1.5m more Aussies to be millionaires in five years

The number of Australians with high net worth is expected to grow by 70 per cent by 2029, as the country is rated the third richest in the world.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Australia’s rampaging property boom is set to create 1.5m more millionaires in the next five years, after doubling the wealth of Australia’s richest 1 per cent in the past two years.

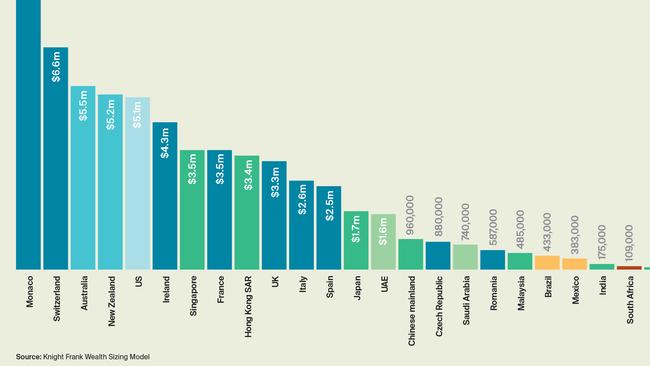

The bar to be considered in the top 1 per cent in Australia rose from $4.2m (US$2.8m) in 2021 to $8.26m (US$5.5m) this year – which is the third highest level in the world now behind Monaco (US$12.4m) and Switzerland (US$6.6m), the latest update to Knight Frank’s Wealth Report found.

MORE: Stunning Qld renovations that defy building costs and uncertainty

Housing crisis relief: 42 two-bedder social housing units open

The property boom was responsible for a big chunk of that growth in wealth, Knight Frank head of residential research Australia Michelle Ciesielski said.

“A large contributor to the top one per cent wealth level doubling in Australia over the past two years has been prime residential property performance recording an upward trajectory, resilient despite the rising cost of finance, as we know 49 per cent of this cohort tend to be cash buyers,” she said.

Knight Frank found Australia’s wealthy populations were set for significant growth over the next five years, with HNWIs (high net worth individuals) – classified as those with net wealth more than $1.5m (US$1m) – set to grow by a massive 71.1 per cent to 3.789m people.

The level of growth ahead for HNWI is 2.5 times the pace it was over the previous five years since 2017.

It found the number of ultra high-net-worth individuals (HNWIs) – defined as those with a net wealth of more than $45m (US$30m) in Australia – were set to rise by 40.9 per cent by 2027, outpacing the forecast global rise of 28.5 per cent.

“On average, the UHNW population in Australia owns 2.9 homes, or equivalent to 36 per cent of their total wealth is in primary and secondary homes. For their investible wealth, 94 per cent of their portfolios tend to be held in Australia; 34 per cent is in some form of commercial property ownership whilst 21 per cent is in equities.”

MORE: See the latest PropTrack Home Price Index

Ms Ciesielski said “the level of wealth required to reach the wealthiest one per cent varies extensively depending on where you live in the world, but it has risen across the board since Knight Frank last published the analysis in The Wealth Report in 2021, reflecting the growth in wealth portfolios over the past two years, despite the dip in 2022”.

FOLLOW SOPHIE FOSTER ON TWITTER

More Coverage

Originally published as 1.5m more Aussies to be millionaires in five years