Coronavirus: NAB allows homeowners to defer repayments for 6 months

Australia’s banking giants are announcing a raft of new measures to help struggling homeowners survive the financial fallout of the coronavirus crisis.

Aussies struggling to keep their head above water as a result of the coronavirus pandemic have been thrown a lifeline after NAB announced its customers would be able to pause their mortgage repayments for six months.

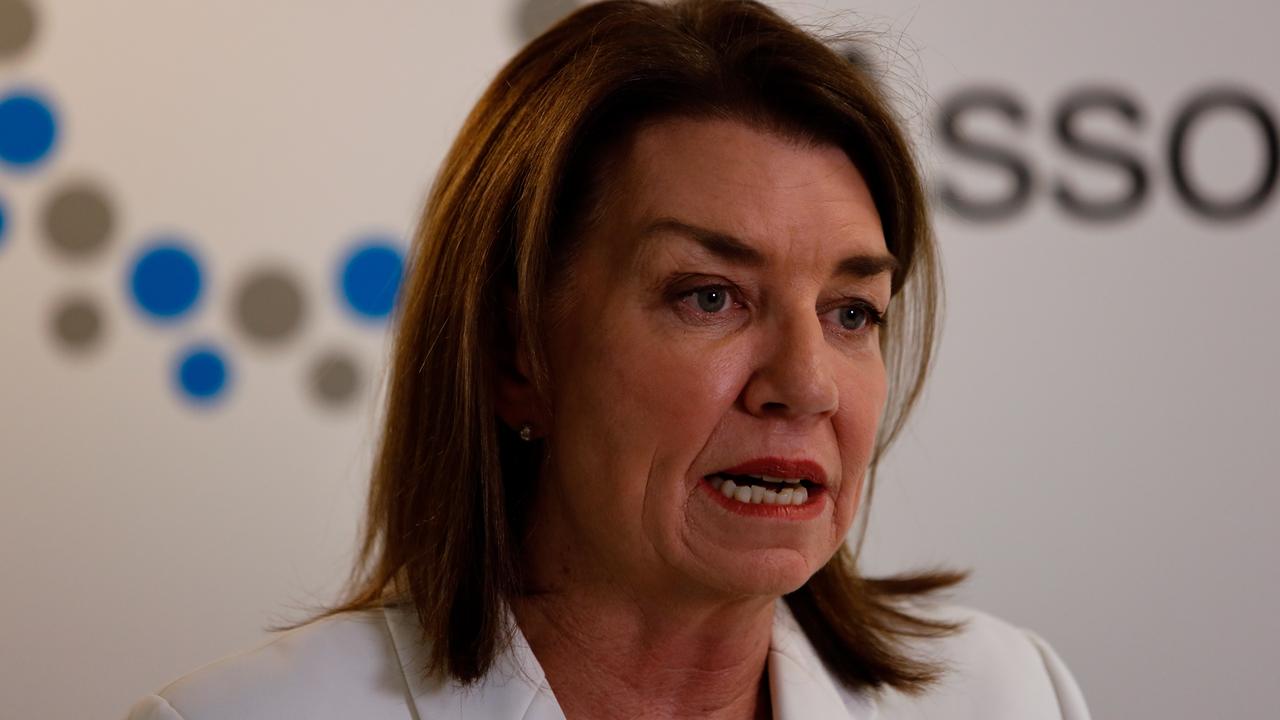

The announcement came after Australian Banking Association CEO Anna Bligh announced a multibillion-dollar package for small businesses also struggling to stay afloat due to the COVID-19 outbreak.

Under the new scheme, small businesses will be able to defer loan repayments for six months – a move designed to “keep the doors open” and keep more Aussies in jobs

It would apply to more than $100 billion worth of existing loans, and would “pour $8 billion back into small business’s pockets”.

“This is a multi-billion dollar shot in the arm for businesses that need it the most,” Ms Bligh said.

RELATED: RBA cuts cash rate in emergency move

RELATED: Bank slammed for ‘disgusting’ decision

She stressed that the package was targeting those most at risk of financial hardship, but said banks could consider action for those experiencing mortgage stress down the track if needed.

She said the pandemic was causing “devastating effects across the economy” but that small business was being particularly hard hit.

Banks are now working on the details of the small business package and could start rolling it out as early as Monday.

“Businesses are doing it very tough … but rest assured, banks have got your back,” Ms Bligh said.

“This package is for small businesses which today have the most urgent and critical need.

“If they start to see any critical need in other areas like mortgages they know they will have to look at that.”

Businesses impacted by COVID-19 need only register with their banks, and provisions will be put in place to fast track the assistance.

Ms Bligh said the measures were devised to “dovetail” the package announced by the RBA yesterday, which included cutting the official cash rate to 0.25 per cent, setting a target for the yield on three-year government bonds, supplying credit to business and an adjustment in interest rates on accounts financial institutions hold with the RBA.

BANKS RESPOND

SUNCORP

Within moments of the ABA announcement, Suncorp Bank CEO Lee Hatton confirmed a deferral of principal and interest repayments would be available for small businesses affected by COVID-19 for six months from Monday.

“Banks are here for Australian small business owners because we know that when small businesses succeed, local communities thrive,” Ms Hatton said.

“If you’re a small-business owner and you’re worried about your finances and business because of coronavirus then don’t be shy – pick up the phone, drop into our store or get in touch with your business banker.

“We’re here to help make things easier to get small business owners back on their feet and their business back on track.”

Suncorp will have a fast track approval process to ensure customers receive support as soon possible.

NAB

NAB also announced a “sweeping support package” for business and personal customers, and confirmed its business clients would also be able to defer payments on a range of floating and variable rate business loans for up to six months.

Home loan customers experiencing financial challenges will also be able to pause their repayments for up to six months, and NAB will cut 200 basic points (bps) from the rate on new loans and all overdrafts on its flagship digital business product QuickBiz, effective March 30.

It will reduce variable rates on small business loans by 100 bps from March 30, on top of the 25 bps reduction announced on March 13.

NAB also announced reductions of up to 60 bps to fixed rate home loans, although like CBA, there are no changes to home loan variable rates.

For depositors, NAB has introduced a 10-month term deposit rate of 1.75 per cent per annum.

ANZ

ANZ will support small and medium businesses by decreasing variable interest small business loan rates in Australia by 0.25 per cent per annum from March 27, resulting in a 0.50 per cent per annum reduction since last week.

All impacted customers can request a six-month payment deferral on loan repayments for term loans with interest capitalised and ANZ is also making available temporary increases in overdraft facilities for 12 months and introducing a reduction by 0.80 per cent per annum to a new two and three-year fixed rate of 2.59 per cent per annum for secured small business loans up to $1 million from April 3.

For home loan customers, variable interest home loan rates will be decreased by 0.15 per cent per annum across all variable rate indices from March 27.

A two-year fixed rate of 2.19 per cent per annum for owner occupiers paying principal and interest will also be introduced, which is the bank’s lowest ever fixed-rate home loan.

Customers can also request a deferral of home loan repayments for up to six-months, with a review at three-months, with interest capitalised.

ANZ today announced an unprecedented support package for small business and home loan customers with the potential to inject $6 billion into the Australian economy and assist in the recovery from the current COVID-19 crisis.

WESTPAC

To support the cashflow needs of small business customers, overdrafts will be reduced by 200 basis points for new and existing customers from April 6.

There will also be a 100 basis point reduction to variable interest rates on small business cash-based loans from that date, as well as a 2.29 per cent per annum fixed rate home loan for one, two and three years for owner occupied customers on principal and interest repayments with a Premier Advantage Package from March 27.

Westpac is also introducing a special 12-month term deposit of 1.7 per cent per annum to provide customers a higher return on their savings, an increase of 70 basis points (up to $500,000 per customer). For Australians aged 65 years and over the rate will be 2 per cent per annum for eight months (up to $500,000 per customer) from March 27.

The bank has also announced a $10 billion home lending fund to support the economy by assisting more Australians into home ownership.

CBA

The Commonwealth Bank was the first of the big four to react to the RBA’s rate cut, revealing yesterday it would not cut standard variable mortgage rates in response to the central bank’s move.

In a statement, CEO Matt Comyn said the bank recognised it was a “very concerning time for our customers and the community” and that we were living in “unprecedented times” which called for “unprecedented measures”.

“We are focused on delivering the best possible service to all of our customers and supporting the Australian economy,” he said.

“Our branch network is open, our call centres are open, and we are helping our customers use our market-leading digital technology to do their banking through Netbank and through the CommBank app.

“Following today’s reduction in the official cash rate by 25 basic points (bps) we are taking deliberate steps to further support parts of the economy most in need. In particular, we want to ensure that we help keep small businesses open so that they can keep Australians employed, and that we do everything we can to support households and older Australians.”

The bank announced a 100 bps interest rate reduction for all existing cash-linked small business loans, a 60 bps increase in 12-month term deposits to 1.70 per cent per annum, a 70 bps interest rate reduction in one, two and three year fixed home loan rates for owner occupiers paying principal and interest to 2.29 per cent per annum and changes to home loan repayments which will release up to $3.6 billion in cash for Australian households.

‘PROFITEERING’ SLAMMED

While the banks have been keen to tout their support for small business customers, attention has turned to pass on interest rate cuts.

According to comparison site Mozo, by holding back some of the official interest rate cuts since the RBA began cutting in 2011, the Big 4 banks have pocketed around $446 million per month in extra revenue – a staggering $23.3 billion in total.

By delaying the effective dates of their interest rate cuts, the big banks have raked in $1.1 billion since 2011.

A Mozo analysis revealed that if passed on in full, the average variable home loan rate would be 3.34 per cent, down from 3.59 per cent at the moment. The average monthly saving could be $55 on a $400,000 loan for an owner occupier paying principal and interest.

“With so many negative pressures on the economic activity, we need our biggest financial institutions to provide relief to home loan customers like never before,” Mozo director Kirsty Lamont said.

“Clearly the coronavirus is hammering the economy and with the outlook for jobs is looking bleak, this is not the time for the big banks to cash in at the expense of the community.”

Originally published as Coronavirus: NAB allows homeowners to defer repayments for 6 months