Federal budget 2022: More houses, more super: key to Aussies getting a new property

Labor has launched an ambitious plan to ease housing affordability concerns but homebuyers will still likely feel the pain for several years.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

States will be called upon to unlock prime real estate in major cities as part of a landmark initiative uniting governments, investors and industry to tackle housing affordability.

A new Housing Accord, announced in the Albanese Government’s debut budget, aims to build one million homes in five years from mid-2024 to keep the record pace of residential construction desperately needed on track for the rest of the decade.

Federal Treasurer Jim Chalmers said the Accord would include an initial $350m federal funding over five years to deliver 10,000 energy efficient affordable homes.

This commitment is in addition to 30,000 new social and affordable dwellings that will be delivered through the $10bn Housing Australia Future Fund in its first five years.

The Housing Accord will bring together state, territory and local governments, investors and industry to “build the affordable homes our country desperately needs, and to help tackle our housing crisis”, Dr Chalmers announced in his maiden budget speech.

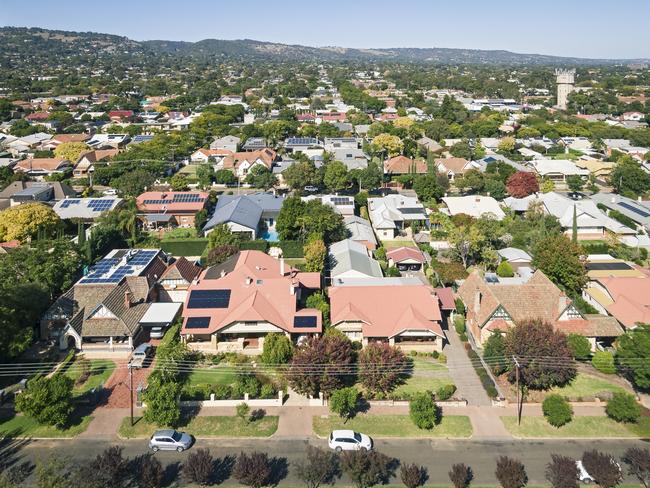

Under the commitment, state and territory governments will be on the hunt for “immediate opportunities” to “free up well-located state land”, such as close to train stations, education and employment, and undertake expedited zoning, planning and land release.

PropTrack economist Anne Flaherty noted one million homes had been built in five years recently, but there were significant headwinds in the industry amid skyrocketing construction costs and shortages so the concerted focus on boosting supply was encouraging.

“However, with the delivery of these new homes not expected until after 2024, we are likely to continue to see challenging conditions for many buyers and renters,” Ms Flaherty said.

The Housing Accord will be made up of the nation’s states and territories, the Australian Local Government Association, investors and representatives from the construction sector.

By delivering an ongoing funding stream to help cover the gap between market rents and subsidised rents, the federal government is aiming to attract “much-needed investor capital” from “hungry” superannuation funds through making projects commercially viable.

“The ambition of this Accord is big and it’s bold – an aspiration to build one million new, well-located homes over five years from 2024,” Dr Chalmers said.

“State and territory governments will build on our commitment with up to 10,000 new homes as well – that’s up to 20,000 new affordable homes in total.”

Experts were generally supportive of moves to increase and speed up supply plus attack NIMBYism that kills off or curbs housing projects.

“It’s exactly what’s needed,” Urban Taskforce CEO Tom Forrest said.

Grattan Institute economic policy program director Brendan Coates also welcomed efforts to increase supply, but was cautious on involving superannuation funds.

Mr Coates noted super funds had a legal obligation to act in members’ best financial interests, so couldn’t invest in housing projects charging less than market rents.

Treasury officials in Canberra said “availability payments” would be on a per-project basis up to the level that made a development commercially viable.

The officials suggested that some project partners might be charities, which could lower tax liability.

They also said some states offered land tax deals for affordable housing.

Coalition treasury spokesman Angus Taylor said: “What we don’t want to see is people’s superannuation being used for pet projects … superannuation is there for people’s retirement, a nest egg that they can rely on so that they can have a prosperous retirement and we don’t

want to see governments using that money as though it is theirs for their projects.”

HOUSING SUPPLY CAN’T KEEP UP WITH DEMAND

Construction sector peak bodies will be worked with to support high energy efficiency rating construction and the training of more apprentices under an extended Australian Skills Guarantee and work to make housing more responsive to demand.

Budget documents noted the “urgent housing affordability challenge”, with Dr Chalmers recognising Australia had a “housing problem” and in the opening lines of his debut budget speech noting “rents are through the roof, and many families are struggling to keep up”.

“More affordable housing” was among the budget’s five-point plan for cost-of-living relief, which also included cheaper childcare, expanding paid parental leave, cheaper medicines and “getting wages moving again”.

“Supply hasn’t kept up with demand, which means too many struggle to live close to where they work. Too many are stuck on waiting lists for social housing,” Dr Chalmers said.

“And for too many, the great Australian dream of homeownership seems completely out of reach. Our country can do better than that — and our government will.”

The Housing Australia Future Fund will also provide up to $500m each year to support investment in social and affordable housing.

This fund will provide 20,000 new social housing dwellings, 4000 of which will be allocated to women and children impacted by family and domestic violence and older women at risk of homelessness.

It will also provide 10,000 new affordable housing dwellings, including for frontline workers.

Legislation to establish the Fund is expected to be introduced to parliament in 2022–23.

The government is also expanding the remit of the $1bn National Housing Infrastructure Facility to more flexibly deploy up to $575m to unlock more than 5500 projected new homes.

INCENTIVES BOOSTERS FOR HOME DOWNSIZERS

Downsizers looking to bulk up their superannuation balances will now be able to do it sooner.

The federal government is reducing the age at which people can drop a lump sum into their super from a house sale to 55.

People over the age of 60 can currently sell their home and make a large contribution to their superannuation without being hit with higher tax rates.

The government is planning to reduce the eligibility age for this policy to 55, allowing more people to contribute to their super sooner, while also encouraging turnover in housing stock.

“The downsizer contribution allows people to make a one-off post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home,’’ the budget documents say.

“This measure provides greater flexibility to contribute to superannuation and aims to encourage older Australians to downsize sooner to a home that better suits their needs, thereby increasing the availability of suitable housing for Australian families.

“Both members of a couple can contribute and contributions do not count towards non-concessional contribution caps.’’

The measure is expected to cost the government $20m over the next four years.

FEDERAL BUDGET 2022: WHAT’S IN IT FOR ME AS A HOMEBUYER

* New Housing Accord aims at bringing states, councils, and the construction sector together to build one million new ‘well located’ homes over the five years from mid-2024.

* Establish $10bn Housing Australia Fund to ‘provide a sustainable funding source to increase housing supply’ – including 20,000 new social housing dwellings, including to help victims of domestic violence and older women at risk of homelessness and 10,000 new ‘affordable’ dwellings, including for frontline workers

* Help To Buy shared equity scheme to help homebuyers purchase a new or existing home with a government contribution – ie Aussies can buy a home with a smaller deposit.

* Regional homebuyer scheme – From October 1, 10,000 places will be available every financial year to help regional first homebuyers to buy a new or existing home with a deposit from five per cent.

* Encourage more Aussies to downsize, to free up housing stock for younger families. Government will extend exemption of home sale proceeds from pension asset testing from 12 months to 24 months. This gives pensioners more time to buy, build or renovate a new home before their pension is affected.

* Access to downsizer superannuation contributions expanded for those aged 55 to 59.