Facebook Marketplace flooded with scammers who are dudding Aussies out of huge amounts of money

A young Aussie who has sold thousands of items on Facebook has issued a grim warning about the one word that instantly raises a red flag for her.

Security

Don't miss out on the headlines from Security. Followed categories will be added to My News.

Facebook Marketplace is being flooded with scammers who are fooling Australians into handing over their hard-earned cash, and the value of losses incurred has tripled in just a year.

News.com.au has spoken to a number of sellers who rely on the platform to offload household goods, furniture, second-hand clothing, arts and crafts, and unwanted appliances.

Each user has encountered an army of persistent con artists – some to an extreme degree – and have grown frustrated with what they see as a lack of action by the social media giant.

And a trusted banking platform that’s meant to increase safety and security is at the centre of it.

Never been worse

Over the past decade, Emilia Rossi has sold thousands of items via Facebook Marketplace as well as similar outlets like Gumtree and eBay.

She’s encountered her fair share of dodgy operators and scams as a result, but the Melbourne marketer has never seen things quite so bad.

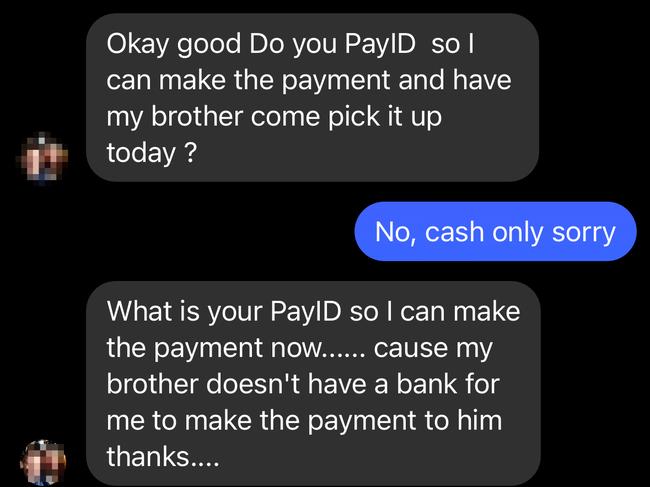

In recent times, the most common con attempt on Facebook involves the PayID system, a mysterious relative, and a fairly convincing script.

“There’s a growing concern about PayID-style scams as online marketplaces become more popular,” Ms Rossi told news.com.au.

“With a wider selection of items available, it seems scammers might also see an opportunity. Economic downturns could further fuel this concern, potentially driving more people to buy and sell online, creating a larger target audience for these scams.

“I’ve noticed an increase in approaches from users on Facebook Marketplace with new or incomplete profiles, often offering immediate payment via PayID without inspecting the item or asking detailed questions. These red flags suggest potential scams.”

‘My brother is coming’

Several recent sellers news.com.au spoke to all reported being inundated with seemingly legitimate messages from people inquiring about a product, asking a few basic questions, and then asking to use PayID.

While PayID is a legitimate form of electronic payment, it is increasingly being used by scammers as a way to commit fraud.

Sellers are told that a relative will then come to collect the item on their behalf, but they never show and those who fall for it have their money swindled.

“I had about 12 of those messages,” one frustrated seller said.

“I just wanted to get rid of my couch. I spent half a day f***ing around with scammers. They seem legit and then you go back and forth, then the ‘relative’ and the PayID bit comes and it’s like, oh God, another one.

“In the end, I’d had enough so I just dumped the couch out the front of my house and booked a council pick-up. F*** Facebook Marketplace.”

Cassandra Cross, Associate Dean at Queensland University of Technology’s Faculty of Creative Industries, Education and Social Justice, Queensland University of Technology, said there are some red flags.

“They usually will not question the price, and they are unlikely to even want to view the item,” Dr Cross said.

“In many cases, they will say a family member or friend will collect it from you.

“The offender will then urge you to accept payment through PayID. Once you’ve shared your PayID – usually phone number or email address – and the scammer has this information, a few things may happen.”

The scammer may claim they’ve sent the payment, but it can’t be processed because the seller needs a suitable PayID account.

“You will be told you either need to ‘upgrade’ the account and/or make an additional payment to release the funds. The offender will then say they have paid the extra amount required and ask you to reimburse the additional funds they have spent.

“If you do transfer any money, it will go straight to the scammer and be lost.”

It’s likely the scammer will provide screenshots of fake text messages or email confirmations, purporting to be from PayID or a bank, confirming the issue, she said.

“Scarily, such messages may even appear in an existing SMS thread with your bank. You may think they are genuine, but they are fake, designed to deceive you into transferring money to the offender.”

One prolific Facebook user told news.com.au she had reported a mammoth volume of scam accounts but noticed minimal action by the platform.

Most of her reports were returned with a message that the complaint had been reviewed but deemed clear, despite clear signs of scammer activity.

Plenty getting stung

Despite how prevalent this style of scam seems to be, many Australians are getting stung.

Research by financial comparison website finder.com.au indicated that one-in-10 marketplace users have been duped.

That’s the equivalent of two million Aussies, who’ve lost an estimated $500 each on average in the past 12 months.

ScamWatch, part of the Australian Competition and Consumer Commission, received a total of 1944 reports relating to online marketplace scams using PayID, with losses totalling $778,315.

That’s more than triple the amount fleeced from sellers in 2022, when losses hit $260,000.

Angus Kidman, money expert at finder.ocm.au, said 15 per cent of Facebook Marketplace users, or about three million people, reporting being targeted but spotted to con and walked away.

“There’s a lot of people doing it tough who are selling unwanted items to make some spare cash,” Mr Kidman said. “But instead of a cash injection, unsuspecting Aussies are falling victim to fraudsters.

“No matter what type of stuff you’re selling – whether it be video consoles or caravans – criminals will try to take advantage of sellers.”

In a statement, Meta, which owns Facebook, said it continues to work the National Anti-Scam Centre and across industries to find new ways to combat scammers.

“Scammers present a challenge in many environments, including social media, and they are constantly finding new ways to deceive people,” a spokesperson said.

“Meta adopts a multifaceted approach to tackle scams. We use both technology, such as new machine learning techniques, and specially trained reviewers to identify and action content and accounts that violate our policies.”

In the final three months of 2023 alone, Meta expunged 691 million fake accounts globally across its platforms.

“We also invest in tools on our services that allow people to report scams and to warn people if they are contacted by someone they don’t know. We partner with local organisations to educate consumers to spot and avoid scams and bring enforcement action against scammers.”

Offering an alternative

Kylie Wallace has been trading, selling and thrifting things since she was a kid – a hobby that evolved into her helping friends and family offload their unwanted goods.

It then sparked a business idea – Upcycle – which she launched in early 2023 with friends Elliot Costello and Sheena Boys.

Someone with stuff to unload registers, the Upcycle team visits their home or storage shed to itemise and photograph everything, then they list and sell it via online marketplaces, managing pick-up and payment.

“Australians want to do their bit to reduce their waste, recycle household products and lighten their impact on the planet but they are time poor and fearful about being scammed,” Ms Wallace said.

“Upcycle is the perfect solution to this growing problem. The second-hand economy is worth approximately $60 billion and the average Aussie households are holding onto $7000 worth of sellable items.”

She’s been shocked by some of her customer’s horror stories about “how rampant scamming is on marketplaces online”.

“People have expressed how initially it was really easy to spot the scammers but nowadays it is much harder to tell the real from the fake buyers,” she said.

“Our customers have told us that they have wasted so much time replying to so many messages about items only to find that half of the people they were messaging were scammers.”

Even Ms Wallace and her side hustle partners are regularly targeted, but they know the signs to look for and haven’t been stung.

Is the scam evolving?

News.com.au heard from one seller who regularly uses Facebook Marketplace and has noticed a slight shift in the PayID scam.

Clinical psychologist Rik Schnabel said the attempted con begins the same way as it has for months now.

“Typically, they come pretty quickly after listing something on the site – so they must have a hack or bot that tells them when something new is listed,” Mr Schnabel said.

“They usually say fairly fast that they want to buy the item and say that their brother or sister will come to pick it up.”

But instead of PayID, he has been directed by the scammers to an app that claims to be able to ‘wire’ the money directly from buyer to seller.

“I haven’t accepted any one of them, so I’m not sure what happens next,” he said.

And in other dodgy instances, PayPal is offered as the method of payment by buyers who are eager for a quick transaction.

Originally published as Facebook Marketplace flooded with scammers who are dudding Aussies out of huge amounts of money