Network 10 is in ‘total turmoil’ and may not survive as Australia’s third commercial broadcaster

Australian commercial TV will likely be reduced to just two players by the end of the decade, experts say, with Ten in a bad position.

Embattled broadcaster Network 10 is facing “serious turmoil” amid failing programs, sliding ratings, an ad revenue crisis, and a messy ownership battle at its American parent company.

News today that glitzy reality series The Masked Singer and major franchise The Bachelor have been axed is the latest sign of the company’s deepening woes – and its existence is in doubt.

Queensland University of Technology Professor Amanda Lotz, who leads the Transforming Media Industries research program, said it’s unlikely Australia will still have three free-to-air commercial networks in the near future.

“I would suspect by the end of the decade that we will have two commercial broadcasters,” Prof Lotz said. “It’s just math. We’re now in a death spiral. And eventually, it might be that we just have one.”

QUT Professor Anna Potter, an expert in digital media and cultural studies, agreed that the landscape is now so stretched that television businesses are dangerously unviable.

“I think there’s a big question too about whether Australia can support three television (commercial) broadcasters – and I’m not sure we can,” Prof Potter said.

But the network’s failure to meaningfully grow its share of audience coupled with an increasingly disrupted advertising market have almost been eclipsed by Ten’s messy ownership, media analyst and Pearman director of strategy and research Steve Allen said.

“A new owner of Paramount Global is unlikely to see Ten as an asset worth retaining because the business is in serious turmoil,” Mr Allen told news.com.au.

“There’s no programming momentum and they haven’t found a really solid anchor for prime time, their revenue looks steady but they can’t seem to significantly reduce overheads, and now there’s upheaval in terms of their US ownership.

“Network 10 is in a real pickle and I don’t see a way out for them.”

Parent company for sale

Ten’s parent company Paramount has been preoccupied with ongoing merger and acquisition negotiations in the United States.

As well as film studio Paramount Pictures, the company owns US network CBS, cable channels Nickelodeon and MTV, British broadcaster Channel 5, and Network 10 in Australia.

It’s chaired by Shari Redstone, who has been making moves to sell her family’s controlling stake in the once-giant media company.

Production company Skydance, founded by billionaire David Ellison who is the son of Oracle founder Larry Ellison, had been in advanced talks to acquire the Redstone family’s shares.

But according to reports, some powerful shareholders were dissatisfied with the offer, rumoured to be worth about $US3 billion ($A4.53 billion).

On Friday, the exclusivity on merger talks with Skydance ceased, leaving Paramount open to discussions with other interested parties.

There have reportedly been calls from major shareholders for the board to consider a rival bid from private equity firm Apollo Global and Sony Pictures, which has offered $US26 billion ($A39.26 billion) for a full acquisition of Paramount Global.

Mediaweek publisher and long-time media commentator James Manning said Ten’s future remains up on the air.

“Some think whoever the new Paramount owner turns out to be, they will be mainly interested in the studio business, the US CBS network, and the US cable channels,” Mr Manning wrote in a recent column.

“Other assets might be sold off. Those could include the Paramount+ streaming business and the free streaming business Pluto TV in the US. International assets to be sold off could include Australia’s Network 10 and UK’s Channel 5.”

He speculated that the most likely buyer of Ten would be a private equity firm enticed by a “bargain buy”.

Prof Potter agreed, saying: “My feeling is that it’s probably not an asset worth holding.”

Disappearing pot of gold

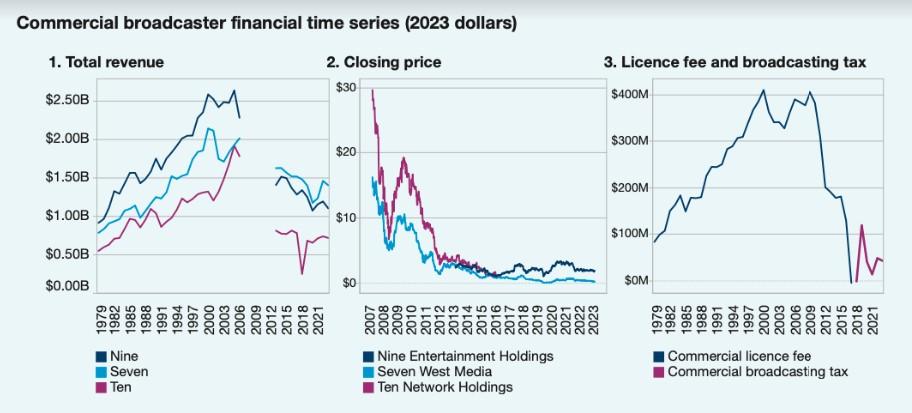

Back in 2006, Australia’s three commercial networks enjoyed a share of $7.7 billion of advertising revenue, allowing them to both turn a profit and invest in quality television programming.

Compare that to 2020-21 figures provided by the Interactive Advertising Bureau, and that huge pot of gold has more than halved to $3.8 billion.

Television accounted for almost half of all ad spend across Australia in 2007, while now it equates to about 18 per cent.

“The pot of ad money hasn’t increased, but the places companies can spend it has,” Prof Lotz said. “Too much money has come out of commercial TV.

“We live in a very different world now and if we had two services, or maybe just even one that had enough money to have a full slate of programming that could gather a significant audience, that might be better for Australia.”

Major losses of revenue have forced commercial networks to “cut back their content so much that people can’t find much they want to watch”, she said.

“All that’s left is sports, news and reality. The idea that having three commercial players doing virtually the same thing is harder to justify.”

Ten’s news offering has never been a serious rival to that of Seven and Nine and it is no longer a serious player in the live sports space.

As well as the dominant streaming services, Prof Lotz said a whole range of media substitutes – like TikTok or Instagram – are captivating eyeballs that might’ve once turned to broadcast.

Major streaming services like Netflix and Amazon Prime are also entering the advertising business, serving them up to subscribers on entry level tiers.

“That’s only likely to make things worse for commercial TV operators,” Prof Lotz said.

Signs of instability

Locally, Ten has grappled with a series of internal changes. The exit of one of its two co-bosses, Jarrod Villani, earlier this year, left Beverley McGarvey, who was appointed the network’s president and Paramount’s regional lead for Australia and New Zealand, as the sole lead.

It’s said the mood within the company’s Pyrmont headquarters has been subdued for some time, not helped by the unwelcome and messy distraction created by Bruce Lehrmann’s long defamation action.

Ten successfully defended the suit but hardly came out unscathed, with the Federal Court criticising its handling of various matters related to the broadcast of The Project’s explosive interview with Brittany Higgins in 2021.

Daily headlines about the court case overshadowed a series of big content plays, many of which failed to deliver a significant ratings recovery.

Warner Brothers, producers of The Masked Singer, had been in discussions with Ten about renewing the celebrity singing guessing-game, which costs a fortune to make.

The structure of the proposed deal included rights to The Bachelor and its various spin-offs, so in passing on The Masked Singer, it lost both.

“That’s a really big hole in their schedule,” Prof Potter said.

When approached for comment for this story early on Tuesday, a Network 10 spokesperson simply said the decision to axe The Bachelor and The Masked Singer was unrelated to Paramount Global’s ownership.

“We regularly review our programming schedule and consider changes to meet industry and audience trends and is a normal part of our local business operations,” the spokesperson said.

Following the publication of this story, the spokesperson sent an additional statement.

“As a member of a global business, we are used to speculation about our company, but Paramount Australia is a strong diversified media and entertainment business spanning linear free-to-air TV, multi-channels, FAST channels, BVOD with 10 Play, SVOD with Paramount+ as well as consumer products, branded content, live events and more,” it read.

“On free-to-air, our content slate has had strong results with 10 securing four of the top 10 shows of the year in the key advertising demographics of 25 to 54s and 16 to 39s with Australian Survivor, I’m A Celebrity… Get Me Out Of Here!, Gogglebox and MasterChef Australia.

“Plus, these shows have all set new records in digital viewing on 10 Play.

“In April, 10 Play had its biggest month ever off the back of strong results in 2023 as the fastest growing BVOD in Australia. And Paramount+ continues to be the fastest growing streaming service in the country since launching more than two years ago.

“We’re confident of our position in the market and are looking forward to an equally strong second half of the year.”

Selling ‘non-core assets’

Last week, Paramount Global chief executive Bob Bakish left the business after a rumoured falling-out with Ms Redstone and was replaced by not one, but three co-CEOs.

“The office of the CEO is working with the board to develop a comprehensive, long-range plan to accelerate growth and develop popular content, materially streamline operations, strengthen the balance sheet, and continue to optimise the streaming strategy,” a statement read.

An email sent to staff from the trio shortly after the news was announced flagged “challenging” days ahead.

Pundits in the US believe that will almost certainly include job cuts, on top of the 800 global redundancies announced in February. Ten staff were set to be among those affected but no details were provided on how many.

But Bloomberg reports the new CEOs are considering a range of measures on top of cost cuts and restructuring – the sale “of non-core assets” like its beleaguered Australian network.

Last year, Ten suffered its worst ratings year ever recorded, with viewers abandoning the network in droves in favour of rivals Seven and Nine, as well as streaming services like Netflix.

Its total audience share was about half that of the other two commercial broadcasters.

It was even beaten by the ABC in third place, cementing Ten as the country’s fourth most-watched free-to-air network.

On top of that, none of the 50 highest rating shows of 2023, in terms of total audience, were on Ten or its streaming and on-demand services.

The global company’s premium streaming service Paramount+, which operates in Australia, is also rumoured to be likely to merge with NBC Universal’s platform Peacock.

Paramount+ has lost billions of dollars globally since its launch in early 2021.

Whatever happens, the uncertainty over Paramount’s future left a bad taste in the mouth of billionaire investor Warren Buffett, who once owned 15 per cent of the company.

Berkshire Hathaway, which Mr Buffett runs, offloaded its entire interest at his direction, he told shareholders at the weekend.

“It was 100 per cent my decision, and we’ve sold it all, and we lost quite a bit of money,” he admitted.

When it comes to just how big the loss was, financial analysts in America are throwing around figures in the vicinity of $US1.5 billion ($A2.26 billion).