‘Australian horror’: 31yo reveals grim mortgage reality

An Aussie has revealed the “horror” new reality that young people just have to deal with.

Young Aussies are moving back in with their parents to save for house deposits, but getting ahead is hard as property prices keep rising.

In 2023, comparison website Finder released a survey that found 13 per cent of Australians – 2.6 million people – had moved back in with their family or had an adult child move back in the past 12 months.

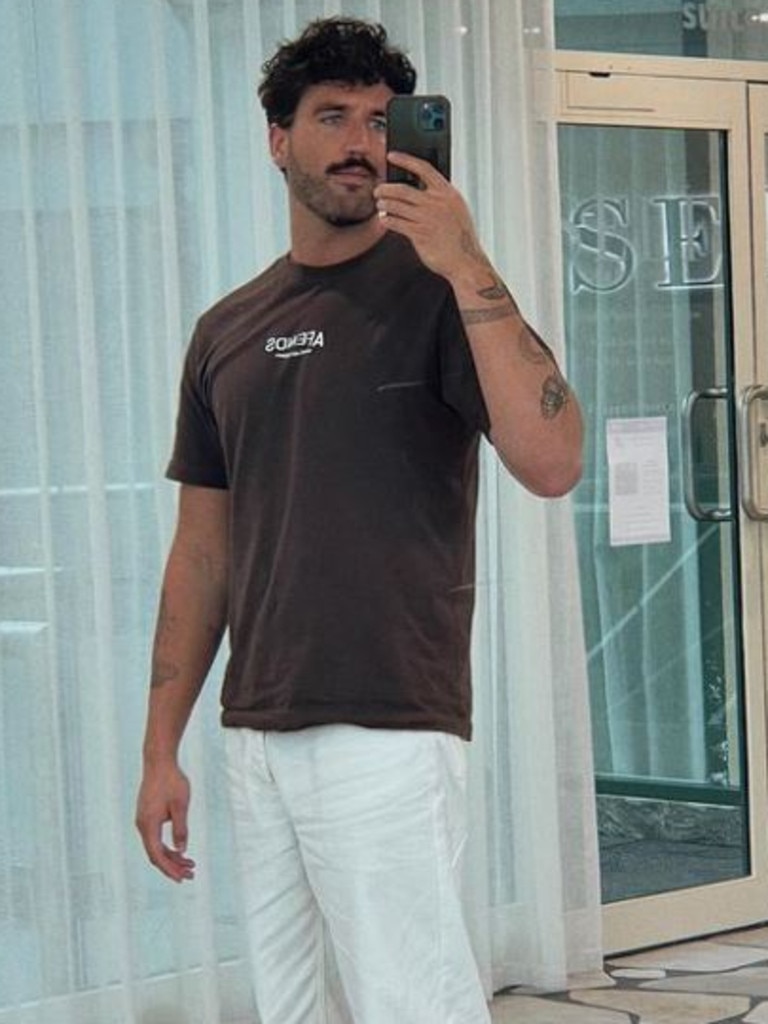

Ryan Turner, 31, moved back in with his parents in October 2022, and, along with his partner Lelio, they’ve managed to save a substantial amount.

Mr Turner said his parents have been incredibly “generous” by letting him live with them again as an adult.

He moved out when he was 18, so returning at 30 wasn’t exactly the plan.

The 31-year-old lives in Adelaide, where the property market has boomed. According to PropTrack’s Property Market Outlook Report, Adelaide’s home values have been up 12.9 per cent over the financial year. The median house price is now over $900,000.

Initially, he moved home because his rental was being sold for an “enormous profit”.

He decided that if he ever wanted to climb onto the property ladder, he needed to stop paying rent.

“Returning home after 12 years was quite confronting. While my parents are incredibly generous, kind, and supportive, I still felt a sense of failure at 30, living with my parents.” He told news.com.au.

“I couldn’t help but think, ‘shouldn’t I have two kids, a home, and an investment property by now?”

Mr Turner said going from being an adult who ran his own race to checking in with his parents again about his comings and goings was “challenging.”

Although he was saving money, Adelaide property prices were rising, which “stressed” him out.

Online, he called it an “Australian Horror Story” because, at one point, he was living at home with his parents and felt like he couldn’t even afford to buy a “driveway.”

“Saving felt pointless because the relentless rise in the housing market made it seem like there was no end in sight for moving out,” he said.

“Watching Adelaide transform into one of the most expensive cities to live in was equally devastating. Every month, it felt like the goalposts were moving further away, no matter how diligently we saved.”

Things were looking pretty hopeless until he heard about the government’s First Home Buyer’s Assistance scheme, which began in July 2023.

That scheme meant that if you were buying a new or existing home valued up to $800,000, you could qualify for a total exemption from transfer duty.

It was a game changer.

Mr Turner and his partner are now building a three-bedroom townhouse and he is over the moon.

“We were able to commence this process thanks to both living at home, as well as the current stamp duty exemption for first home buyers for new builds. This scheme ensured we were able to secure our loan way easier,” he explained.

Their home will be ready in 2025, but until then both he and his partner will continue to save by living at home.

Mr Turner said while his story has a happy ending, he feels like the entire system is broken right now.

“As a young person today, getting ahead financially feels like trying to win a race with your shoelaces tied together. We’re navigating a world where debt is the norm, housing prices are skyrocketing, and wages just can’t keep up with inflation,” he said.

“I am extremely fortunate to be paid well by my amazing employer and to live at home to save, and I just cannot fathom the difficulty those face without those two things. Young people today are expected to save, invest, and plan for the future, all while juggling the realities of an ever-changing working landscape and, on top of that, the pressure to maintain a certain lifestyle,” he said.