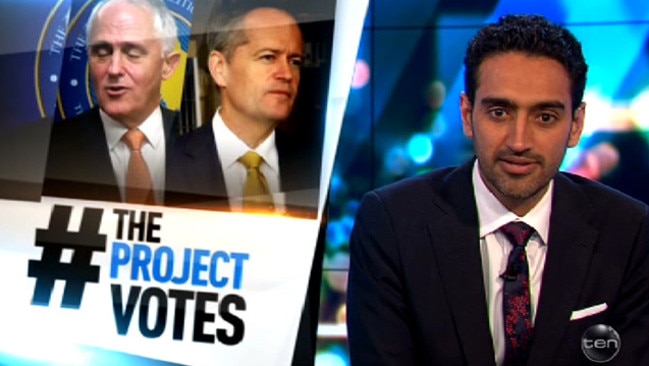

‘I’m giving this one to the Coalition’: Waleed Aly takes on rich Aussies and super reform policy

THE Project’s Waleed Aly has taken on the super reform policy and the rich Australians who use superannuation to avoid paying their taxes.

WALEED Aly has taken on super reform policy, saying he’s “giving this one to the Coalition”.

In his “Something we should talk about” segment on Monday’s episode of The Project, Aly took aim at rich Australians who use super to avoid paying tax.

“Let’s say there’s a 60-year-old man. Let’s call him Tiger Thunderfist,” he began. “And let’s say that Mr Thunderfist has worked his way up to a $300,000 wage. Generally, he would be taxed at almost 50 per cent on that, but if he sticks a chunk of it in super it will only be taxed at 15 per cent.”

Aly pointed out these high-income earners who are only a few years off retiring are using their supers as a “generous savings account” — and the tax they would otherwise be paying would go to hospitals and schools.

“The point is, because of our generous super system, wealthy older Australians have been exploiting it to the detriment of the rest of us,” he continued. “Thankfully both sides of parliament agree on that premise and each has come up with a solution. Labor and the Coalition will both increase tax on super contributions from 15 per cent to 30 per cent for people who are earning more than $250,000 a year.”

As for the wealthy older Australian’s using their super funds as savings accounts, Aly pointed out both Labor and the Coalition agree they should pay 15 per cent tax on money their accounts generate. “So, for Labor, that kicks in when yearly returns hit $75,000. For the Coalition, that kicks in when the principle in the account exceeds $1.6 million which experts say works out to be about the same,” he said.

“But here’s where the two really do differ: Currently, if you are rich enough to have $180,000 lying around, you could put that into the share market and pay about 50 per cent on anything that you make from it, or you could stick it into super and pay a lot less and you could do that every year. But the Coalition is introducing a lifetime limit on after-tax contributions to $500,000 and that, by the way, would include contributions made since 2007.”

The change would stop the wealthy using super to avoid paying tax.

“It will only affect one per cent of Australians — the rich ones. Which is why I love this policy,” he said.

While Labor say they also “hate” it, they say they’ll still consider it if they win government.

“When we form a government, if we win the election, we will revisit these measures to see their workability, to fully understand if they can actually be done,” Bill Shorten said recently.

“So you make up your own mind but for me, when it comes to super reform policy, I’m giving this one to the Coalition,” Waleed concluded.