Alcohol consumption to hit 55-year low

IT MAY be an Australian icon, but our love affair with the humble tinnie of VB is fading fast, according to a new report.

IT MAY be an Australian icon, but our love affair with the humble tinnie of VB is fading fast.

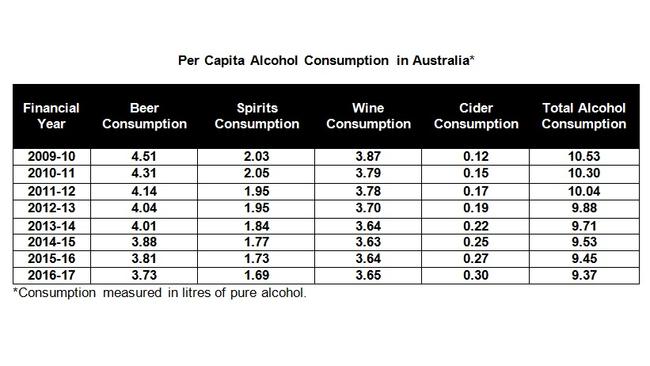

Domestic alcohol consumption in Australia is set to fall to its lowest level in more than half a century, with per capita alcohol consumption to hit 9.37 litres in 2016-17, according to IBISWorld.

The trend is forecast to continue, with alcohol consumption in Australia expected to fall to 8.54 litres per capita by 2023-24 — down from 10.57 litres in 1990-91.

“Domestic per capita consumption of beer, wine and spirits has slumped to a 55-year low, largely as a result of government legislation and increasing health consciousness among consumers,” said IBISWorld senior industry analyst Andrew Ledovskikh.

The market research firm says while winemakers have found new growth as export demand booms, beer manufacturers have been hit particularly hard, with traditional staple brands such as VB and XXXX rapidly declining in popularity.

“Unlike the wine production industry, local beer brewers produce almost exclusively for the domestic market,” Mr Ledovskikh said. “This has compounded the effect of declining alcohol consumption for brewing companies.”

Beer consumption has fallen from 4.51 litres per capita in 2009-10 to 3.73 litres in 2016-17, while spirits consumption is down from 2.03 litres to 1.69 litres. Wine, while down from 3.87 litres in 2009-10, rose marginally from last year to 3.65 litres. Cider consumption, meanwhile, has more than doubled in the same time, from 0.12 litres in 2009-10 to 0.3 litres in 2016-17.

According to IBISWorld, export markets are expected to account for 41.5 per cent of wine industry revenue this year at $2.5 billion. The wine production industry is forecast to grow by an annualised 2.3 per cent over the five years to 2016-17 to $6.2 billion.

“Rising exports to Asia are anticipated to drive export growth over the next five years,” Mr Ledovskikh said. “Free trade agreements signed with Japan, South Korea and China in 2014 and 2015 are expected to lead to new growth in Asian export markets, as Australian wines become more competitive.

“Rising middle class incomes in China are also expected to contribute to strong demand growth over the next five years. As a result, China is anticipated to overtake the United States as the largest importer of Australian wine.”

The beer manufacturing industry, however, is expected to decline by an annualised 0.7 per cent over the five years to 2016-17 to $4.2 billion.

“An ongoing shift in consumer preferences from quantity to quality has affected the industry and its product range,” Mr Ledovskikh said. “As beer drinkers purchase more premium, craft and internationally branded beers, the increase in per-unit prices has offset the decline in consumption.”

IBISWorld notes that as most of the large Australian beer brewers are owned by foreign multinationals, there is little incentive for these companies to produce locally for export. Most exported brands are produced under contract in the destination country, rather than physically shipped overseas.

Craft beer remains a silver lining, with the industry expected to grow at an annualised 11.7 per cent over the five years to 2016-17 to $454.2 million. IBISWorld says in 2011-12, there were just over 140 craft brewers in Australia. In 2016-17, there are expected to be almost 300.

“Consumers’ shift to higher value beers has been supported by rising household discretionary incomes, and further aided by the fairly homogenous nature of traditional brews,” Mr Ledovskikh said.

“Craft and boutique brewers have focused on European and American styles previously under-represented in the Australian market, such as pilsner, pale ale, porter, amber ale, dark ale and wheat beer.”

IBISWorld says export for craft beer is a “potentially lucrative” market, but there are a number of challenges. “Exporting bottled beers tends to be expensive, and the transport process can harm the quality of the product,” the firm said.

“Some local producers, such as Australian Brewery, have switched to canned craft beer products to help tap into export markets.

“Craft beer batches also tend to be small, making efficient transport difficult. This will likely drive craft brewers to create export groups among themselves, using export agents to consolidate shipments and reduce per unit costs.”