Apple emerges as come-from-behind winner in DeepSeek chaos

US markets bled hundreds of billions of dollars after the release of a revolutionary Chinese AI — but one company has emerged as the surprise winner.

US markets have been roiled this week by the release of DeepSeek, a low-cost Chinese artificial intelligence chatbot that threatens the dominance of Silicon Valley tech firms — but one company has emerged as the surprise winner.

Apple, the world’s most valuable company with a $US3.6 trillion market cap, emerged unscathed from the chaos that saw more than $US1 trillion wiped off US shares on Monday, led by a 17 per cent decline in Nvidia.

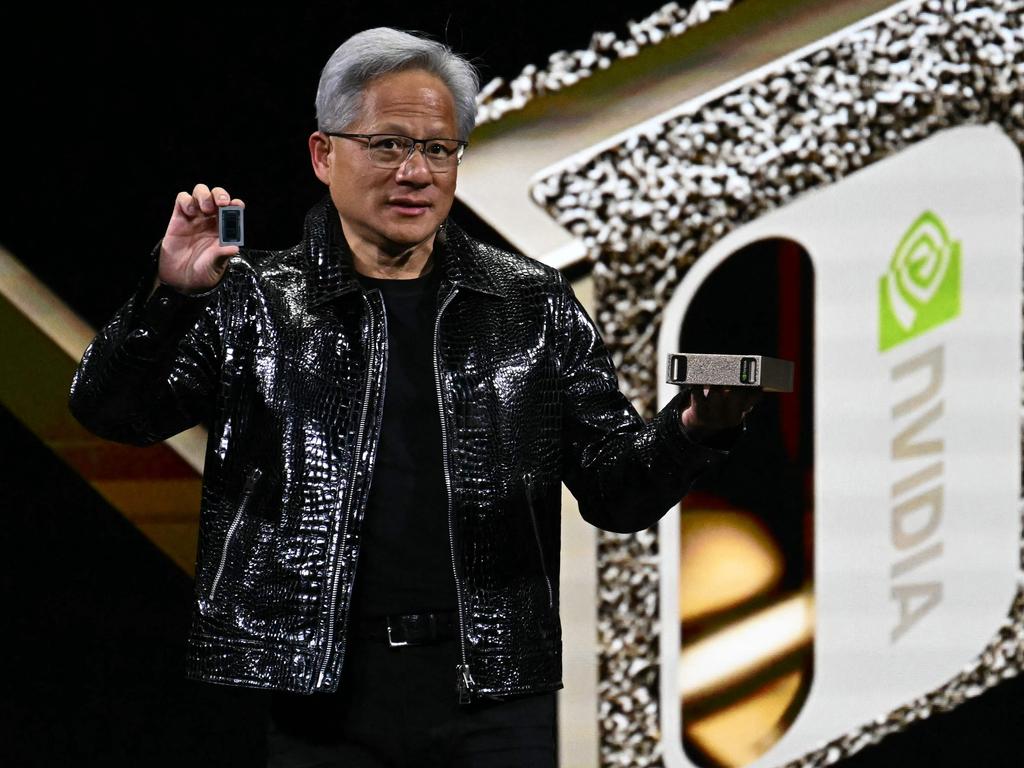

Nvidia, which makes most of the advanced AI chips used by firms including ChatGPT maker OpenAI, Meta, Google and X, saw its value plunge by $US589 billion — the largest single-day loss for a public company in stock market history.

Shares rebounded on Tuesday with Nvidia clawing back gains of 8.8 per cent, adding around $US260 billion back to its market cap, marking the second highest ever single-day gain for a stock.

Apple, meanwhile, rose 4 per cent, building on a gain of 3 per cent on Monday when many of its tech peers went into free fall.

The reason?

While others in the so-called “magnificent seven” American tech leaders — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla — have committed hundreds of billions of dollars to building out massive AI data centres, Apple’s “AI ambitions are far more contained”, Morgan Stanley analysts wrote in a note on Tuesday, per Forbes.

The iPhone maker, having opted largely to watch the generative AI arms race from the sidelines, emerges as a “relative winner” with the release of DeepSeek, which claims to offer a service on par or even exceeding rivals like ChatGPT with vastly lower computing resource cost.

Apple stands to greatly benefit in any advancements from large language models (LLMs) as it “owns the most valuable consumer technology distribution platform that exists”, Morgan Stanley added.

Analysts at Baird similarly noted that as a leading manufacturer of consumer-facing products, Apple was “well positioned” to benefit from generative AI “without spending tens of billions of dollars on LLMs or infrastructure”, Investing.com reported.

“On the bright side, DeepSeek making Apple’s behind-everyone-else-in-AI approach look like a calculated master plan,” Wall Street Journal columnist Joanna Sterm quipped on X.

Apple was conspicuously late to dip its foot into the space, only rolling out its first set of AI features, dubbed “Apple Intelligence”, across its iPhone, iPad and Mac devices in October.

Similar features, integrating ChatGPT-style generative AI technology into a range of applications, had earlier been rolled out by Meta, Microsoft and Google.

Baird’s analysts said the competitive impact of DeepSeek’s low-cost AI model to Apple Intelligence was “limited”, while noting that in the longer term, more efficient generative AI could catalyse a “better cycle” of product upgrades.

DeepSeek, a Hangzhou-based AI developer founded in 2023 by Chinese hedge fund High-Flyer, stunned the industry with the release of its latest model, DeepSeek-R1, which it says can match the capacity of top US AI products for a fraction of their costs.

DeepSeek said in a technical paper accompanying the release of its previous V3 model over Christmas that total training costs — using less than state-of-the-art GPUs available to China due to export bans — amounted to a shockingly low $US5.576 million ($8.86 million).

For comparison, Meta’s total training costs for its Llama 3.1 model were estimated to be around $US120 million ($191 million).

DeepSeek is also up to 93 per cent cheaper to run on the user end.

“There were real algorithmic breakthroughs that led to it being dramatically more efficient both to train and inference,” Gavin Baker, chief investment officer at Atreides Management, wrote on X.

Ben Thompson of the Stratechery tech newsletter said Apple was a “big winner”.

“Dramatically decreased memory requirements for inference make edge inference much more viable, and Apple has the best hardware for exactly that,” he wrote.

“Apple Silicon uses unified memory, which means that the CPU, GPU, and NPU (neural processing unit) have access to a shared pool of memory; this means that Apple’s high-end hardware actually has the best consumer chip for inference (Nvidia gaming GPUs max out at 32GB of VRAM, while Apple’s chips go up to 192 GB of RAM).”

But Mr Thompson stressed “model commoditisation and cheaper inference” in the long run were “great for big tech”, with the likes of Amazon, Microsoft, Meta and Google all set to benefit from reduced costs and greater efficiency.

He said Monday’s bloodbath was “likely the market … working through the shock of R1’s existence”.

President Donald Trump welcomed DeepSeek’s development of a “faster and much less expensive method of AI” in an address to Republican members of Congress on Monday night, but warned it was a “wake-up call for our industries that we need to be laser-focused on competing to win”.

“If it’s fact and if it’s true, and nobody really knows if it is, but I view that as a positive because you’ll be doing that too so you won’t be spending as much and you’ll get the same result, hopefully,” he said.

All three major indices on Wall Street finished higher on Tuesday, with the Nasdaq Composite rising 2 per cent buoyed by a rise in tech stocks, reversing some of its losses from Monday.

Despite these gains, Briefing.com’s Patrick O’Hare noted that this was not a broad market advance.

The rally was “probably more of a reflection of people embracing the idea that yesterday’s sell off in these mega cap and AI plays was overdone”, he said.

The Nvidia sell-off “may have gone too far”, said Kathleen Brooks, research director at XTB, adding that there were doubts over whether DeepSeek’s AI was developed as cheaply as it claims.

“It may be too early to write off Nvidia yet, even though the prospect of a Chinese rival is causing a crisis for the chip maker,” she added.

Gains in US equities last year were driven by a handful of large tech stocks led by Nvidia, and the wider stock market largely avoided Monday’s rout.

“It’s difficult to work out if the worst is now over, or if yesterday’s slump was just another sign that the top is already in for US equities,” said David Morrison, senior analyst at Trade Nation.

Earlier, Tokyo fell as AI-linked companies were pulled lower and new comments by Mr Trump rattled analysts.

The US dollar rose after Mr Trump said on Monday that he wanted universal tariffs “much bigger” than the 2.5 per cent suggested by his newly confirmed Treasury Secretary Scott Bessent, fanning fresh fears about a trade war.

Mr Trump said he wants high tariffs on imported metals, pharmaceuticals and semiconductors.

Investors will turn their attention to interest-rate decisions this week.

The Federal Reserve’s policymaking committee meets on Wednesday and is largely expected to leave rates unchanged, despite Mr Trump’s calls for lower interest rates from the independent US central bank.

A day later, the European Central Bank will hold a press conference after its first meeting of the year, with some analysts expecting a small cut in lending rates.

— with AFP

Originally published as Apple emerges as come-from-behind winner in DeepSeek chaos