Victorian property market sales plunge $37.28bn in 2022, with big hit to state coffers

Victoria’s real estate market took a $37.28bn hit in 2022, but there was a twist to the fall revealed in Valuer General figures that spells good news for owners. SEE YOUR AREA’S MEDIAN.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Victoria’s real estate market took a $37.28bn hit in 2022, but there was a twist to the fall that spells good news for owners.

The state’s annual real estate report card for 2022 revealed the number of property sales dropped more than 58,000 from 2021 amid dire forecasts of a house price crash.

Now the extraordinary down shift laid out in the Valuer General’s Annual Guide to Property Values has been credited with keeping home prices rising despite the Reserve Bank hiking interest rates eight times last year.

RELATED: Inside Australia’s great home building fail

Real Estate auction blog: Livestreams and rolling updates from Melbourne’s auction market

‘Slim pickings’: Family add $400k to budget as investors flood market with unit stock

Real Estate Institute of Victoria chief executive Quentin Kilian said the plunge in sales had been bad news for the government’s purse strings.

Mr Kilian said it was hard to say absolutely that lost stamp duty revenues had influenced a decision to raise the state’s land tax impost for commercial and investment properties as well as holiday homes in this year’s budget, but the property sector was seen as a “cash cow”.

“If I were the treasurer I would be looking at that shortfall and saying how do I replace that,” Mr Kilian said.

“And stamp duty and land tax are very easy taxes for them to increase.”

The Valuer General’s Annual Guide to properties is considered the state’s most authoritative property report and uses notices of acquisition sent to the State Revenue Office to capture details of 95 per cent of all sales statewide for the past year, which totalled at 167,834 results totalling at $161.96bn.

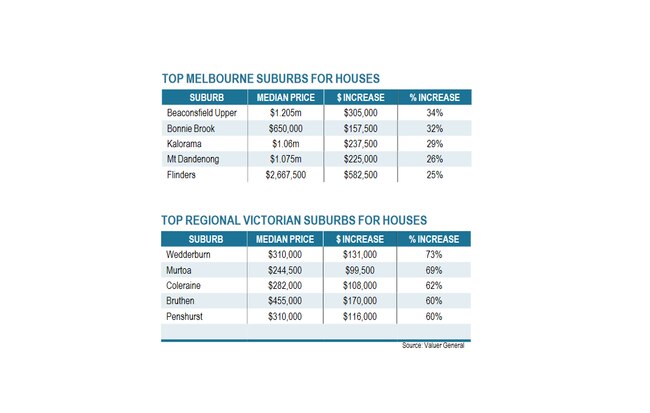

While the state’s housing market overwhelmingly improved, it was largely driven by regional areas with country Victoria’s typical house gaining $90,000 (13.7 per cent) to reach $580,000 after the number of sales fell by 35 per cent.

The Melbourne median house price increased a modest $17,500 (2 per cent) to $892,500, but sales numbers fell more than 15,000 to 55,407 in 2022. Unit prices in Melbourne fell $11,000 (1.7 per cent) to $620,000 despite 8000 fewer sales.

PropTrack economist Anne Flaherty said the figures showed negative property market sentiment had ironically thwarted dire property price predictions in 2022 as thousands of owners postponed sales plans and inadvertently raised demand for those who did proceed.

“When everyone holds off and the market grinds to a halt … and that is part of the reason why we saw property prices increase,” Ms Flaherty said.

Ray White head of commercial real estate Vanessa Rader said non-residential sales were also down across the country in 2022, but the decline was “worst in Melbourne”.

The poor performance of Melbourne’s office market could also see international investors increasingly opt for Sydney, costing the treasury additional tax revenue charged to foreign buyers.

It compounds the prospect of further pain for Victoria’s coffers, with the Valuer-General report’s preliminary figures from early in 2023 showing Melbourne’s median house price had tumbled from $892,500 to $770,000 — meaning less stamp duty being paid.

Cate Bakos Property boss Cate Bakos said this wasn’t necessarily bad news for homeowners, with sales dominated by poorer quality homes than many sold in the first half of last year.

Ms Flaherty added that realestate.com.au sales figures for the first 36 weeks of 2023 indicated numbers were 16 per cent below last year for the same period and while she expected a spring rebound, Victoria would still have “one of its softest sales years”.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Melbourne suburbs where upgraders, downsizers should make next move

Late Melbourne nightclub king, Janet Roach’s ex, George Zogoolas’ estate listed

House owned by TV, radio host Ed Kavalee and Biggest Loser’s Tiffiny Hall sells