City where 98 per cent of home prices are falling

As one of our capital cities enjoys record median home prices in 97 per cent of its suburbs, another is enduring falling values in 98 per cent of its suburbs.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Australia is not just one property market. It is a collection of markets, and it could be argued that each of those markets is defined by suburb boundaries.

That means we have 15,300 different markets in Australia, by the way, because that’s how many suburbs the Australian Bureau of Statistics recorded at the last official count. Each of these markets has its own character, and many other factors contribute to local home values being what they are today.

These include the types of homes, amenities such as schools and parks; transport links; shopping and cafe villages; walkability; and of course, supply and demand. Then there are the macroeconomic factors that impact every market, such as rising interest rates.

Historically, rising rates have tended to dampen property values because they reduce affordability. It’s harder to get finance to buy, and it’s harder to afford the home loan repayments as rates go up.

But we have an unusual situation whereby home values have risen and continue to rise in many markets, despite rising rates, because the supply of homes for sale is constrained and demand is high. Supply is limited because people are not motivated to sell if they don’t have to in today’s economy, and we have a chronic undersupply of new homes.

Meantime, demand is strong because of record immigration, vast wealth among baby boomers who can buy their next homes with cash, and rising foreign investor interest. We also have a tight rental market, with weekly rents increasing by 43.5 per cent since August 2020 to a national median of $627 per week, which has prompted many investors to re-enter the market.

On top of that, vacancy rates are so low that some new migrants, who typically rent first, are buying instead, along with many first home buyers who figure they’re better off owning than paying rent.

INDIVIDUAL NATURE OF EACH PROPERTY MARKET

But as I mentioned earlier, these are broad trends that are only relevant to some markets.

In other markets, there is plenty of supply and prices have corrected since interest rates began rising.

New research from CoreLogic serves as a reminder of the individual nature of each property market. A new report examines price performance over the two years before interest rates began rising in May 2022, and the two years afterwards through til today.

While interest rates were at emergency lows during the pandemic, Australia’s national median value rose by 31.7 per cent between May 2020 and April 2022. Since rates began rising in May 2022, the median has risen just 2.8 per cent over two years. This can be explained by the downturn from mid-2022 and the rebound from early 2023.

But drill down a bit to the capital city level and you’ll see vast differences in the way prices have moved over the past two years. Perth has been the best performer over the past two years with a 25.7 per cent surge in house prices. Hobart has been the weakest performer with an 11.2 per cent drop. Brisbane house prices have risen 6.1 per cent and Sydney house prices have risen 0.4 per cent since rates began rising. At the same time, Melbourne house prices have fallen 4.2 per cent.

CoreLogic’s research director, Tim Lawless, says Melbourne, Hobart and Canberra have underperformed relative to the other cities because they’ve had a higher supply of homes for sale; weaker demographic trends, such as lower population growth; and affordability constraints.

These factors have impacted property values across the board, not just at a citywide level.

The data shows 98 per cent of Hobart suburbs have seen home values fall, along with 87.8 per cent of Melbourne suburbs and 87.6 per cent of Canberra suburbs over the past two years.

POPULATION GROWTH AND STRONG ECONOMY PUSHING UP PRICES

Meantime, Perth values have surged, largely because homes are much more affordable and the city is attracting more interstate migrants for this very reason. High population growth and a strong state economy are also factors in Perth’s growing home values.

East Coast investors are also drawn to Perth for its attractive rental yields and ongoing prospects for good capital growth. Put all these factors together and 97.3 per cent of Perth suburbs are now sitting at record high median prices.

So from a national point of view, we have a divergence in price performance between the capital city markets right now.

What does that mean in the long run for the average homeowner?

Absolutely nothing.

There are always short-term trends impacting Australia’s many suburban markets. Wherever there are softer market conditions, there are more opportunities for buyers. Wherever there are strong market conditions, there is a benefit to owners, investors and sellers.

The property market is cyclical and each suburb will have its price slowdowns and surges from time to time for varying reasons.

If you’re buying or selling right now, short-term trends are worth having a look at so you understand current market dynamics.

But if you’re a homeowner, you can ignore these trends and simply go on living life and enjoying your home. Reliable capital growth in Australian real estate is derived over the long term, no matter which capital city (or region) you choose to buy or invest in.

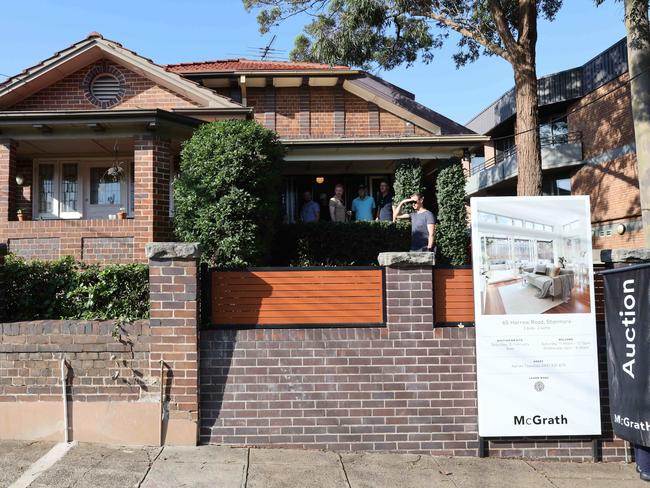

* John McGrath is the founder, Managing Director and Chief Executive Officer of McGrath Estate Agents

More Coverage

Originally published as City where 98 per cent of home prices are falling