Clough Group collapses after WeBuild ends $350m merger

The building firm was borrowing hundreds of millions of dollars pinning its hopes on a deal that came to a sudden end, sealing its fate.

A major Western Australian building and engineering company has collapsed after its $350 million lifeline ended when another firm pulled out of a merger deal.

On Monday, Perth-based Clough Group went into voluntary administration after the takeover deal fell through, leaving its 1250 employees uncertain about their future.

An Italian industrial construction group called WeBuild planned to acquire Clough as a way to enter the Australian market.

The $350 million conditional deal was struck on November 8 but less than a month later, it fell apart, leaving Clough on the rocks.

In the lead-up to the merger, WeBuild reportedly loaned Clough $167 million and was set to fork out a further $30 million, before pulling out of the acquisition.

Clough’s South African owners, Murray & Roberts, then appointed Sal Algeri, Jason Tracy, David Orr and Glen Kanevsky of Deloitte as voluntary administrators.

In a short statement on Monday evening, WeBuild said the merger had been scrapped as the companies had “jointly determined and agreed that there is no reasonable prospect of that acquisition proceeding through to a successful completion”.

“The parties have therefore unconditionally agreed to terminate the sale and purchase agreement with immediate effect,” WeBuild said.

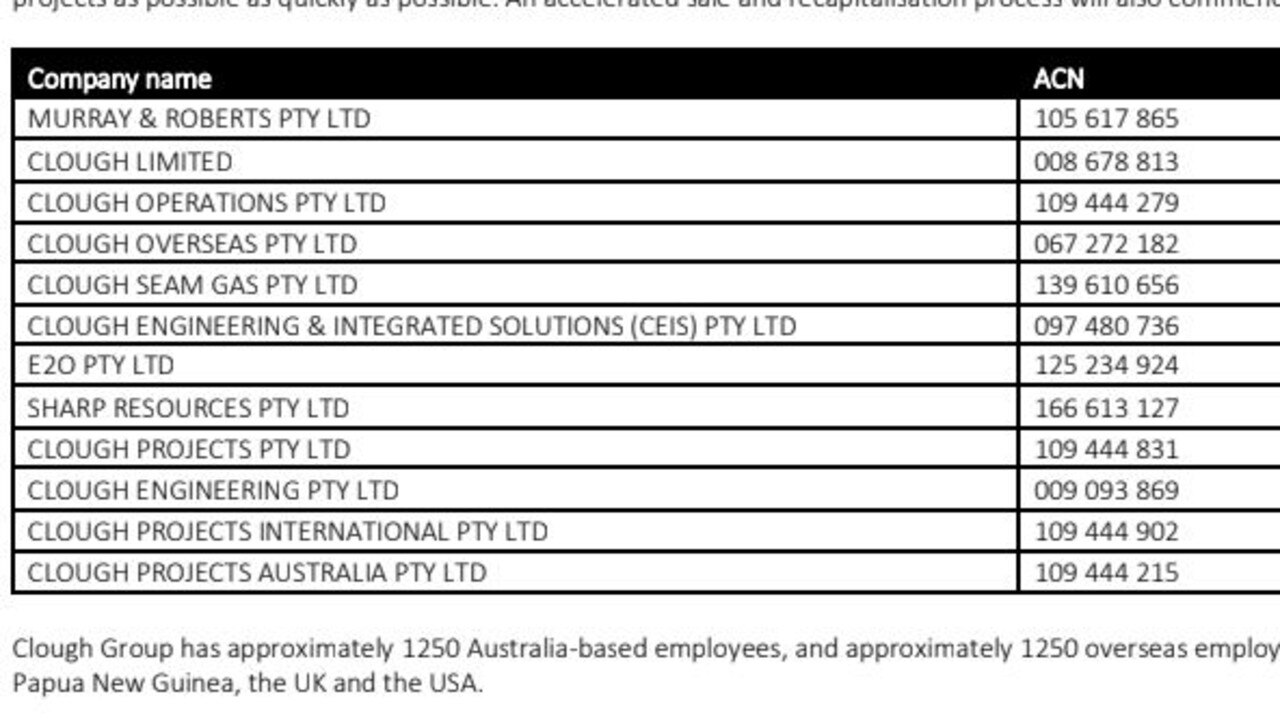

The firm’s administration has impacted 12 companies under the Clough Group umbrella.

It’s also left in doubt the future of Clough’s 1250 Australia-based employees, and the 1250 overseas employees from Papua New Guinea, the UK and the US.

Clough builds industrial projects in the energy, resources and infrastructure sector, which has left a number of sites in the lurch.

They were contracted for the federal government’s Snowy Hydro 2.0 expansion, as well as a number of other projects in NSW, Western Australia and Papua New Guinea.

Clough appears to have been in financial strife for some time with its auditors, PwC, warning in the most recent filing with the Australian Securities and Investments Commission (ASIC) that the firm’s continued survival was dependent on the merger.

In the lead up to the acquisition, Clough borrowed $167 million from WeBuild, according to The Australian.

Clough posted a $375.3 million loss and a $304 million working capital deficit in the last financial year.

WeBuild was also meant to hand out a further $30 million as a loan to keep the company afloat but put an end to this when the merger was scuppered.

In a statement, Clough said the administration process “provides for the possibility of compromise with creditors, through adoption of a Deed of Company Arrangement, a binding arrangement between the company and its creditors governing how the company’s affairs will be dealt with”.

Voluntary administrator and Deloitte Turnaround & Restructuring partner Mr Algeri, said in a statement to news.com.au: “With our appointment, over the next two to three days, we will carry out an urgent assessment of the financial position of the Clough Group companies, with a view to sourcing immediate interim funding to be able to continue work on as many projects as possible as quickly as possible.

“An accelerated sale and recapitalisation process will also commence.”