Melbourne home price growth is sluggish to begin 2024 compared to rest of the nation: PropTrack Home Price Index

The city’s property price growth has been seemingly sluggish to begin the new year compared to the nation’s other capital cities, new data from PropTrack reveals.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Melbourne home prices are stuck in the doldrums, with the lowest price growth of any Australian capital cities in the past four years.

The latest PropTrack Home Price Index released today revealed the city’s median home value has increased by $107,000 (15.4 per cent) since March 2020 — the lowest price growth of all the nation’s major hubs.

Adelaide and Brisbane experienced the highest jumps in dwelling prices rising 58.7 per cent and 57.8 per cent, respectively.

RELATED: Shock reason Melbourne home prices could boom

Mum with 17 homes’ bullish prediction for Victoria

Summer sell off: Best time to buy a holiday home in years

PropTrack economist Angus Moore said Melbourne was lagging as a result of Victorians migrating interstate.

“We did see a lot of people from Melbourne moving away towards, perhaps more attractive at the time and also more affordable parts of the country, to places like southeast Queensland, Adelaide, or Hobart (during the pandemic),” Mr Moore said.

“That’s a core fundamental driver of property demand.”

He added that there had also been more homes for sale to choose from for buyers in Melbourne relative to other states.

“That’s probably helping temper some of the competition and taken a little bit of the heat out of prices in the past six months or so,” he said.

PropTrack’s figures show the city’s $799,000 median dwelling price is currently about $39,500 below (4.71 per cent) its March 2022 peak.

Melbourne’s median house price of $909,000 fell by nearly $1000 (-0.11 per cent) in January, while the typical unit price of $611,000 increased by around $183 (0.03 per cent).

Mr Moore said Melbourne’s relatively flat growth was a result of “the most challenging affordability conditions for buyers in at least three decades”.

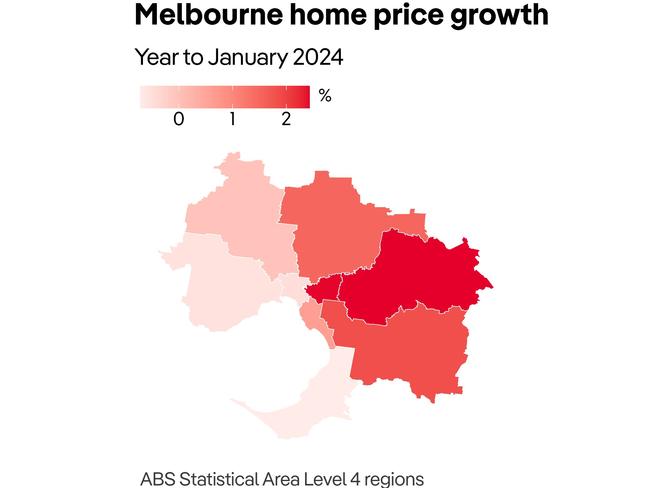

Melbourne’s outer-eastern suburbs experienced the largest annual growth in home prices compared to the rest of the city, with the region’s median dwelling rising about $22,100 to $911,000.

Everest Loans Melbourne founder Navjeet Kaur said affordability and inflation had significantly affected many buyer’s borrowing capacities.

“People are struggling. The problem is when inflation got hit and the interest rates increased, the rent also increased so living costs increased, and savings got depleted,” Ms Kaur said.

“I think until rates change, it’s going to get worse; because a lot of people are struggling with money.”

Buyer’s advocate Emily Wallace said while it looked as though prices were dwindling, she wouldn’t be shocked, given population growth and the lack of housing, if Melbourne were to move eventually into second or third place in terms of price growth.

“Melbourne’s not struggling, it probably just looks like it is in comparison to other cities,” Ms Wallace said.

She said her forward outlook for the city’s property market was that prices would rise because of the lack of supply, particularly in the apartment space with tenants getting out of the rental market.

Price Growth of Australia’s Capital Cities Since the Pandemic

Rank / Capital City / Change Since March 2020 / Jan 2024 Median Home Value

1. Adelaide – 58.7% – $708,000

2. Brisbane – 57.8% – $794,000

3. Perth – 50.2% – $640,000

4. Hobart – 36.2% – $669,000

5. ACT – 34.7% – $823,000

6. Sydney – 31.2% – $1.057m

7. Darwin – 25.7% – $481,000

8. Melbourne – 15.4% – $799,000

Source: PropTrack

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: 33-year-old worth $10m shares top tip to retire rich

One of suburb’s first homes has its own wine label

No-one swiping right on Tinder co-founder’s marble mansion

sarah.petty@news.com.au