier told The Sydney Morning Herald it was time for investors to start seeing some money.

“No-one is seeking to ‘punish’ any other innocent member of the Caddick family,” he said. “The Bridges investors are sympathetic to the extent that those family members are also victims.

“In balancing all of the interests, for how long is it reasonable for Caddick family members to continue to live on investors’ funds?”

Mr Calabria is representing 15 investors, who allege they’ve lost a combined $6 million through Ms Caddick’s business.

In total, it’s believed Ms Caddick allegedly conned around $25 million out of investors.

Bank statements controlled by Ms Caddick showed more than $20 million was deposited into her account between January 2018 and September 2020. Just $700,000 of that remains.