Dreams of buying a Melbourne house are dying as borrowing capacity shrinks drastically

The borrowing capacity of someone who could have got a $500k loan less than a year ago has plummeted by more than $100k. See what areas you can still buy in.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A single-income family earning about the average national wage can no longer get a loan for a median-priced house in any Melbourne suburbs, according to new Canstar analysis.

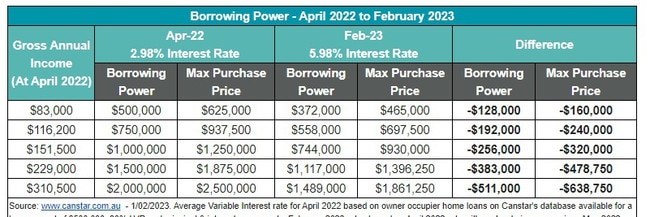

The borrowing capacity of someone who could have got a $500,000 loan less than a year ago has plummeted $128,000, killing off backyard dreams as buying power disappears.

The maximum purchase price of someone with a 20 per cent deposit on a wage of $83,000 — about the average national full-time wage — has fallen from $625,000 – which 20 Melbourne suburbs have a median price of or lower – to just $465,000 since interest rates began to rise from last April, the Canstar analysis shows.

RELATED: Homeowners face 50 per cent rise in mortgage repayment costs

Where to buy to become a millionaire in 10 years

Greens MP Aiv Pugleilli shares ‘cooked’ Melbourne rental crisis story

That’s beneath the cheapest suburb’s median house price, Melton’s $501,500 in January, according PropTrack values, but it could be a boon for country Victoria, with single-income earners still able to chase their home dream outside of the big smoke.

Detached houses still commonly trade for less than $500,000 in some Geelong suburbs, as well as Bendigo, Ballarat and farther flung regions.

It comes as bank buffer zones factoring in a 3 per cent interest rate rise to borrowers’ capacities have been blasted through in just nine months with the Reserve Bank’s Tuesday increase.

The RBA has raised the cash rate from its record low 0.1 per cent last April to 3.35 per cent, with nine consecutive rises in the steepest whack to borrowers’ hip pockets in history.

More homeowners could be forced to sell as finding extra funds each month continues to become harder, with further rises expected.

Ray White chief economist Nerida Conisbee said there would “almost certainly” be another rate rise and “maybe two” but believed the reduction in inflation should prevent more.

“What’s likely is people will get rid of the things they don’t really need that are costing them money, like cars, boats, holiday homes and then things like investment properties,” she said.

“With the family home, people do tend to try and hold on and I hope people who are finding it difficult are speaking to their banks or shopping around.

“Banks are well capitalised and are not in trouble; they’re in a good position to help people out. There are some decent rates out there, including introductory rates.”

Barry Plant chief executive Mike McCarthy said buyers were “out in force” relative to the amount of stock, which had contracted significantly.

“It’s a highly unusual market with a conjunction of rising interest rates, really low unemployment, and many people with money in the bank post-Covid so (they are) able to ride through interest rate rises at the moment,” he said.

“But equally we’re now stretching beyond the buffers the banks built into their lending pre and post-Covid, those buffers are now gone, so people who purchased at that time who perhaps haven’t had the benefit of wage increases or change of jobs start to feel the pinch if they’re not already.”

Mr McCarthy said this could lead to more stock on the market over the coming months.

Canstar Group executive, financial services, Steve Mickenbecker said many buyers would need to compromise “in terms of location, or housing style, standard or size”.

Ms Conisbee said apartment and townhouses could provide a sound alternative to buying a house, and had been the natural first purchase in pricier Sydney for 10-15 years.

Aaron Kandiah said he was very conscious of the impact rate rises were having on the property market and they had motivated him to sell up now before prices fell further.

Across the past few months, Mr Kandiah has noticed more homes in his Preston neighbourhood selling within their quoted range since rates began to rise, rather than above it as had been the case early last year.

The electrician said the rate hikes weren’t a direct concern for him and his partner as they had renovated and sold a house in front of their 41A Jacka St home a few years ago.

They were planning to use the impact on other homebuyers to help move up the property ladder.

“It will affect most people and slow most down,” Mr Kandiah said.

“We weren’t intending to sell, but we are thinking we can make the best of the situation by selling now and buying after there’s a bit of a dip.

“We’re hoping we’re on the shoulder of it. So we will wait and see what the flow-on effects of a few more rate rises are before we buy.”

— Nathan Mawby

Borrowing Power – April 2022 to February 2023

Gross Annual Income (At April 2022), Apr-22 2.98% Interest Rate Borrowing Power and Max Purchase Price, Feb-23 5.98% Interest Rate Borrowing Power and Max Purchase Price, Difference Borrowing Power and Max Purchase Price

$83,000, $500,000, $625,000, $372,000, $465,000,-$128,000, -$160,000

$116,200, $750,000, $937,500, $558,000, $697,500, -$192,000, -$240,000

$151,500, $1,000,000, $1,250,000, $744,000, $930,000, -$256,000, -$320,000

$229,000, $1,500,000, $1,875,000, $1,117,000, $1,396,250, -$383,000, -$478,750

$310,500, $2,000,000, $2,500,000, $1,489,000, $1,861,250, -$511,000, -$638,750

Source: www.canstar.com.au – 1/02/2023.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Brutalist Murray Valley Private Hospital sells for close to $7m

Altona ‘70s classic beach house listed for sale for first time ever

Balwyn North neoclassical mansion set to become one of suburb’s most expensive homes

scott.carbines@news.com.au