Big issue with Treasurer Jim Chalmers’ new ‘double’ tax cuts

Treasurer Jim Chalmers has rolled the dice on sweeping new tax cuts for every Aussie earning over $45,000 – but there’s a big catch with the cost of living relief.

Australians can expect an itty-bitty tax cut of an extra $5 a week for anyone earning more than $45,000 from next year in a surprise election bribe that will be hard-pressed buying most voters a cup of coffee.

Treasurer Jim Chalmers has rolled the dice on tax cuts so modest that he expects they won’t have any discernible impact on inflation.

It compares with a $5 tax cut offered by the former Treasurer Peter Costello in 2003 which was lampooned at the time as “piddling” and not enough to buy a “sandwich and a milkshake”.

But building on existing stage three tax cuts brought in by Labor last year, the changes will deliver the average worker a total tax cut of $2548 a year or about $50 a week.

Asked whether he planned to spend the extra $5 on a coffee or a McFlurry, the Treasurer wasn’t biting.

“I am not going to give people free advice on how to spend their tax cuts,’’ Dr Chalmers told news.com.au.

“We are topping up the tax cuts. We know they are modest in isolation but they are meaningful in combination.

“Three rounds of tax cuts is about $50 a week when you add them all up. We know there’s an appetite to do more.”

Asked about the comparison with Mr Costello’s widely mocked $5-a-week tax cut, the Treasurer said he wanted to make sure they could provide a little more cost of living relief.

“I understand there’s always appetite for governments to do more,’’ Dr Chalmers said.

“We’ve got budget constraints.

“But it’s not the only thing we are doing in cost of living. It goes hand-in-hand with more bulk billing, cheaper medicines.

“The total value is $50 a week. It includes the $150 energy rebate.”

The federal government is billing the changes as a double tax cut because they also increased the Medicare levy low income thresholds.

This means that one million Australians on lower incomes will continue to be exempt from paying more tax under the Medicare levy, or will continue to pay it at a reduced rate.

Over the next decade from 2024, the average Aussie will pay $30,000 less tax than they would have if the Morrison Government and the Albanese Government had not embarked on and then implemented tax reform.

Staggering cost of tiny $5-per-week tax cut

Despite offering a stipend so small it would barely buy a weekly cup of coffee, the cost to the budget is huge, because it’s delivered to every full-time worker.

In fact, the cost to the budget in terms of revenue foregone for the extra tax cut is $17 billion by 2030 – an impost the Treasurer insisted was worth it to help relieve bracket creep and reward workers.

“Tonight, the government is proud to be delivering more tax relief,’’ the Treasurer said.

“Every Australian taxpayer will get a tax cut next year and the year after, to top up the tax cuts which began last July.

“This will take the first tax rate down to its lowest level in more than half a century.

“These additional tax cuts are modest but they will make a difference.”

Insisting the government had struck the right balance, the Treasurer said the modest tax cuts were all about sharing the love with Australians who have born the brunt of inflation and higher interest rates.

“This budget builds on the progress we’ve made, together,’’ he said.

“It’s a plan to help with the cost of living.

“With two new tax cuts and higher wages, more bulk billing and more help with electricity bills, cheaper medicine and less student debt.”

How the new tax cuts will work

The good news is that the additional tax cuts will rise from $5 a week in 2026 to $10 a week in 2027.

But that’s just the extra tax cut. Workers can expect a total tax cut of around $50 a week by 2027-28 when combined with the first round of tax cuts which came into effect last year.

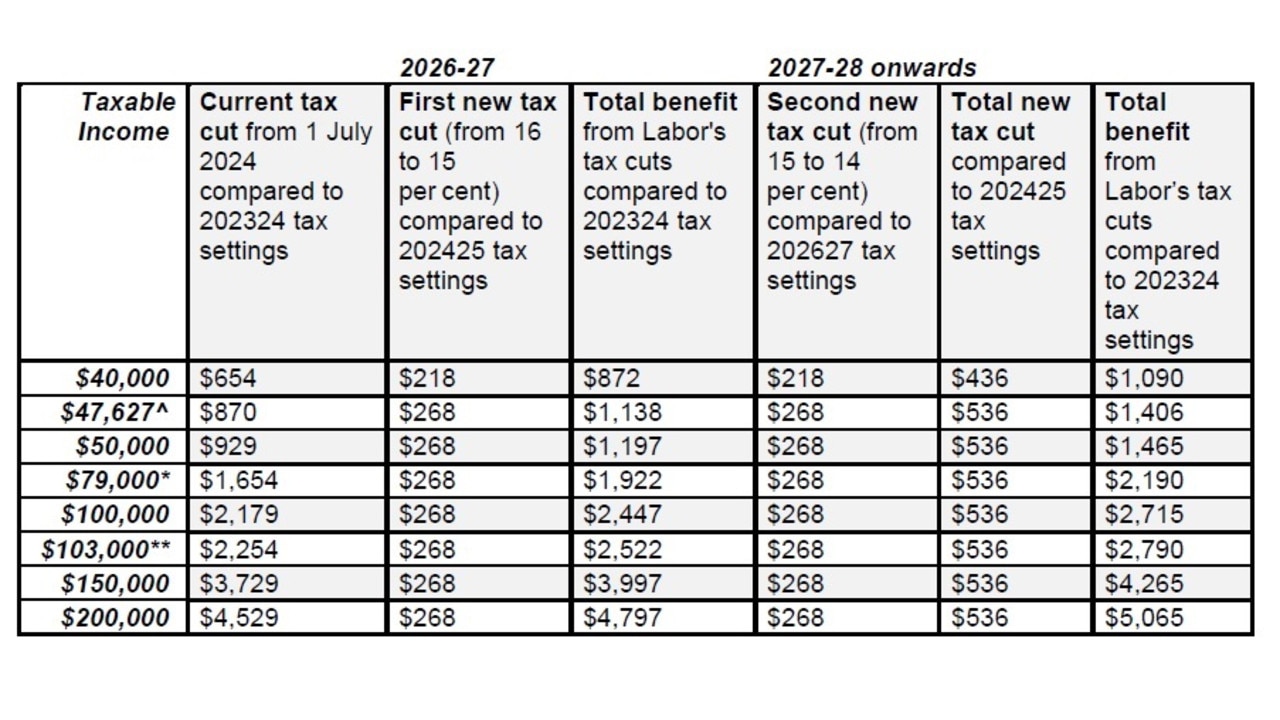

In other words, the average worker earning a salary of $79,000 will receive a total tax cut of $1922 next year and $2190 the year after.

The bad news is that the ‘new’ tax cuts are so modest they are a blink-and-miss affair at just $268 year in the first year. That will rise in the second year to $536 a year.

That’s $20 a month or a piddling $5 extra a week over the 2026-2027 financial year.

The tax cuts will be delivered by cutting the 16 per cent tax rate that applies to all earnings between $18,201 and $45,000.

From July 1, 2026, the 16 per cent tax rate will be dropped to 15 per cent and the following year it will be dropped to 14 per cent.

What it means is that very low income workers, for example high school students, earning under the tax free threshold of $18,200 will receive no relief at all.

Workers earning more than $18,200 but under $45,000 will secure slightly less.

For example, someone taking home $30,000 a year will receive a tax cut of $118 in the first year and $236 in the second year.

That’s around half of what the vast majority of workers earning more than $45,000 will secure.

In the first year of operation starting in July, 2026, workers earning over $45,000 will secure $268.

It doesn’t matter if you’re earning $200,000 or $65,000. You get $268 in additional tax cuts in 2026.

The following year that additional tax cut doubles to $536. Once again, it doesn’t matter if you earn $500,000 a year or $50,000.