Sydney home prices rise in June for the seventh straight month: PropTrack Home Price Index

The key factors driving Sydney’s seventh straight growth in house prices have been revealed, with more growth on the cards.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Sydney has recorded seven straight months of price growth, driven by a lack of new housing supply and buyer demand.

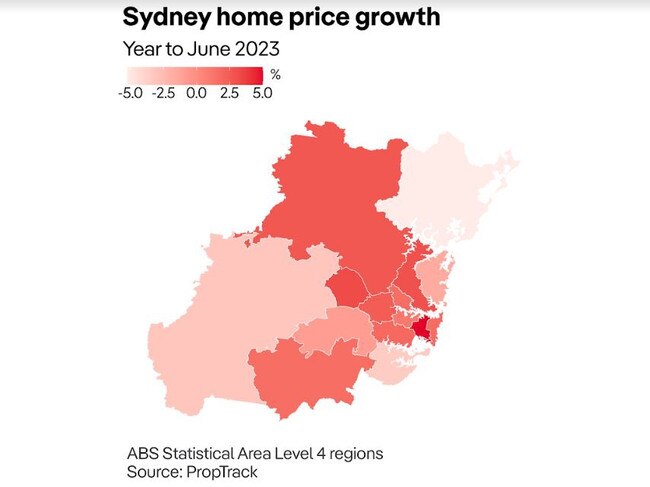

The Harbour City continues to lead the house price recovery across Australia with a 0.63 per cent increase in June, according to the PropTrack Home Price Index.

Sydney prices are up 4.5 per cent since their lowest point in November last year and 27.4 per cent from March 2020 levels.

“Prices in Sydney are now just three per cent below their peak recorded in February 2022,” PropTrack economist Angus Moore said.

MORE

King Charles’ secret Sydney home for sale

Ex wife of disgraced billionaire selling rare home

Why 2023 is the year of the trophy home

Mr Moore said the increases were being driven by limited stock and continued demand for property.

“The number of new properties hitting the market is well down from what we were seeing last year,” he said.

“We are also seeing strong buyer demand and auction clearance rates have been pretty firm through Autumn and into Winter.

“While interest rates are a lot higher than they were, they are not increasing as quickly as they were and I think that’s giving buyers a lot more confidence about what their mortgage is going to cost and how much they can borrow.”

Mr Moore said while existing mortgage holders were feeling the pinch of interest rate rises, data showed that mortgage arrears remains low compared to pre-pandemic levels.

“At least to date large groups of people haven’t been forced into struggling on their mortgage,” he said.

“Lots of people haven’t rolled off their fixed rates yet, we would expect more stress as that happens over the rest of this year.”

However he said one of the key factors in mortgage default was job loss and to date, unemployment remains low.

He said there were “tailwinds” to support continued price growth over the coming months.

“Talking about limited stock hitting the market, that’s going to continue through winter,” he said.

“At the same time auction clearance rates remain strong which indicates we will continue to see strong demand for property.”

Mr Moore said at least two further interest rates rises were expected by the end of the year.

According to PropTrack data, regional NSW prices were also up in June by 0.12 per cent taking them 2.36 per cent below June 2022 levels.

Real Estate Institute of NSW chief executive officer Tim McKibbin said many people remained “perplexed” as to how house prices remain strong after 11 interest rate rises.

“The reason is deceptively simple,” he said.

“It’s the forces of supply and demand at work and the undersupply of homes to buy and rent is the principal driver.

“That’s why clearance rates are so strong and rents are high, and this is set to continue.

“Even if there’s another rate rise next week, the new cost of borrowing appears to have

been factored into buyers’ plans.

MORE

Why apartment living is more attractive than ever

‘Simple’ way investor got $7.7m in 4 years

Sydney’s most in-demand suburbs this winter

Mr McKibbin said the increasing population and supply issues will continue to dictate activity and prices.

“There is not much cause for optimism on the supply side in the short term. The high

cost of materials and skilled worker shortage is being compounded by political debate,

especially around the affordable housing fund, to stymie the progress of new

development.

“For vendors, it’s encouraging news, and there are signs of an increase in listings as

people have the confidence to take their properties to market.

“However, with more instances of mortgage stress, there’s also the potential for an increase in distressed sales as people succumb to mortgage repayments which have risen beyond their means.”

Ray White Group’s head of research Vanessa Rader the interest rate increase in June may have seen some sellers opt for a “wait and see” attitude resulting in limited listing numbers.

“The outcome of this being a mismatch in supply and demand.,” she said.

“But this lack of supply is aiding price growth across the country.

“Both houses and units have enjoyed an uptick in values however houses continue to grow at a more rapid pace.”

Originally published as Sydney home prices rise in June for the seventh straight month: PropTrack Home Price Index