The Aussie dream is in tatters as housing prices surge across the nation

Housing prices in Australia reached new peaks this month flattening the dreams of many Aussies wanting to buy their own home.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The Aussie dream is in tatters as house prices across the country reached new peaks in July, pushing many first home buyers out of the market.

July is typically the slowest month for house price growth, but the PropTrack Home Price Index revealed in 2024 house prices across Australia bucked the trend increasing 0.8 per cent.

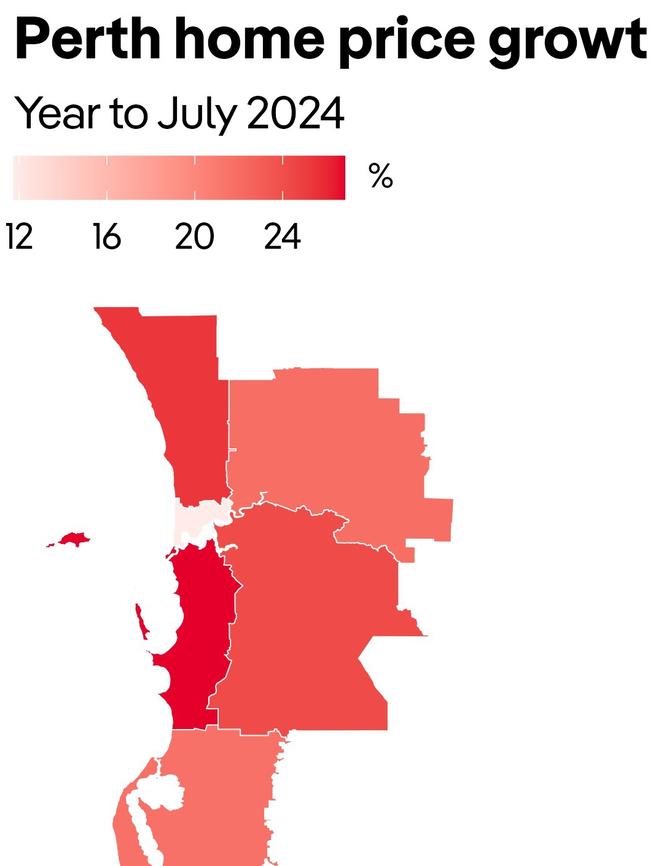

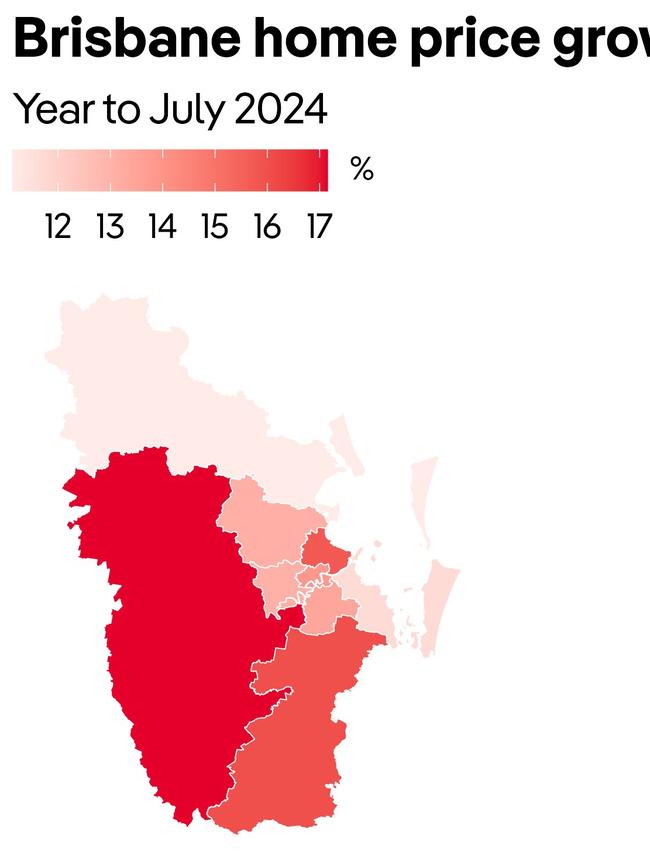

Over the past year Australia’s housing market has not slowed down, showing growth of 6.28 per cent across the nation, with Perth’s property market experiencing huge growth.

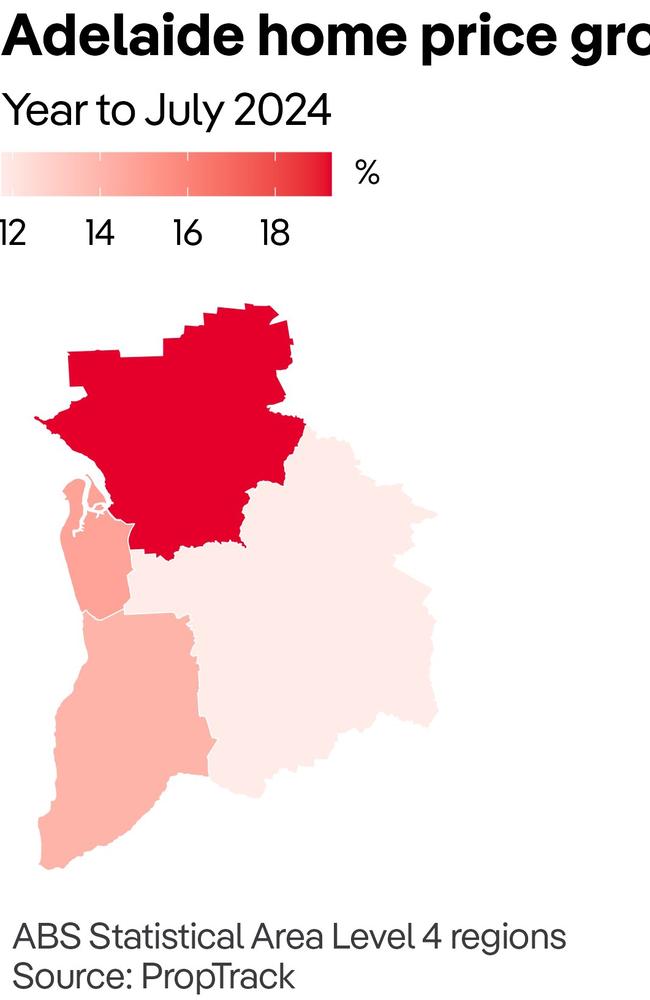

House prices in the west have soared 23 per cent in the past 12 months, with Brisbane and Adelaide also experiencing double digit growth.

PropTrack senior economist Paul Ryan said it was a tough period for housing affordability with interest rates at 2011-12 levels, and home prices doubled.

“That puts things into perspective,” he said.

“The numbers we are seeing from Perth are quite astonishing, to see house prices increase almost 23 per cent in the last 12 months is really daunting.

“But the perspective there is that price levels have remained quite low in Perth, which is one of the key factors we are seeing across the country driving performance across different markets.”

Over the past decade, Mr Ryan said apart from Darwin, Perth prices increased the least out of all the capital cities and it was now catching up after a lot of building occurred in the mid-2000s.

REIWA chief executive officer Cath Hart said strong population growth had also contributed to the surge in Perth’s housing prices with almost 80,000 people moving to WA from interstate and overseas in 2023.

“However, we are not building enough new homes to meet demand. In the year to December there were about 16,700 private dwelling completions, which is a shortfall of about 15,000 homes when compared to population growth,” she said.

“The ongoing constraints in the building industry continue to drive people toward the established homes market.

“There will need to be a significant change in new supply or demand to ease the pressure in the Perth property market. At the moment there are no signs the market will slow down.”

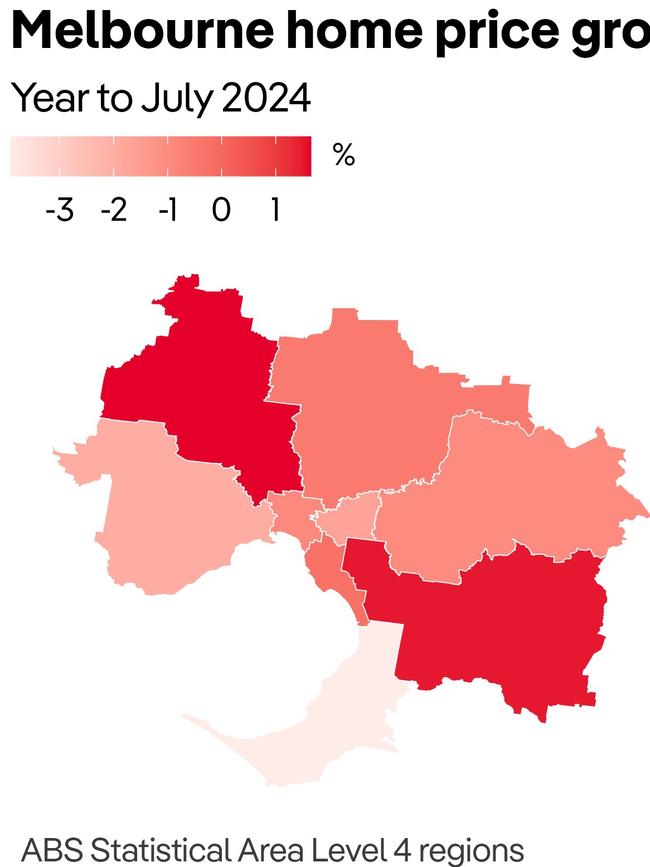

On the other end of the spectrum, data from PropTrack Home Price Index showed Melbourne’s market had dropped by 0.21 per cent in July for the fourth month in a row, with Darwin falling 0.15 per cent, and Hobart 0.4 per cent.

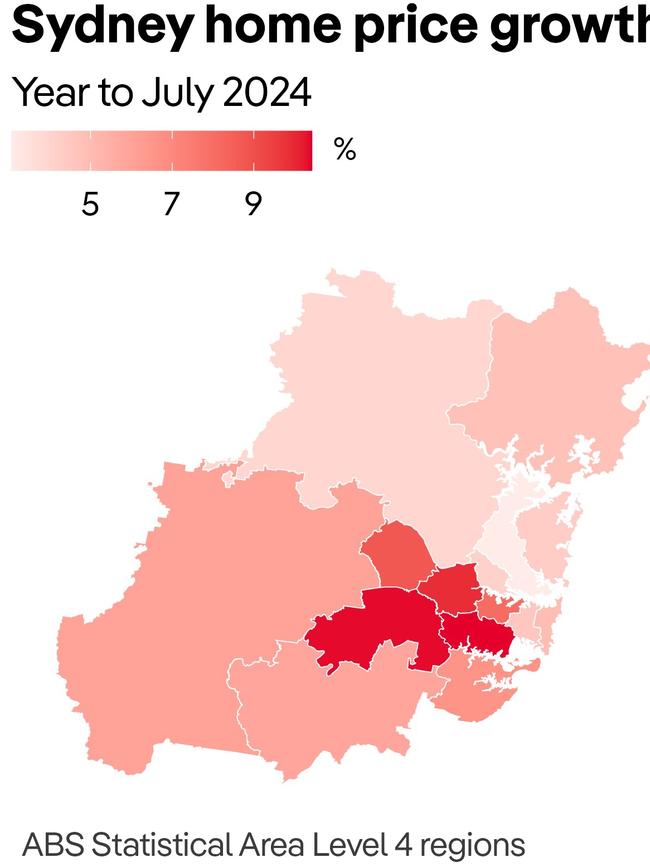

While Sydney peaked with prices up 0.12 per cent, the market has been flat over the past year along with Melbourne, Hobart and the ACT.

“That is consistent with the higher interest rate environment that we have at the moment,” Mr Ryan said.

“To see a solid flow of new properties come to market (in Melbourne and the ACT) and prices stay flat despite interest rates at very high levels that we have not seen for a decade, shows there is still a lot of housing demand in those markets.

“It is hard to sustain price groups when interest rates have increased so strongly and reduced borrowing capacity by so much.”

My Ryan said Sydney sat between the two groups but was still above average with the median house price at $1.1m.

“We typically see annual price growth over a longer term around 4 per cent, but Sydney is sitting at 6.1 per cent over the past year,” he said.

“In this higher interest rate environment it says there is still huge demand for housing.

“Sydney has not built as many homes, which is a key factor why prices are pushed higher.”

A big story this year has been the shift in buyers with investors responding to tough conditions and strong housing demand, and people upgrading their existing property through equity.

“Rental availability is really low and we saw nationally that rents are still up 9 per cent over the past 12 months,” Mr Ryan said.

“Investors can clearly see there is a lot of demand for housing.

“There has also been a pick up in the share of people borrowing a relatively small portion of the value of their home.

“They are borrowers who bring a lot of equity to transactions.

“One of the positives from the pandemic was that it enabled a lot of people to upgrade their home in terms of location or size for their family.

“The downside is that it pushed out first home buyers, which tend to be borrowing constrained and the increased interest rates have affected them a lot.

“First home buyers don’t have equity to bring to transactions so they have been the big losers in this shifting market with higher interest rates.”